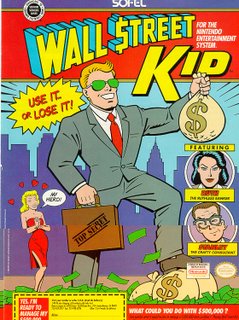

Here's the 800 pound gorilla in the room:

There will soon be an epic battle of Gen X / Gen Y vs. the Baby Boomers.

Here's my take. The Boomers have stolen the money and destroyed the prospects of future generations, and they did this knowingly.

The Boomers who've led the past 20 years have:

* Allowed the mother of all Ponzi schemes - Social Security - to grow to an unsupportable level - where they get to cash out at the top, knowing that the suckers (the last ones in) at the bottom of the pyramid (Gen X / Gen Y) ain't gonna get paid out, although they paid in

* Allowed the mother of all Bubbles - the Housing Bubble - to grow to an unsupportable level - where they get to cash out at the top (selling that $50,000 house for an $800,000 gain), retire nice and comfy, knowing that the suckers (the last ones in - the younger generation) will see plummeting values on the assets the Boomers sold them

* Allowed the mother of all Debts - the Deficit - to grow to such an unsupportable level that future generations will struggle to simply pay the interest due, or even default. No worries though - it was sure a blast spending all that money (on themselves) the past 20 years. Saving? Boring! Spending? Fun!

But, alas, the Boomers will soon lose their grip on power as they get older and retire. Soon we'll have our first Gen X Senators, our first Gen Y President. The Harold Fords, the Barrak Obamas, etc.

That's when it'll be on. That's when Gen X / Gen Y start cutting the benefits of the Boomers - health care, social security payments, pensions etc.

The damage will already have been done, but there will be some major paybacks for the Boomers - who'll have lost the levers of power. They'll also have to worry about the effect of a plummeting dollar, a declining market, sky-high interest rates and skyrocketing health care costs eating away at the value of their nest eggs.

You can't pave the streets with gold. Everyone can't get rich. And if you don't save, you might not eat.

Let the battle begin. The sooner it does, the better the outcome.

It'll start with a recognition by Gen X / Gen Y that the boomers set them up with the Housing Bubble, and they'll be pissed.

January 31, 2006

Let's get it on - Gen X / Gen Y vs. the Baby Boomers

Posted by

blogger

at

1/31/2006

27

comments

![]()

![]()

January 30, 2006

The last great days of America? Savings Rate at Lowest Level Since 1933

Ah, what a party we threw ourselves. Future generations will look back at this one with such scorn, such disgust. Who were these people, they'll wonder, that didn't save, spent future generations money, and bought themselves Hummer H2's, McMansions, exotic vacations and lived significantly beyond their means?

After any great party, the bills eventually come due. I think the bill is in the mailbox and most folks have no idea...

Americans' personal savings rate dipped into negative territory in something that hasn't happened since the Great Depression. Consumers depleted their savings to finance the purchases of cars and other big-ticket items.

The Commerce Department reported Monday that the savings rate fell into negative territory at minus 0.5 percent, meaning that Americans not only spent all of their after-tax income last year but had to dip into previous savings or increase borrowing.

The savings rate has been negative for an entire year only twice before _ in 1932 and 1933 _ two years when the country was struggling to cope with the Great Depression, a time of massive business failures and job layoffs.

One major reason that consumers felt confident in spending all of their disposable incomes and dipping into savings last year was that a booming housing market made them feel more wealthy. As their home prices surged at double-digit rates, that created what economists call a "wealth effect" that supported greater spending.

The concern, however, is that the housing boom of the past five years is beginning to quiet down with the rise in mortgage rates. Analysts are closing watching to see whether consumer spending, which accounts for two-thirds of total economic activity, falters in 2006 as Americans, already carrying heavy debt loads, don't feel as wealthy as the price appreciation of their homes would seem to indicate.

Posted by

blogger

at

1/30/2006

20

comments

![]()

![]()

Oh dear god I wish I was in the US to go to one of these Trump / Learning Annex "Get Rich in Real Estate" seminars

Think about the dolts and losers who are STILL paying to go to this as-of-today-not-yet-cancelled seminars on getting rich through real estate.

What's reallllly bizarre is that one of the featured speakers, Rich Dad's Robert Kiyosaki, has recently turned from housing bull to big time housing bear ("He confesses that he's currently dumping real estate that produces no cash flow (from rental income) and going "long on gold and oil."

So what's his speech going to be about - how to get a refund on this ill-timed seminar? Or how blood suckers are making money by telling stupid people and losers how to get rich quick?

Meanwhile, how long until The Donald either goes bankrupt (again) or renegotiates his debt to skate by (again) due to his plummeting real estate assets?

And wouldn't we all recommend they change the promo text on the site? Here's what it says today (ha ha ha ha!)

Register Now!

The Real Estate market is booming nationwide and no region has witnessed this boom more than the greater Los Angeles area. Take advantage of the thriving market by attending this one of a kind event!

Posted by

blogger

at

1/30/2006

7

comments

![]()

![]()

January 29, 2006

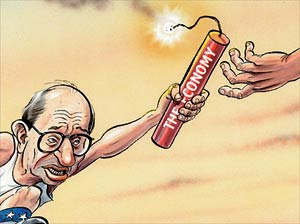

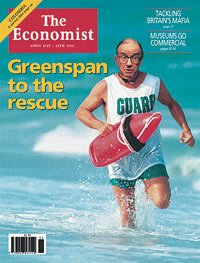

Greenspan leaves (finally) this week - post your goodbye comments here

Dear Alan;

Dear Alan;

History will not be kind.

But then again, your short-sighted views, your fascination with power and celebrity, and your endorsement of out of control spending, pure naked greed and get-rich-quick bubble schemes is very representative of the culture, so I don't fault you - I fault the society you were allowed to lead.

Enjoy your time off and $150,000 appearance fees.

Sincerely

Housing Panic

Posted by

blogger

at

1/29/2006

12

comments

![]()

![]()

High-rise speculators likely in for a fall (HP readers - predict how far)

For the ones that do get completed, for the buyers who don't walk away from their down payments and do close, what % drop in value do you think condos in Miami will see 12 months from now?

I'm guessing 20%

That's why I think most folks will just walk away if they haven't closed. 5% is nothing compared to 20%.

Market has peaked, causing problems for condo markets in Miami and West Palm, experts say.

If you're buying a single-family home or condominium, plan to live in it long term because the days of making fast cash in real estate are over, industry experts said Friday

In Miami-Dade, more than 71,500 units are built or planned, Miami real estate consultant Jack Winston said, adding that only 9,100 units were completed countywide in the past 10 years. He did not release figures for Broward or Palm Beach counties.

Some small banks will be in trouble because they've loaned money to condo developers who won't follow through on building plans as the market softens, analysts said Friday. They think falling land prices are inevitable during the next year.

Likewise, real estate speculators will take hits if supply continues to outpace demand, hurting their ability to resell or rent units. Already, agents are reporting price reductions in some condo resales. "Miami is ground zero for the housing bubble," Winston said. "It's going to be severe in Miami, and it's going to be problematic in West Palm. We've built too many units compared to the projections for real users."

Posted by

blogger

at

1/29/2006

8

comments

![]()

![]()

January 27, 2006

The median home price for a single-family house in San Luis Obispo County fell nearly 12 percent in December, or more than $70,000

Pop.

Amazing numbers, and amazingly mind-numbing comments from the local realtors

All is well... All is well. Remain calm... Remain calm..

Not sure about you, but when I hear that, I run for the nearest life boat

The median home price for a single-family house in San Luis Obispo County fell nearly 12 percent in December, or more than $70,000, but local real estate professionals warn that it is too early to determine if the market is headed downward.

The $534,930 median home price -- the statistical point where half of the homes sell for more and half for less -- declined 11.6 percent from the November price of about $605,160, according to the California Association of Realtors.

Nonetheless, it still represents a 12.5 percent increase from December 2004 when the median-priced home sold for nearly $475,610. The December 2005 figure was the lowest monthly median price registered since May 2005.

In another measure of the local housing market, permits for new homes were down 14.4 percent in 2005 for the county, with 1,937 permits. The steepest decline in the county was for the city of San Luis Obispo, which saw permit activity fall 69.6 percent to 35 from 115 permits in 2004.

Posted by

blogger

at

1/27/2006

29

comments

![]()

![]()

Question for readers - 6 months from now, which US real estate market will be the bloodiest?

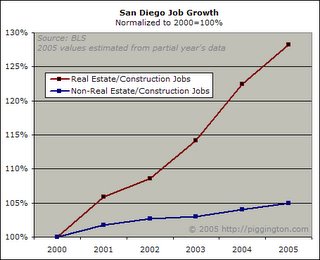

Phoenix was my vote all along, but San Diego could vault ahead. In Phoenix, the Arizona Republic once reported that over 40% of all jobs in town were tied to Real Estate. When people ask me what Phoenicians do to earn a living I tell 'em that they buy and sell houses from each other.

So what happens when that stops?

We'll soon find out.

Here's an essay on this phenomena in San Diego. Ahh, what a house of cards we have built ourselves..

But San Diego's economy is still overly dependent on a single, vulnerable industry. It's just no longer aerospace or defense.

It is the real estate industry itself.

Forty percent of all new jobs in the past 3 years were in either real estate or construction. This calculation doesn't even include the explosive mortgage industry, which unfortunately can't be isolated in the available BLS data, but which might push the real estate-related share of recent jobs up to as much as 50 percent

Given the decline in real incomes, how are people paying for their new BMWs and Fashion Valley spending jags?

The answer is that the money came from people's homes

There are 115,000 San Diegans employed in the real estate and construction industries, almost 26,000 of whom entered the industry since 2000, in addition to untold thousands in the mortgage business.

How many jobs are at risk should home sales volume continue to decline?

Posted by

blogger

at

1/27/2006

16

comments

![]()

![]()

CNN: As the market slows, home sellers are throwing in sweeteners to move properties

FYI - incentives like these below, and also the $100,000 Centex give-away, will NOT affect median or mean home sale values. These off-balance-sheet entries are indeed depressing prices though - the price the home can sell for after the receiver of the give-away closes.

($500,000 house - VW Beetle) = $470,000 true price, but $500,000 sale price recorded in the mean and median numbers. Now, if they'd throw in Lindsay Lowhan, that'd be another thing...

Great gimmick by the real estate industrial complex to keep the suckers buying and buying

Everybody wants something for nothing, and as housing markets slows, homebuyers are starting to get just that. Sellers, reluctant to drop home prices, have been finding creative ways to move product.

The trend is especially evident among developers and homebuilders who have to act much more decisively than individual homeowners who have the option of sitting tight.

Some recent freebies include trips to Las Vegas, home-entertainment and security packages, furniture store gift certificates, golf club passes for a year -- even swimming pools

Steve Melman, a spokesman for the National Association of Home Builders (NAHB) reports that sales incentives have become the rule among its membership -- 56 percent feature non-price incentives.

One builder, Georgia-based Forrest Homes, is giving away a two-year lease on a Volkswagen Beetle with a home purchase. That's right, these houses come with their own Bugs.

Pulte Homes, a Michigan-based homebuilder, is paying the heating bills for six months to anyone who buys a home in one of its Maryland developments. Pulte also will throw in a free-gas fireplace, hardwood floors, upgraded cabinets, and a washer/dryer -- and a 42" plasma TV.

Posted by

blogger

at

1/27/2006

6

comments

![]()

![]()

Ameriquest - the Enron of the bubble?

Who is the Enron? Toll Brothers? NAR? Greenspan?

Here's a vote for Ameriquest:

Disclosing the details of a $325 million settlement between Ameriquest Mortgage Co. and 49 states, Massachusetts Attorney General Thomas F. Reilly advised consumers to avoid doing business with the California mortgage company.

Reilly, who is running for governor, said Ameriquest's unfair lending practices have persisted despite several regulatory actions against the company during the past decade. The current settlement, if approved by the courts, would be the fourth agreement that Ameriquest has entered into since 1996 over its lending practices.

''This is a very bad company engaged in despicable practices," by failing to disclose it was extracting high fees from customers' home equity when it refinanced their home loans, Reilly said at a press conference yesterday.

''They have been doing it a long, long time," he said. ''I would personally have nothing to do with this company."

Posted by

blogger

at

1/27/2006

4

comments

![]()

![]()

January 26, 2006

Vegas Condos Go Cold

We reported on this over a month ago. Nice to see Time magazine catch up... Wonder what kind of screaming deals you can get today in Vegas compared to 6 months ago?

Now that several high rollers in the Las Vegas condo-hotel game, including luxury properties linked to Michael Jordan and Ivana Trump, are either folding or selling their holdings, a growing number of players are losing their taste for big bets on high-rise, residential real estate development.

Over the past two years, as high-rise fever spread across town, prices for the luxury apartments ballooned, fetching as much as $500 - $1,000 a square foot— or up to $1.5 million for a one-bedroom— at the peak. Buyers, mostly interested in flipping them for quick profits, eagerly anted up five-figure down payments, while developers planned more than 70 luxury towers holding a total of about 43,000 units on or near the Strip and downtown. But the intense competition for the city's limited supply of contractors sent construction costs skyrocketing 30% last year, just as lending policies tightened, interest rates climbed and sales started to slow.

Currently, just 18 projects are underway, and nervous developers have called off three high-profile projects over the past seven months.

"The days of the two guys from the East Coast or Canada coming into town and promoting a condo development with a website and a dream are over.”

Posted by

blogger

at

1/26/2006

10

comments

![]()

![]()

Realtors Group Says Housing Slowdown Is Likely to Mean Slower Growth for U.S. Economy

It's interesting to read articles that are acknowledging that we're post-peak

It's interesting to read articles that are acknowledging that we're post-peak

Seems just yesterday the real estate industrial complex folks were talking about the good times continuing, soft landings and buy buy buy..

The five-year housing boom is showing increased signs of cooling, and that's likely to mean slower growth for the entire national economy. The big question now is whether home prices will come crashing to earth with even more severe consequences.

"The bloom is definitely off the housing rose. Housing peaked last summer and has been weakening ever since," said Mark Zandi, chief economist at Moody's Economy.com.

Posted by

blogger

at

1/26/2006

6

comments

![]()

![]()

January 24, 2006

OMG: Realty Times talks about inventory explosion on home page!

Once I see realtor sites (NAR, Realty Times) mentioning the truth, I figure they can't keep the truth from leaking out anymore..

The National Association of Realtors reports that in November, housing inventory – the number of homes available for sale – rose to its highest level since April 1986.

Among the cities that topped the list -- Chicago, Illinois; Binghamton, New York; and Boston, Massachusetts.

Chicago, Illinois, peaked at the top of the monthly supply survey completed by NAR. In it they found that the Chicago area had an inventory increase of a staggering 132.2 percent. It seems that everyone wanted to get on what they thought was the last stand for the sellers market. What was so worth the gamble of putting a home on the market

Posted by

blogger

at

1/24/2006

12

comments

![]()

![]()

Question for HP readers: Does anyone know anyone who's still out there trying to buy a house?

In other words, has the greatest fool already bought?

Tell your stories here about friends/neighbors (or yourself) on the buying or selling side.

I can tell you I don't know a soul in this world who is actively thinking about or trying to buy a house. But I know plenty of folks thinking about or trying to sell

hmmmm....

Posted by

blogger

at

1/24/2006

30

comments

![]()

![]()

January 23, 2006

CNN: Home prices get even more overvalued (take a look at your hometown)

Who's still buying houses out there today, that's my question...

Housing markets have cooled a bit, but not before prices got even less affordable than ever.

Although many overheated U.S. housing markets lost steam during the third quarter of 2005, most still grew less affordable.

That's according to the Local Market Monitor, a real-estate market research provider.

Through the third quarter of 2005, 79 of the 100 surveyed markets had gotten more expensive, relative to what Local Market Monitor calculates as fair value.

At the top of the list for overpriced cities was Santa Barbara, Calif. at 86 percent overvalued. The average home there should cost $308,900, according to the Local Market Monitor. Instead it sold for $573,100. The survey found that only 16 of the markets had gotten less expensive.

Overall, 37 markets were found to be severely overpriced, which meant that they were at least 15 percent more expensive than they should be, and only 6 were underpriced by 15 percent or more. Fifty-seven were deemd to be farily priced.

Posted by

blogger

at

1/23/2006

15

comments

![]()

![]()

Lies lies and more lies: The Myth of the Housing Shortage

It has become almost universally accepted over the past few years that San Diego is experiencing a severe housing shortage. The presumed housing shortage -- or when the occasion calls for slightly more drama, "housing crisis" -- has served as the a priori basis for untold articles, analyses and conversations regarding San Diego real estate.

Even your mother's folksy platitude that "they're not making any more land" has made a rousing comeback.

But the fact is that there is no housing shortage in San Diego, and there never was.

Posted by

blogger

at

1/23/2006

3

comments

![]()

![]()

Phoenix lesson in supply and demand coming - watch a market implode in front of your eyes

I realize that most of the dolts who live in Phoenix don't have the luxury of a college education, or at least a good one (see ASU standards), so this could get a bit confusing, but just in case:

There's this thing called supply. When it increases, prices likely will decline.

Then, there's that thing called demand. When it drops, that can create more of that thing called supply, which when it increases, as we know now, prices likely decline.

Talking to some folks in Phoenix, I'd say they have no idea that 1) prices are already declining, 2) inventory is rapidly increasing or 3) the market is crashing now, and I mean right now. Many homeowners I know are still counting their paper worth, or worse still, extracting $$ from their "equity" to buy new cars, a fancy trip, etc.

This market has fallen off of the cliff.

Thanks to http://overvalued.blogspot.com for another great chart. A picture is worth a thousand words (especially to the illiterate homebuyers/flippers/investors in Phoenix)

Posted by

blogger

at

1/23/2006

18

comments

![]()

![]()

January 22, 2006

Real Estate: Buy, sell, hold?

I'd add "Panic" to the list of choices of course...

Every homeowner must adjust to the new realities in real estate. How to think through your three options.

Signs are a-popping that the era of explosive home-price gains is kaput for at least the next few years.

In the past four months, the median asking price has fallen 5 percent or more in Boston, Cleveland, Los Angeles, Miami, Phoenix and Washington, D.C., reports blogger Ben Engebreth's Housing Tracker Web site, which compiles weekly data on 49 cities.

Across the United States, the number of existing homes sold fell 1.7 percent in November, while the supply of homes continued to tick higher.

Real estate agents in formerly redhot markets like San Diego and Boston say that open houses are getting little traffic.

"At the height of the frenzy, properties sold after one to three days on the market, with multiple offers," says ReMax realtor Mary Kaljian, whose Los Banos office is 75 miles southeast of San Jose. "Now we are looking at six to eight weeks -- or longer. It's becoming a buyer's market."

Posted by

blogger

at

1/22/2006

2

comments

![]()

![]()

Boston housing market crashing

Anyone from Boston out there? Gotta be getting REALLY ugly right now - you'll be the first official "PANIC" market - will be interesting to watch...

A decline in house sales last fall has left a January glut of unsold properties in suburban Boston as the big spring selling season approaches, according to data released yesterday.

The number of single-family homes for sale jumped 54 percent to 4,077 as of Friday, compared with a year earlier, said MLS Property Information Network of Shrewsbury. The data include all the suburbs surrounding Boston, extending out to Route 128; the city of Boston was excluded.

Some real estate agents expect this large supply of housing to be compounded by new sellers entering the market for the first time in February and March, which typically begins the busiest season for sales.

''We are going to be overstocked, because we have a lot more coming," said Gil Campos, an agent for Re/Max Real Estate Center in Foxborough.

Posted by

blogger

at

1/22/2006

1 comments

![]()

![]()

Question for HP readers: Anyone catching a falling knife?

Anyone tempted to buy stocks Monday morning at the new lower prices (btw where is "the banker" now that stocks have collapsed?)

Anyone tempted to put low-ball offers in on houses?

Posted by

blogger

at

1/22/2006

29

comments

![]()

![]()

Escape from New York: New York City mayor freaks out the market: NYC mayor: housing market "dramatically" slowing

Wow.

Wow.

Thanks HP readers for the link

New York City Mayor Michael Bloomberg on Friday said the real estate market was slowing "dramatically" and only a "miracle" could stop soaring mortgage rates from eating into housing prices.

Consumers are definitely feeling the pinch of higher mortgage lending rates and are not quite as eager to snap up a new home especially at time when house prices in the Big Apple are near record-highs, the Republican mayor said in his weekly radio show.

"The real estate market is slowing down dramatically and we‘re going to have a problem down the road," Bloomberg said.

"If people who want to sell their houses have to wait a longer time before someone comes along and buys it, it would be a miracle if prices didn‘t start to go down," he said.

Posted by

blogger

at

1/22/2006

3

comments

![]()

![]()

January 21, 2006

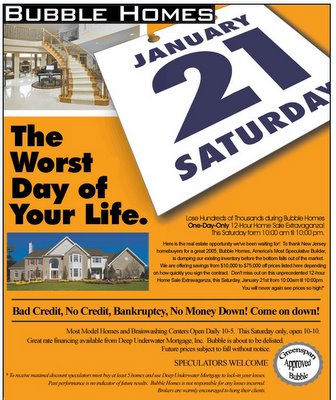

Centex blow out sale continues - and now a good parody ad

NJ Bubble did this one up - cracked me up

Builders are going to clear what they have now as fast as they can - and screw all of the new buyers to high heaven.

If that happened to me not only would I be pissed at myself, but also the Centex front man who told me about waiting lists, great investment opportunity, how he'd buy one himself, etc, even though they knew they were about to screw you hard.

Posted by

blogger

at

1/21/2006

11

comments

![]()

![]()

January 20, 2006

So 2000: Home sales fall "off the cliff" - like tech just a few years back

I was amazed in 2000 when I read what was happening to Cisco, Oracle, Intel etc. - when inventory was hitting a crazy peak, and at the same time orders fell of a cliff.

Skip forward 5 years - housing starts are at an all time high, just when home sales hit the wall.

Supply. Demand. Any questions?

Southwest Florida home builders, subcontractors and suppliers are beginning to fret about the state of their industry.Many have seen sales drop in the past three months. If that trend continues, the regional economy could be in for a rough year.

Whether inflated prices, rising interest rates, fear of hurricanes or a pullback by speculators are to blame, all eyes are fixed on what will happen during the next two months -- a time considered the high season for the sales.

"Sales have just fallen off the cliff," Wetherington said. "There's going to be a dramatic slowdown over the next six months."If he is correct, everyone connected to the powerful housing industry, from roofers and real estate agents to interior decorators and mortgage bankers, will feel the impact.

Posted by

blogger

at

1/20/2006

5

comments

![]()

![]()

Hello HP readers from bubble-rific jolly ol' England

Good god, if anyone wants to see the bubble in all its glory, come here, to London

A 2-bedroom flat in a bad neighborhood for the low low price of $1.2 Million

Seriously

And you can tell it's a sucker's game. There's a desperate estate agent (retail storefront) on every friggin corner. One word - disintermediation. But what I see are tons and tons and tons and tons and tons and tons and tons of listings - and likely no buyers, as rent only covers a percentage of the carrying costs.

What a joke. What a nice ponzi scheme on the way up. But what a hangover on the way down

London, Dublin, Sydney, Phoenix, Miami, Vegas, Boston - what happened in these cities that so many people go so stupid at the same time?

Cheers all - sorry I'll be out of pocket for a bit more as I get settled in - please post articles with links here

Keith

Posted by

blogger

at

1/20/2006

6

comments

![]()

![]()

January 17, 2006

Merrill Lynch Pump and Dump Update #3: Banc of America cuts builder stocks

So, when is that (new) SEC investigation of Merrill going to be announced?

Banc of America Securities on Tuesday downgraded two homebuilder stocks, Toll Brothers Inc. and Meritage Homes Corp., saying it was cautious on 2007 and 2008 earnings for the sector as expenses, especially land, continue to rise.

Analyst Dan Oppenheim in a research note to clients said although his estimates do not assume a housing crash, he sees profit declines for builders as costs increase faster than revenues.

Oppenheim cut his rating on Toll to sell from neutral, citing "a slower pace of sales and price appreciation along with increases in land, labor, and materials costs."

BofA said it expects demand to weaken significantly at higher price points, therefore Toll "may see more weakness than peers given its focus on the luxury segment of the market."

Posted by

blogger

at

1/17/2006

15

comments

![]()

![]()

Next up: Honolulu. This market has now popped.

The hits keep coming. And to think, it can get worse than this. Amazing. Thanks to a HP reader for the leads today

Hawaii home market cools Median price down as number of listings on Oahu surges

In November, the median price for a home on Oahu was $418,000 -- well below a peak of $569,000 in August and 8 percent below the year-ago median -- according to DataQuick, a La Jolla (San Diego County) firm that tracks real estate markets throughout the country. Its surveys are based on filings with county recorders' offices and usually reflect sales initiated 30 to 60 days earlier.

Last month, the Honolulu Board of Realtors reported a nearly 25 percent drop in the number of single-family houses sold at the same time the supply of listings surged 47 percent.

Posted by

blogger

at

1/17/2006

4

comments

![]()

![]()

Sacramento last week. San Diego is now official. Pop goes the housing bubble.

One classic trait of bubbles is the feeling among the bubble asset holders that they'll be able to get out in time

Most times the crash comes to quick and too severe - think 1929, think tulip bulbs.

However, with housing, it's even worse, as it takes many months to list and sell a house.

Especially when there are NO buyers.

Here's the POP in San Diego. Memo to San Diego homeowners: It's too late to get out now. You'd be lucky to sell at a 30% loss from the top.

San Diego County resale house prices tumbled last month by the biggest number in 18 years of record-keeping and contributed to the smallest year-to-year rise in overall prices in six years, DataQuick Information Systems reported Monday.

The median resale price for existing single-family homes dropped $15,000 from November to December to stand at $550,000, the largest month-to-month decline since DataQuick began keeping records in 1988.

Posted by

blogger

at

1/17/2006

17

comments

![]()

![]()

January 16, 2006

Iran and the return of $70+ oil - affect on housing bubble and far-out exburb house values

Does anyone want to live 50 miles away from the city center (and jobs) when gas prices stay above $3 a gallon? How about $4? How about 6?

We'll see soon

My experience with the Denver bubble in 1990 was that houses far away from the city became nearly worthless - and the ones near the city center held their values better.

I think in Phoenix and elsewhere we'll see a similar trend in 2006 - 2007.

I sure do feel sorry for the folks who live so far away - not only will their home values plummet (especially with builders undercutting them), but what a piss-poor, boring and thanks to gas prices expensive quality of life. Well, they can drown their sorrows at their neighborhood 5-star restaurant (Taco Bell)

Posted by

blogger

at

1/16/2006

24

comments

![]()

![]()

Wonk Alert: The housing bubble will probably burst.

What's happening is actually a very sad thing for America, and the world. Lives will be ruined, economies will be devastated. And why? One word - greed. But the market has it's own way of flushing out destructive behavior - if it didn't it'd be irrational. But it truly is rational, and periods of irrationality are met with periods of rationality.

Makes me wonder - who will be the winners (are there any) during this bust? And who will be the biggest losers?

Here's the article - very good read:

The 20% or greater fall in average median prices on a national basis we foresee is decidedly nonconsensus. And it will have substantial effects at home and abroad. Indeed, even a flattening of house prices will be meaningful.

Furthermore, those many who recently bought second homes and homes for investment (Chart 25) will get quite nervous if house prices stop rising. They've flooded the market with rentals, depressing rents (Chart 26), so even with interest only mortgages, many have negative carrying costs with taxes, interest, maintenance and other costs exceeding rental income. Once their confidence in rapid appreciation fades, their zeal to dump their properties onto the market leaps.

Posted by

blogger

at

1/16/2006

30

comments

![]()

![]()

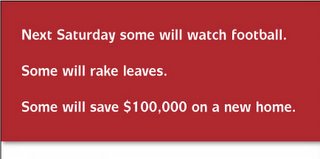

Centex Firesale Update: Save up to $100,000 on Centex homes this weekend - HOLY CRAP!

Again, can you imagine buying into a Centex neighborhood a couple of weeks ago, only to see your builder undercut your sale price by $100,000 a few days later (essentially taking your resale value down $100,000, or bankrupting you).

Again, can you imagine buying into a Centex neighborhood a couple of weeks ago, only to see your builder undercut your sale price by $100,000 a few days later (essentially taking your resale value down $100,000, or bankrupting you).

Wow.

Builders are going to screw everyone. Including themselves.

The big question is the accounting - does this drop median sales price by $100,000, or is this discount shown as "marketing expense" and the high price is recorded?

Here's the ad:

Turn off the tube. Drop the rake. Next Saturday is your chance to buy a Centex Homes in almost any Centex Northern California neighborhood and take $40,000 to $100,000 off the price on selected homesites.

New construction or one of our ready-to-move-in homes, it doesn't matter. Next Saturday's the day. 10a.m. till 10p.m. is the time. Every model will be open in each of our neighborhoods. So why not let the leaves blow into the neighbor's yard, you're gonna be moving away.

Posted by

blogger

at

1/16/2006

6

comments

![]()

![]()

January 15, 2006

Phoenix we have a problem - Listings soar past the 30,000 mark (up from 10,000)

These numbers are truly amazing. Up almost 1500 in 4 days. Up 200% in the past 6 months.

Meltdown Phoenix.

Here's how it goes down - listings explode, prices hold, sales dry up (no buyers), listings build, prices start to move down, listings build, prices move down faster, listings build (panic sets in), prices move down faster, and finally, we're back where we started.

Tracking Phoenix/Maricopa & Pinal Counties

Population 2005: 3.8 million

Listing per population ratio 7/20: 1:353

Listing per population ratio 11/10: 1:150

7/20: 10,748

7/30: 11,656

8/10: 13,099

8/30: 15,042

9/10: 16,716

9/30: 18,799

10/10: 20,073

11/10: 25,387

12/10: 27,649

12/30: 27,455

1/2: 26,715

1/10: 28,790

1/14: 30,279

Posted by

blogger

at

1/15/2006

17

comments

![]()

![]()

Gotta know when to hold 'em, know when to fold 'em: Homeowners cash in, hope market cools off

Is this sell and rent strategy happening nationwide? I can tell you that this is my personal strategy - sold in July 2005 for 100% gain, and rented vacation rentals since for 50% or so of the cost of ownership.

I really think this is going to be important for the soon-to-retire baby-boomers. Could you sleep at night knowing that 80% of your net worth was in one asset (your house)? That'd be like 80% of your net worth being in copper, or Cisco.

Two things - do this calculator from CEPR on owning vs. renting. The key variable they're using is the assumption that housing reverts back to the mean (which of course one day it will). But do the calculator - it's freightening if correct.

http://www.cepr.net/calculators/hb/hcc.html

Next, here's the article from the Arizona Republic today on this sell and rent strategy. Read the whole thing. I don't believe the media is causing the crash, but I do believe that awareness via stories like these plants seeds of doubt, and also seeds of wisdom.

Kurt Nishimura is taking a calculated ride on Arizona's real estate wave. He sold his home in the Willo neighborhood, believing its value has topped out, and is renting an apartment in the Arcadia area for a year, hoping to buy something after the wave has crested.

Nishimura is not alone. A few people are cashing in, some for good, others to sit it out for a while, hoping to beat the market.

They're betting on a crash, on the belief that the market will soon cool, and there will be bargains for the picking.

The idea: Get your money out near the top and, if you're near retirement, keep it; if you're not, wait until the market drops to get back in.

Posted by

blogger

at

1/15/2006

7

comments

![]()

![]()

January 14, 2006

HousingPanic is moving to London

Well folks, I'm off to London next week, leaving sunny (and bubblishious) Arizona for the soggy UK for a year or two.

I can tell you, if you think we're in a bubble, you should see England, or especially Ireland. So it should be interesting to report to you from "over there".

Hopefully this will give HousingPanic more of an international flavor - 'cause the bubble is truly worldwide (see New Zealand central banker's ongoing active attempt to deflate before it gets worse).

For those of you in Arizona - keep us posted what it's like "on the ground" here. Nothing brought the bubble more to life than to be in the middle of ground zero, and seeing the sea of for sale signs, and disappearance of 20 year old flippers, here in Phoenix.

Cheers

Keith

Posted by

blogger

at

1/14/2006

27

comments

![]()

![]()

Another great article in the Economist. How should Mr Bernanke respond to falling house prices and a sharp economic slowdown when they come?

I continue to be impressed with the foresight and writing in the Economist. The Harvard MBA class of 2012 will be too, when they're working on their paper on the 2000 - 2005 Housing Bubble. Here's a highlight:

When house-price rises flatten off, and therefore the room for further equity withdrawal dries up, consumer spending will stumble. Given that consumer spending and residential construction have accounted for 90% of GDP growth in recent years, it is hard to see how this can occur without a sharp slowdown in the economy.

How should Mr Bernanke respond to falling house prices and a sharp economic slowdown when they come? While he is even more opposed than Mr Greenspan to the idea of restraining asset-price bubbles, he seems just as keen to slash interest rates when bubbles burst to prevent a downturn. He is likely to continue the current asymmetric policy of never raising interest rates to curb rising asset prices, but always cutting rates after prices fall. This is dangerous as it encourages excessive risk taking and allows the imbalances to grow ever larger, making the eventual correction even worse. If the imbalances are to unwind, America needs to accept a period in which domestic demand grows more slowly than output.

Posted by

blogger

at

1/14/2006

13

comments

![]()

![]()

January 13, 2006

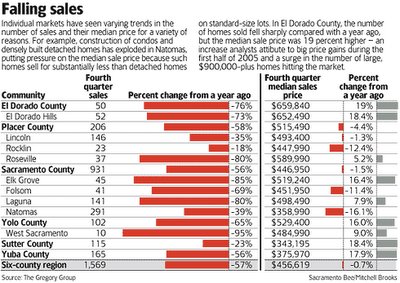

FLASH: Sacramento housing bubble has popped: New home sales down 57% for the quarter

Holy crap.

Remember when IT companies reported in 2000 that orders just fell off the cliff (right when they had maxed out production to meet demand)?

Same story this bubble. So much inventory coming on line around the country, at the exact wrong time.

Here's Sacramento. Absolutely amazing numbers. Anyone who bought in 2005 is absolutely screwed. Anyone buying today because of incentives will be equally screwed. Like buying Cisco when it dropped 10%. It's a long, long, long way down.

Sales of new houses fall 57%

Region's builders try to lure buyers with lower prices and free upgrades.

Sales of new homes in the Sacramento region plunged 57 percent in the last three months of 2005, forcing builders to offer buyers sweeter deals.

The incentives include paying off fees for roads, thousands of dollars toward granite countertops and other upgrades, and the option to make no mortgage payments for six months or more.

In some cases, builders are simply lowering their prices. For example, KB Home, one of the region's largest builders, recently cut prices on many homes 3 to 5 percent to stoke sales, said Jefferey Fautt, the builder's local division president.

"Sacramento has always been a nice, affordable market, and our prices just got a little too aggressive," said housing analyst Greg Paquin, whose Folsom firm, the Gregory Group, collected the data.

"So there are some price adjustments in some (areas) right now."

Posted by

blogger

at

1/13/2006

17

comments

![]()

![]()

Remember the homebuilder pump-and-dump call by Merrill on Monday? More bad news for Toll Brothers today

After rallying Monday, the builder stocks crashed back down to their pre-call level. Still, it was a perfectly executed pump-and-dump. Congratulations are in order to Merrill Lynch - good work!

And Toll Brothers put out this update today:

Toll Brothers Says Slowdown in New Home Contracts Continues Into First Quarter

NEW YORK (AP) -- Toll Brothers Inc., one of the nation's top luxury builders, said Friday it is seeing a slowdown in contracts for new homes, as people take more time to make buying decisions.

"Beginning in the fourth quarter of fiscal 2005 and continuing into the first quarter of fiscal 2006, we have experienced a slowdown in new contracts signed," Toll Brothers said in its annual 10-K report for 2005.

Among other factors, Toll attributed the slowdown on softening demand from buyers, a lack of available home sites caused by delays in new community openings, and delays in getting approval for new phases of existing communities.

Toll also said damage from last year's hurricanes, high gasoline prices and expected increases in heating fuel costs have dampened consumer confidence and home demand.

"Because home price increases have slowed in most markets, it appears that customers are taking more time in making home buying decisions," the company said in the filing.

Posted by

blogger

at

1/13/2006

4

comments

![]()

![]()

Question for readers: In 2008, after the fall, who will take the lion's share of the blame

What entity or profession will the public blame the most for this latest bubble? After the ARMs adjust, after the interest-only crowd walks away from their home, after people are undercut by the builders, after that paper wealth disappears, after the Senate hearings, who will the public blame the most?

Themselves?

The Fed?

Builders?

Lenders?

Realtors?

Speculators?

President?

Congress?

Fannie/Freddie?

Appraisers?

China?

And what one person (besides Greenspan) will be the face of the 2000 - 2005 Housing Bubble (RIP)? The Bernie Ebbers of this bubble?

Posted by

blogger

at

1/13/2006

16

comments

![]()

![]()

Freddie Mac economist address the 800 pound gorillia in the room - the expected flood of investor owned condos

I was driving down the road today, looking at all the for sale signs and new condo construction in Phoenix. And I thought to myself - what happens if there are NO buyers. I mean none.

Game it out - assume not one single buyer is to be found for all of these investor-owned condos and homes (especially here in AZ).

How does that look? How does it play out?

The big boys are starting to think about this. And they're scared. Really scared. Either because they don't know the answer, or because they do.

Here's an article fromn the economist roundtable at the International Builders show. Must have been an interesting meeting...

But danger does lurk, especially in Palm Beach County, which has a large number of investors who bought condominiums for speculative purposes, Freddie Mac economist Frank Nothaft said.

All three economists warned that investors are pulling out of the housing market and that most of them bought condos. The full extent of their involvement in the condo market isn't known yet, they said, because most investors paid cash.

Some experts have said investors hoping to sell at higher prices have bought as many as 50 percent of all new condos in Palm Beach County. In Miami-Dade, as many as 70 percent to 80 percent are investor-owned, experts say.

If thousands of investor-owned condos flood the local market, prices will drop dramatically, the economists said Wednesday.

"The big risk is: How many investor-owned units are there?" Seiders said. "How many hidden units will come back into the market?"

Posted by

blogger

at

1/13/2006

9

comments

![]()

![]()

Economist on Greenspan: "His legacy will linger in the shape of the biggest economic imbalances in American history"

This important article from the Economist today on Greenspan and Bubbles, a source of articles on our situation that I find incredibly spot-on. I highly recommend reading this article in its entirety.

On Mr Greenspan's watch, America has also experienced the biggest stockmarket and housing bubbles in history. Presiding over one bubble could be seen as bad luck; presiding over two smacks of carelessness.

The Greenspan era will not end on January 31st. Instead, his legacy will linger in the shape of the biggest economic imbalances in American history: a negative household saving rate and a record current-account deficit (see chart 1). Until these imbalances unwind—a process that could prove painful—it is too soon to applaud Mr Greenspan's record.

The Economist's long-running quarrel with Mr Greenspan is that he chose not to restrain the stockmarket bubble in the late 1990s or to curb today's housing bubble. He has declared himself vindicated in not pricking the equity bubble with higher interest rates, but instead to let it burst and then cut rates sharply to “mop up” the damage.

Asset-price inflation can be as harmful as conventional inflation. A sudden collapse in share or house prices can trigger a deep downturn.

When the party ends, Mr Greenspan will not be there to clean up the mess. But end it surely will.

Posted by

blogger

at

1/13/2006

7

comments

![]()

![]()

January 12, 2006

January 13 - 15: HousingPanic "Refer a Friend Weekend"

I started this blog as a community service. I've told my circle of friends and family all I know about bubbles, about panics, about manias, and about how we're in the mother of all speculative leveraged bubbles. This blog was a way of spreading the message beyond the folks I know personally.

People can take this information and do what they feel is right. For some, it's cashing in. For others, it's not buying at the peak. And for others, it's ignore the advice. We call all only do so much - people have to make their own decisions in life (and live with 'em)

So... I'm asking the 2,000 or so daily HousingPanic readers, all of whom should be pretty aware now of what's going on, to refer this blog to a friend or family member this weekend. Talk to folks, post the address on sites or chat boards you visit, whatever it takes.

Let people know what you've learned from this source and others. Let them know your course of action. And then tell them to take a spin on these pages.

I so wish in 2000 that there was a "NASDAQPanic" site that I had found before the market tanked and the bubble burst. I so wish I had a friend back then versed in economics, bubbles, manias and crashes. I didn't - and we all got soaked.

Spread the word. Help those you can help.

And sleep well knowing you made your best decision, and you helped others make theirs. Ignorance is bliss they say, but in this case, ignorance is bust.

Cheers

Keith

Posted by

blogger

at

1/12/2006

11

comments

![]()

![]()

HP readers - let's hear from you - what US market has the biggest housing bubble?

We talked about this a couple of months ago, and Miami, San Diego, Phoenix, Vegas, LA and SF were all at the top of the list.

Knowing what you know today, what do you think is the biggest bubble market? As in, big rise followed by upcoming big decline?

Word from the street here is very good - so if you're actually from that market, let us know what you're seeing out there.

From my perch today in Phoenix, not only do I see the explosion in inventory, but I hear fear out there - fear on the part of potential new buyers that they'd be buying at the top, and fear from my contacts in the real estate industrial complex that the good times may be over.

Posted by

blogger

at

1/12/2006

22

comments

![]()

![]()

Wow. Centex "$60,000 Off 12-Hour Sale" this Saturday in Atlanta

Wouldn't you be PISSED if you bought a home from Centex last week, or heck even today, and then found out that for 12 hours on Saturday they're giving $60,000 off (as in, you overpaid $60k, or your home's value just dropped $60k)

These builder price cuts are a slippery, slippery slope, and like Vegas saw last year, open the builders up to charges of fraud and deception.

One more thing for folks to consider who are buying next to where builders are building. They can crush you at any time. The profit margins on new houses have soared to such atmospheric heights that they can hack away at price and still make a fortune. However, if you bought one of their houses for say $500k, your cost basis is $500k if not more.

Hat tip to HP reader AJ for the lead

Posted by

blogger

at

1/12/2006

12

comments

![]()

![]()

Boston: ARMs come home to roost

Once you get behind that 8-ball, it's tough to get out

I've heard stories of people who refi'd just to take $ out to help with their monthly payments which they couldn't afford

Here's the sad update from Boston - thanks to a couple of Boston HP readers for sending the article:

Squeezed by rising interest rates, homeowners who stretched their finances to buy properties while the market was hot are scrambling to pay higher monthly payments on adjustable-rate mortgages that were the least expensive option at the time they purchased their homes.

''A lot of people live paycheck to paycheck, and they're losing a couple hundred bucks a month" due to higher rates, said Edmund Poli of Poli Mortgage Group in Norwood. More homeowners are coming to his firm for help, but ''sometimes there's not much they can do because they have 100 percent financing."

''People have put problems off by multiple financings and increasing equity," he said. As a last resort in a rising market, he said, people could sell the house and pay off the loans. But if prices decline, selling a house will not generate enough cash to pay off a loan.

''I have a sense it could get ugly soon," he said.

Posted by

blogger

at

1/12/2006

1 comments

![]()

![]()

January 11, 2006

BusinessWeek: More and More Unsold Homes - A huge boom in housing construction may be about to create a glut in the market

Supply.

Demand.

Any questions?

The inventory of unsold new homes doesn't look too scary when you view it the conventional way, namely, in proportion to the rate of new-home sales. In November, the inventory added up to 4.9 months' worth of new-home sales, vs. 4.3 months' worth one year earlier.

But the inventory looks scarier when you look at the actual number of unsold homes--503,000, seasonally adjusted, in November. That's up from around 350,000 in the early 1990s, the last time there was a glut.

The only reason there isn't a glut so far this time is that the rate of sales remains strong. But if the rate of housing sales drops, the inventory is likely to pile up faster than builders can dial back on construction. That's what happened in 1991, when the inventory of new homes topped out at more than nine months' supply. Now, with a lot more homes in the market, it's easy to imagine the ratio of inventory to monthly sales getting even higher.

Thanks to John Burns of John Burns Real Estate Consulting Inc. (who, by the way, is not a housing bear) for pointing out this issue

Posted by

blogger

at

1/11/2006

1 comments

![]()

![]()

Pump and Dump?

Anyone feel like we're in the middle of a classic pump and dump on Wall Street, especially with the analyst upgrades of the homebuilder stocks?

Posted by

blogger

at

1/11/2006

10

comments

![]()

![]()

We are now China's puppy: Mortgage Watchers Worry About China

Not only does China own us financially (holding nearly $1 Trillion in our bonds), not only does China supply our Wal-Marts, but now China controls the future of our housing market? Amazing.

Ever have someone steal your wallet when you were passed out drunk in the bushes?

Home Buyers Could See Higher Rates if China Curtails U.S. Treasury Purchases

NEW YORK (AP) -- China's recent signal that it may diversify its foreign investments in 2006 has mortgage industry watchers concerned that if China buys fewer U.S. Treasury securities this year, it may drive interest rates higher and pour more cold water on the real estate market.

Last week, China's foreign currency regulator said its plans for 2006 include "actively exploring more efficient use of our FX (foreign-exchange) reserve assets" and "widening the foreign exchange reserves investment scope." While China's central bank said Tuesday it has no plans to sell dollars from its $800 billion-plus foreign reserves, some analysts predict China may buy less U.S. government debt at Treasury auctions this year.

While Hackel believes the change in China's buying of Treasuries should result in a marginal increase in mortgage rates, David Olson of Wholesale Access, a firm that tracks the mortgage banking industry, believes mortgage rates could be as much as half a percentage point higher.

"I don't think they (China) are going away completely, but if they do then we're going to have quite a runup in rates," said Olson.

Posted by

blogger

at

1/11/2006

10

comments

![]()

![]()

New: BUBBLE TALK ongoing chat area - talk about any housing topic you'd like here

Hey, it's your blog too - talk about anything you want here, as long it's about our little friend, the housing bubble, in some way

Posted by

blogger

at

1/11/2006

114

comments

![]()

![]()

Help a HP reader - offer your free advice - should he buy or bolt?

Here's an email I received from a HP reader from Arizona. He wanted me to post this to the site to get HP readers' feedback and advice

Poor guy. It must be gut-wrenching right now to sign your name to that mortgage, no matter what the situation.

Step up HP readers - give the poor guy your best, serious advice.

To HousingPanic:

I have been following your blog for sometime and am addicted to it.

I am supposed to be closing on a home in Mesa, Az on Feb 6th for 305,000. It is a new build from KB Homes (Summerlin). I bought the house for 279,000 plus 25k in upgrades. It is 1817 sqft and has almost no back yard at all.

Since I am a first time homebuyer the earnst is only $2500. The same house is now going for about 313k but that price has not changed in a couple months.

I am wondering if I should bail on this house.

I cant stop thinking about it and was hoping that you can provide me with some advice. I can still bail on it and the worse case is that I will lose $2500 right now...and I may even be able to get that back. Any help is greatly appreciated.

Here is the link to the home:

http://www.kbhome.com/Community~CommID~00875455.aspx

Thank you in Advance!

Ajay

Posted by

blogger

at

1/11/2006

38

comments

![]()

![]()

January 10, 2006

Soros added to housing bubble believer list

Wanna bet against Buffet and Soros? Go ahead. Stupider things have been done. Maybe.

Soros: U.S. recession may occur in '07

Billionaire investor George Soros said Monday the Federal Reserve might overshoot in its bid to tighten monetary policy, deflating housing prices and tipping the economy into recession in 2007.

A collapse in U.S. housing prices could be associated with a dollar decline, scuppering the Fed's attempt to engineer a "soft-landing" for the economy, Soros told an audience at the Singapore Institute of International Affairs.

"If housing continues to cool while rates are slowing then it could turn into a hard landing," Soros said. "That's why I expect a recession to happen in 2007, not 2006."

Posted by

blogger

at

1/10/2006

10

comments

![]()

![]()

Dot Condo Miami Update: 25,000 (flipper) condos hitting the market soon. Maybe Sonny Crockett will leave the boat?

Good interview today on the Miami condo market bubble. 25,000 condos under construction. Amazing. Like GM rolling out the Hummers right when $3 a gallon gas hit. The Miami situation will be amazing to watch unfold over the next 12 months.

Good interview today on the Miami condo market bubble. 25,000 condos under construction. Amazing. Like GM rolling out the Hummers right when $3 a gallon gas hit. The Miami situation will be amazing to watch unfold over the next 12 months.

Henry Fishkind is the principal of Orlando based-economic consulting firm Fishkind & Associates.

Q: How do you characterize the housing market in Miami?

A: There is a significant condominium bubble in Miami. There are by our account 25,000 condos under construction in Miami-Dade County right now. I believe 18,000 of those are in the city; in downtown alone there are 9,800. It is completely unrealistic to believe that all of those units can be absorbed in the next 12 months.

Q: What are the ripple effects of a housing slowdown in the broader economy?

A: Clearly as housing activity slows, there will be a direct effect on construction. Pricing pressures will improve. It's interesting to note that about one-third of the upsurge in retail (both local and national) sales were directly related to housing. As the housing market slows, we'll see concomitant slowing in construction and in retail sales. I am only projecting mortgage rates to rise to 7 percent. That's enough to cool the markets without crushing them.

Posted by

blogger

at

1/10/2006

2

comments

![]()

![]()

Greater Fool in Boston: A new home, grand trip, and boatload of debt

I'm speechless

(hat tip to HP reader Mike for the article)

Eleanor Hoxie makes a good living as a marketing manager for a Boston consulting firm, but is she spending her money wisely?

The 28-year-old Rhode Island native says she lives a ''pretty rich life," eating out a lot and planning lavish trips such as her $4,000 vacation to Hong Kong with her boyfriend. But her biggest splurge by far is the $375,000 East Boston loft condominium she bought in August 2004, using two interest-only mortgages to get in the door without a down payment.

''It was a very rash decision," Hoxie said.

''I know I could be doing something better, but I'm unsure where to focus energy. Should I pay down the principal on one of the mortgages, try to get rid of the credit card or student loan debt or focus on retirement savings?" Hoxie said.

Sagan said the purchase of a home with no money down 20 years ago ''was unheard of."

''This product arose in response to those who want to be homeowners but lack the income and/or the assets to make a down payment," he said.

The number of interest-only loans in Massachusetts has surged to 19.5 percent of total mortgages in 2005, up from 1.8 percent in 2000, according to LoanPerformance, a San Francisco firm that tracks mortgage data.

''Without the interest-only option, Eleanor would not have been able to afford the condominium," Sagan said

Posted by

blogger

at

1/10/2006

8

comments

![]()

![]()

Analyst corruption (again)? Merrill housing analyst Lorraine Maikis goes directly against Merrill Chief Economist David Rosenberg

File this under very very very strange things indeed. Perhaps we add "Wall Street Analysts and Bankers" to our list of Real Estate Industrial Complex participants?

There's been good talk here at HP in the past few weeks about how dangerous it is to short stocks, and homebuilder stocks. Short term that couldn't be more true. Manipulation and insider games will kill the small investor. But long term I can't see a way out for the major builders.

Especially odd today is Merrill Lynch housing analyst Lorraine Maikis (who can be reached at 212-449-1157) coming out with a positive recommendation on the homebuilders she follows (perhaps a bit too closely if you know what I mean), when David Rosenberg, Chief North American Economist for the very same Merrill Lynch (and a MAJOR and VOCAL housing bear), recently said:

“A lot of the economy’s fortunes hinge on the housing market, and yet it doesn’t look like it’s all that stable to me,” Rosenberg said. “The last leg has been fueled by a mountain of leverage and a lot of speculation"

and

"The demographic story behind the housing market boom, as we always thought, was a giant hoax"

and

"The Fed is in some sense caught in a box,'' said Rosenberg, who estimates 60 percent of the U.S. is experiencing a housing-price bubble.

Do Mr. Rosenberg and Ms. Maikis ever talk? Any way you slice it, Merrill has (another) big stench around it today. I'd encourage the media reading this blog to dig a bit at the investment banking relationships of Merrill and the likes of Toll, Pulte, Lennar, etc. A Merrill analyst popping the stocks of these companies, whose insiders have been dumping like crazy, frankly stinks.

Here's today's action:

Shares of big homebuilders jumped on Monday after a batch of positive analyst reports painted an optimistic outlook for the housing sector in 2006, reassuring investors that the nation's homebuilders may have more room to rally after nearly five years of frenzied growth.

"Long-term housing demand remains strong, (with) housing starts over the next decade to be in a range of 1.8 to 2 million per year," Merrill Lynch analyst Lorraine Maikis wrote in a report dated Jan. 9.

Merrill's bright forecast for the industry coincided with bullish reports issued by other investment banks on Monday.

Posted by

blogger

at

1/10/2006

8

comments

![]()

![]()

January 09, 2006

Trouble with Condos from Washington, DC: Area Condo Sales Cooling After Record-Setting Year

Few interesting tidbits from bubble market DC

* Already oversupplied condo market about to have 50,000 more units dumped on market in the next 36 months

* Developers rushing to completion because they have to financially

* 500% more condo units for sale today than 12 months ago (wow!)

* Investors pulling out, canceling units and deposits for fear they won't be able to break even

I'm reminded of the "Trouble with Tribbles" Star Trek episode here - condos multiplying like Tribbles and nobody can stop 'em. (No, not ST geek, but a great episode for sure). Here's highlights:

That's a big change from when there were only a handful of properties available and buyers had to snap them up with little time for reflection, she said

About 51,400 units were being planned or marketed for delivery within the next three years, Delta Associates found, up from 39,000 three months earlier. It appears some builders are proceeding with projects they have spent years developing, even as the supply of new units rises, in hopes their projects will be more successful than the competition

Leisch said many condo developers are proceeding because they must financially. "They paid so much for the land, and they are so far down the development timetable, they are so far committed, that, practically speaking, they can't stop," he said.

"I think without question the condo market will continue to soften," said Kenneth Wenhold, Virginia and Maryland director for MetroStudy, a Houston-based real estate research firm that specializes in the new-home market. Wenhold said there are five times as many condo units for sale as there were a year ago.

When the condo market was at its peak a year or so ago, investors flocked to buy units before construction with the intention of flipping them for a profit. Wenhold said he has heard that some of those investors are deciding not to go through with their purchases, giving up their down payments, to avoid being left holding units they cannot sell.

"Contracts are falling through because people are walking away from the closing table,"

Posted by

blogger

at

1/09/2006

6

comments

![]()

![]()