Good term: Hit and Run. That about describes Phoenix for sure. Investors swooped in, driving prices up 55% last year, buying up everything in sight.

Good term: Hit and Run. That about describes Phoenix for sure. Investors swooped in, driving prices up 55% last year, buying up everything in sight.

Then BAM, they were gone like cockroaches in the night, with the locals left holding the bag.

And now we go back to exactly where we started. However, tens of thousands of folks will lose everything. Everything.

Investors hit and run on housing

Catherine Reagor - Arizona Republic

04/25/2006 02:07:34

Investors didn't just ravage metropolitan Phoenix's housing market last year. Almost 28 percent of all home sales nationally were investor driven in 2005, according to a new report.

In Phoenix the figures is probably closer to 35 percent.

The National Association of Realtors reports 27.7 percent of all homes sold last year went to investors, and another 12 percent were sold to people buying vacation homes.

The demand for both investment and vacation homes obviously drove the housing market to its record levels last year. Those sales made up 40 percent of all deals.

If the housing market fell by half that much this year, it would be devastating to Phoenix's economy. For the first quarter of this year, used home sales were off 34 percent from 2005's first quarter.

April 30, 2006

Arizona Republic columist: Investors "hit and run", ravaging the Phoenix housing market

Posted by

blogger

at

4/30/2006

27

comments

![]()

![]()

April 29, 2006

"This game is up" - Moody's predicts DC condo to plummet 20%, with more cities in trouble too

Let's just say when Moody's talks, people should listen. I'd like to see their forecast for Miami, Phoenix, San Diego and more. Predicting a 20% decline in the DC condo market is safe, but as we all know, bursting bubbles tend to overshoot on the way down. A 50% decline is not outside the realm of possibility...

Let's just say when Moody's talks, people should listen. I'd like to see their forecast for Miami, Phoenix, San Diego and more. Predicting a 20% decline in the DC condo market is safe, but as we all know, bursting bubbles tend to overshoot on the way down. A 50% decline is not outside the realm of possibility...

Watch out below - some US cities are about to be devastated by this condo hurricane...

In D.C. Area, Condos to Take Biggest Hit as Inventory Grows

Home prices in much of the Washington region will likely drop 10 percent or more because prices have far outpaced affordability for first-time buyers and investors, according to a forecast this week by Mark Zandi, chief economist of Moody's Economy.com.

Condominiums will be hardest hit, Zandi predicted Thursday at the National Association of Home Builders' spring construction forecast. He said during his presentation that there are no hard data to pin down how far prices might fall or how the prices of single-family houses would be affected, compared with condos. In an interview later, he said that the growing inventory of condo units that are for sale or being built here suggests that the slide would be worse for that sector

"I could say roughly that prices would fall about zero to 5 percent for single-family homes and about 15 to 20 percent for condos," he said.

He pinpointed six areas where prices have exploded as the most likely to see crashes. In addition to the Washington area, they were Atlantic City-Ocean City, N.J.; Las Vegas; Miami; Orlando; and Phoenix.

"This game is up," Zandi said.

Posted by

blogger

at

4/29/2006

10

comments

![]()

![]()

April 28, 2006

FLASH: David Lereah, NAR Chief Weirdo, with some more wonderful quotes

HUGE hat-tip to Mish's Global Economic Trend Analysis for these dandies from the bizarre, confused, corrupt and possibly psychotic Mr. Lereah at a private meeting of real estate pros, as quoted by real estate pro Mike Morgan.

After reading these, you'll understand that Mr. Lereah is at times brutally honest (but never in press releases or public meetings) and at other times the most confused and incompetent economist in the profession:

“Some builders will get caught with their pants down, because they built too much”

“Naples Florida is even worse. Misery loves company.”

“If you have a healthy local economy it is almost impossible to have a bubble burst!”

“You have a great future in real estate, but you need to cleanse your real estate markets. We made a mistake. It’s going to hurt. You are going to have a double digit drop. Expect it.” And in his very next breath, “2006 will be the best year ever.”

“The laws of supply and demand have not been revoked.”

“Is this a bad year. Yes. Your numbers will down. You got ahead of yourselves. The market got ahead of itself.”

Lereah said it will be the “middle of 2007 when you start to pick up again. I see Florida picking up in 2007. But there are particular markets that will not. It depends on inventory levels.”

“40% of all loans in 2006 were interest only. . . Prices went higher because of the artificial energy in the real estate market . . . that’s what took the punch bowl out of the party.”

He continued to paint a rosy picture by stating that real estate was the, and I quote, “new gold standard

Posted by

blogger

at

4/28/2006

18

comments

![]()

![]()

"What a dream it is to become wealthy without effort"

Unfortunately, the common American does not understand he is being manipulated and impoverished by the Federal Reserve.

When money is no longer real (i.e. fiat currency vs. gold and silver), then people may come to believe in the surreal, and a hyperreality emerges.

In particular, during the reign of Alan Greenspan, money and credit – created out of thin air – rained upon Americans as if to assure us that crop failures and misfortune had been banished from U.S. soil.

Hence, we came to live in a world of plenty where one may become wealthy by simply purchasing a house – with lots of borrowed money – and by "investing" in stocks for the long run.

What a dream it is to become wealthy without effort.

This mass delusion is only one step away from collectively believing that cotton candy is a cash crop.

Alas, Americans will soon discover that housing values don’t grow to the sky and that heavy mortgage debt leads to a harvest of financial despair.

The Austrian theory of the trade cycle will be validated yet again.

- Eric Englund, April 2006

Posted by

blogger

at

4/28/2006

12

comments

![]()

![]()

One more disaster for the list - folks who are basing their retirement on their house "savings"

I've heard so many of these stories, of folks who stopped contributing to their 401ks, or went out and splurged on everything to trips to Tahiti or Hummer H2s, because of the wealth effect of housing.

Why save anymore, when because of your house, you're loaded? Why not buy that Hummer H2 - your house just went up another $100,000!

Well, because just like the dot-com paper gains, they can go away really, really quickly. As the folks in Phoenix (among other cities) are just now finding out.

Here's an article about people basing their retirements on their home. Oh, man, do I have some bad news. So sad. Not only will many not be able to retire "on the house" - they'll even have a tough time staying in the house...

Finance: Your house as a nest egg

Do you think your house is your retirement nest egg? Think again, say some financial advisers.

Many, if not most, homeowners do expect to retire "on the house" according to the Center for Retirement Research at Boston College.

But at the same time they are reducing their own equity by borrowing against their homes for other expenses. They may be counting on inflated home values that could fall by the time they are ready to sell and move. They may be counting on a resource they never really want to sell.

In other words, they may not be being very realistic.

"We all say people will sell their house and that's how they are going to live," says Bev Moore of MainStay Investments, a division of New York Life Investment Management. "But the bubble might be in the process of bursting."

Posted by

blogger

at

4/28/2006

11

comments

![]()

![]()

May 1st: Round 'em up! Huge immigration protests threaten to shut down America

I'm sorry - you want to invade our country illegally (while tens of millions wait in their home countries for their chance to LEGALLY enter the US) and then you want to disrupt our economy, shut down our cities, and cause havok in the streets?

I'm sorry - you want to invade our country illegally (while tens of millions wait in their home countries for their chance to LEGALLY enter the US) and then you want to disrupt our economy, shut down our cities, and cause havok in the streets?

OK, that's cool. But I sure hope someone in the Bush Administration wants to send a Reagan-fires-the-air-traffic-controllers-like-message: Round 'em up and send 'em home. And this is going to backfire so hard, and so fast, that heck, I couldn't have planned it better myself.

May 1 protest aims to "close" cities

Pro-immigration activists say a national boycott and marches planned for May 1 will flood U.S. streets with millions of Latinos to demand amnesty for illegal immigrants and shake the ground under Congress as it debates reform.

Such a massive turnout could make for the largest protests since the civil rights era of the 1960s, though not all Latinos -- nor their leaders -- were comfortable with such militancy, fearing a backlash in Middle America.

Posted by

blogger

at

4/28/2006

44

comments

![]()

![]()

April 27, 2006

HousingPanic archives - October 2005 - Nothing like cashing out at the top

SoCal bubble reminded me of this article we all posted back in October 2005 about the king of real estate investing getting out back then. Man, what a call.

The rich get richer, the poor get poorer, and trust me, the pros are long, long gone. It's the poor folks, the greedy and especially the stupid amateurs who bought post-peak that are going to lose it all.

The king of real estate's cashing out

Tom Barrack is selling most of his U.S. portfolio. Maybe you should be nervous too.October 24, 2005: 7:56 AM EDT By Shawn Tully, Fortune Senior Writer

NEW YORK (Fortune) - Tom Barrack, arguably the world's greatest real estate investor, is methodically selling off his U.S. real estate holdings as prices drive the market to nosebleed levels.

He likens the current real estate market to a game of polo.

"I feel totally safe playing polo on a field full of pros," says the bronzed 58-year old. "But when amateurs are all over the field, someone can get killed. They have more guts than brains. They charge after every ball and don't know when to hold back."

It's the same with U.S. real estate right now. "There's too much money chasing too few good deals, with too much debt and too few brains." The amateurs are going to get trampled, he explains, taking seasoned horsemen, who should get off the turf, down with them.

Says Barrack: "That's why I'm getting out."

Right now, Barrack's view of the U.S. market couldn't be clearer: It's a great time to sell, and a terrible time to buy.

Posted by

blogger

at

4/27/2006

2

comments

![]()

![]()

I absolutely LOVE this nut!!!

When you own oil stocks and gold, are dumping dollars and rent vs. own, you root for this nut to keep yapping away. Gold soars, oil soars, and then we have a great excuse to take him and his government and their nukes out, bigtime.

I think a few folks out there too waiting for the rapture and armageddon (hmmm.. maybe even the president) are rooting for the nut too.

Keep yappin Mr. Iranian Jerk. Keep up the good work! Don't let us down!

tick... tick... tick... tick...

Ahmadinejad's defiant stand on eve of nuclear deadline

With less than 24 hours before the latest deadline to halt its uranium enrichment expires, Iran's President Mahmoud Ahmadinejad today made another belligerent pledge to press ahead with his nation's outlawed nuclear programme.

At a rally in the north of the Islamic republic, the President told crowds: "We have obtained the technology for producing nuclear fuel. Thanks to God we are a nuclear state, no one can take that away from our nation."

NI_MPU('middle');

The President's claims were bolstered by warnings from an Iranian opposition group in exile, which reported that Tehran was further ahead with its research than it has admitted.

Posted by

blogger

at

4/27/2006

11

comments

![]()

![]()

Realtors and other members of the corrupt Real Estate Industrial Complex - the floor is yours - make your case

Defend your profession. Defend your peers. Tell us why housing isn't collapsing. Tell us why real estate is a great investment today. Tell us why the cost of ownership to rent ratio doesn't matter. Tell us why your city isn't in a bubble (even if the rest of the country is).

Tell us why people need realtors. Tell us why realtors deserve a commission. Tell us how appraisers aren't motivated to inflate their appraisals. Tell us why 50 year interest only no down no doc loans are a good idea. Tell us why the NAR numbers are valid. Tell us how US property is undervalued.

Tell me what an idiot I am. Tell us why deficits don't matter. Tell us why the outsourcing of American jobs to Mexico and China doesn't relate to housing values.

Tell us whatever you want. The floor is yours!

Posted by

blogger

at

4/27/2006

32

comments

![]()

![]()

HousingPanic's new name

You can see above, I've changed it to "HousingPanic - The Bubble Blog with Attitude"

I think that about sums it up.

If you want just a stream of housing bubble bursting news, I'd suggest browsing the ones I've listed on the right sidebar. If you want a Democrat or Republican blog, there are plenty of those too.

But if you want more of a ruckus, a bubble blog that tries to tie it all together into the complete story, with some independent, biting, hard hitting, no-punches-pulled, no-sacred-cows view on the news and events tied to the bubble, then I'd recommend HP.

As loyal readers know, the issues that seem to go hand in hand with the collapse of the housing bubble are:

1) The credit bubble, misguided central bank policy and reckless lending

2) The US debt, deficit and trade imbalance explosion

3) The corrupt Real Estate Industrial Complex (realtors, brokers, developers, builders, bankers, etc)

4) The incompetence and corruption of our leaders - Democrat and Republican

5) The pure laziness and biased agendas of the mainstream media - Fox News, the Arizona Republic, the New York Times and so so so many more

6) World geopolitical events' impact on the world economy and future economic prospects - the war in Iraq, and soon to be Iran, the war on terrorists, the battle between christians, muslims and jews

7) America's outsourcing of its manufacturing base to China, coupled with its internal labor force to Mexico

8) The shallowness of the American surburban lifestyle - far-flung new homes built in characterless tract communities, gas guzzling cars, the Wal-Mart nation, chain stores, chain restaurants and loss of local character

9) The stock market, gold, the declining dollar, wealth preservation, CEO pay, and the get rich quick mentality versus hard work.

10) Oil, global warming and environmental policy

Keep in mind that this is a blog, not a TV network. Flamers and Realtors cannot and will not drive what content I publish, or my commentary. I'll call it like I see it, period. Then folks are welcome to respond with their opinion. Or leave. I just ask that you keep it clean.

At the end of the day, the reader has a lot more information than they had before, some nuggets to think about, and hopefully some fun.

Cheers.

Posted by

blogger

at

4/27/2006

36

comments

![]()

![]()

Goldbugs - make your case for investing in gold and commodities

You've heard me yammer away, including putting my money where my mouth is with that big buy I did last week of GLD.

You've heard me yammer away, including putting my money where my mouth is with that big buy I did last week of GLD.

My case: The falling dollar drives gold's price rise, plus a flight to safety, Iran, Iraq, the debt, the deficit, the trade imbalance, rebalancing of foreign reserves, the housing bubble popping, blah blah blah...

The yellow stuff seems to be taking a breather at $635 or so, and I think we'll see $700 by May's end.

For anyone who DOESN'T think gold is in the early days of a big rally, (try to) make your case too. Talk me out of buying more - seriously!

Gold and metals posted strong gains for the second day in a row on Wednesday after strong U.S. economic data supported the outlook for continued demand for commodities.

Gold for June delivery finished up $7.80, or 1.2%, to $642.0 an ounce. Silver for May delivery rose 25 cents, or 2%, to $12.81 an ounce. Copper for May delivery gained 7.45 cents, or 2.2%, to $3.3950 a pound, off a fresh record high at $3.49.

Posted by

blogger

at

4/27/2006

41

comments

![]()

![]()

Centex orders fall 11 pct, slashes forecast (even firesales don't help)

Even those $60,000 off fire sales can't help at this point... it's a long, long, long way back down for Centex and the other homebuilders. Just like the telecom's in 2000 - they're drowning in capacity right when the bubble blew...

Plus, if I was an accountant advising these builders, I believe they must write down the value of their inflated assets (land) to reflect current market valuations, vs. the prior bubble valuations. Just like telecom had to do (or didn't do in the case of some that are now in jail)

No. 4 U.S. home builder Centex Corp. (CTX.N: Quote, Profile, Research) on Wednesday reported a lower-than-expected quarterly profit and sharply cut its outlook as new orders fell 11 percent, sending its stock down 7 percent.

Since peaking last summer, the U.S. housing market has sagged under the weight of rising mortgage rates, which have climbed to their highest level since 2002.

"Net-net it's disappointing," said Keith Gangl, portfolio manager at Thrivent Investment Management

Posted by

blogger

at

4/27/2006

5

comments

![]()

![]()

Bravo to US News & World Report - reinforces what the bubble blogs are saying on housing numbers

More than a few realtor trolls were flaming in the housing number posts this week - about how homes were flying, no need to worry, and how HP is full of ___ when I said

More than a few realtor trolls were flaming in the housing number posts this week - about how homes were flying, no need to worry, and how HP is full of ___ when I said

"Classic bubble behavior - units sold (i.e. dumped at the new low prices as the smart folks bail out) increased, as median price tumbled again"

Well, here's a great article today in the MSM that should be used to flog any realtor or housing pumper:

Let me get this straight: Mortgage and interest rates are on the rise. Household finances are also being pinched by record gasoline prices. Yet somehow, Americans have all of a sudden decided to go out and buy a whole slew of new homes?

That's what a new government report released this morning would seem to suggest. But dig a little deeper, and you'll see what's really going on.

According to the Commerce Department, new-home sales in March shot up an unexpected 13.8 percent, after plummeting nearly 11 percent in the prior month. As a result, the inventory of new unsold homes in the market fell from 6.3 months' worth of housing stock to 5.5 months.

The news comes only a day after the National Association of Realtors reported a slight increase in existing-home sales last month.

The March new-home sales figures came as a bit of a shocker to economists, who were forecasting single-digit growth at best. But the news wasn't all good.

In February, for instance, the government reported that the median price of a new home sold was just under $240,000. At that price, homebuilders found that demand was diminishing. In fact, new-home sales plunged by 10.9 percent that month.

So in March, homebuilders started slashing prices. The median sales price of a newly constructed property sold in March fell 7 percent down to $224,200. And since peaking at $243,900 in October, median sales prices on new houses have tumbled 8 percent.

What does this mean? While demand for new homes may be up, this is clearly turning into a buyer's market.

So if you're in the market to purchase a new home, wait. If you show some patience, chances are home sellers will be putting their properties in the discount bin

Posted by

blogger

at

4/27/2006

10

comments

![]()

![]()

April 26, 2006

White House and Fox News tie the knot officially - let the propaganda continue

This is the most out of touch white house in my memory. Worst than Carter during his rose garden hideout days. Worse than when Nixon roamed the halls drunk talking to portraits.

This is the most out of touch white house in my memory. Worst than Carter during his rose garden hideout days. Worse than when Nixon roamed the halls drunk talking to portraits.

But add out of touch with politically unsavvy, and you get this (new) disaster. They obviously didn't check the guy's CV very much though (which is par for the course - remember Brownie? Remember Harriet? Remember the shoplifting advisor?).

Must've saw Fox News on the resume and said you're hired! I hope he gets Jeff Gannon back in the room too. And maybe start paying for stories again in Iraqi papers. And start paying Armstrong Williams to place stories too.

You know, Hitler was fond of propaganda too. So was the USSR. It does have its place when you want to control and manipulate an impressionable population. Kudos to the team on this one!

Here's some great Tony Snow quotes:

Posted by

blogger

at

4/26/2006

26

comments

![]()

![]()

New home prices crash (again) in February, and mainstream media asleep at the wheel again

Classic bubble behavior - units sold (i.e. dumped at the new low prices as the smart folks bail out) increased, as median price tumbled again.

It's interesting how the MSM are spinning this. They're reporting the GREAT NEWS - home sales up - as their headline. And they're quoting 2.2% decline in price - even though that's against March 12 months ago. The true price decline was down a whopping 6.5% from February.

The MSM also makes no point of the Centex $100,000 off sales, the huge incentives and cash-back used by builders to dump inventory, or the 8% commissions being paid. That would involve the MSM doing work of course, and not a rip-and-read.

Does anyone care what the cost of gas, or flour, or a milk was versus 12 months ago? NO! They care versus what it cost them last month. 101 folks.

Obviously, the smarter folks in the room see this as classic bubble behaviour. And that guy who bought a house 30 days ago for $1 Million that is now worth $65,000 less today.

Sales of new homes soared in March by the largest amount in 13 years, reflecting a rebound from bad weather in February. But the median price of the homes sold last month actually declined, providing evidence that the nation's five-year housing boom is slowing.

The median price, the point where half the homes sold for more and half for less, also showed a decline in March when compared to February, falling by 6.5 percent.

Posted by

blogger

at

4/26/2006

25

comments

![]()

![]()

April 25, 2006

Bush, gearing up for war with Iran in days or weeks, suspends deposits to Strategic Oil Reserve

Oh, man, it's on. He couldn't have telegraphed it more than he did today. He knows he's going in, and he knows he wants to avoid gas lines, although $5 gas is a certainty at this point. He knows we need as much liquid gold in the system as soon as we can get it there. Because world supply is gonna get tight, real tight, in a matter of days or weeks.

Good luck all. Get ready for Even days and Odd days.

"We'll leave a little more oil on the market'' by halting deliveries to the reserves, Bush said. "Every little bit helps.''

Posted by

blogger

at

4/25/2006

48

comments

![]()

![]()

Questions for America (and how can anyone be long the stock market in this environment?)

* Who has more buyer's remorse - the 50.7% of people who voted for George Bush in 2004, or the couple who bought that Toll Brothers house in Phoenix in July 2005?

* Will the Democrats win the House in 2006? The Senate too?

* Will they censure Bush? Will they impeach him? Will Bush resign? Who in his administration will be shown the door soon?

* Are there a "Pentagon Papers" or "Nixon Tapes" out there? What will they be?

* Will there be the Rapture this year? Will the Hidden Imam reappear? Will Jesus?

* Will Bush's approval ratings go below 25%? Will he go down as the least popular and worst president in US history? Will he make it to January 2009?

* Will Bush get rid of Cheney soon? Will he appoint Rice VP and save the party and his presidency? Or issue a terror alert?

* Will bird flu break out human to human? When? Where? And what will be the aftermath?

* Will there be a major terrorist attack on the US in 2006? 2007? 2008?

* Will gold hit $1000? $2000? Will oil hit $100 a barrel? When?

* Will the Dow close up or down for 2006?

* What will be the #1 issue for the 2006 races? Iraq? Iran? Terrorism? Housing? Cronyism and Incompetence? Immigration? Gays? Abortion?

* Will there be a big surprise before the election? If so, what will it be?

* Will Bush ever address a crowd that is not hand-picked?

* Will there be mass protests in the streets of DC to throw the bums out and end the war?

* Will Sean Hannity, Rush Limbaugh, Tony Snow or Fox News say one critical thing about the Administration?

* Will Hillary run? Will Trump? Who will be the front runners for 2008?

* Will the evangelical christian right realize they got hoodwinked in 2004? Who will they support? Will they matter?

* Will gas prices hit $4 in California? $5? $10? Will there be lines?

* Will there be a devastating hurrican season? Will we lose another American city to global warming?

* Will Fox News white male gay-hating muslim-hating, women-hating angry christian viewers start seeing the truth?

* Will Israel or the US or NATO attack Iran's sites? When? How?

* Will Osama or Al-Zarqawi get caught or killed before the election? Will there be another terror alert?

* Will GM go bankrupt? Will Ford? Will Fannie Mae? Will Toll Brothers?

* Will FirstRung still be around in 2008?

* Will Scooter Libby go to jail? Will Ken Lay?

* Will Britney divorce Kevin? Will Katie divorce Tom? Will Charlie go OJ on Denise? And who will win American Idol?

Posted by

blogger

at

4/25/2006

30

comments

![]()

![]()

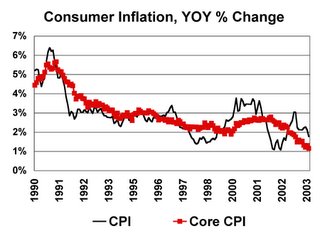

If everything is getting more expensive, why is the CPI inflation reading so tame?

Pure deception, hoisted off on the American people by a corrupt government. If true housing expenses were used to compute CPI, I think we'd be amazed at the double digit inflation we're suffering from today.

Pure deception, hoisted off on the American people by a corrupt government. If true housing expenses were used to compute CPI, I think we'd be amazed at the double digit inflation we're suffering from today.

If rents keep going down as more and more empty and spec homes hit the market, you'll see the inflation number remaining low, when you know damn well it's flying.

Wait a minute. You mean these huge rises in housing expenses have zero effect on inflation? How is that possible? As Alan Abelson explained in a May 30, 2005 Barron's column:

Shelter, you see, which accounts for about 30% of the core CPI is measured not by the dictates of the marketplace, how much houses actually fetch when they're sold, but by a strange -- make that perverse -- yardstick called owners' equivalent rent.

Homeowners are asked how much they think they could get were they to rent their abodes. The result, as Tony Crescenzi, chief bond market strategist for Miller Tabak, deftly puts it, is that "surging housing is suppressing the CPI." Rental income, he reports, has fallen to $147.8 billion, from the peak of $186.6 billion back in April 2002.

"This weak pricing pressure in the rental market," he comments, "is weighing upon the owners' equivalent rent portion of the CPI" and, we might add, providing a distinctly distorted picture of what's happening in housing and inflation as a whole.

Posted by

blogger

at

4/25/2006

20

comments

![]()

![]()

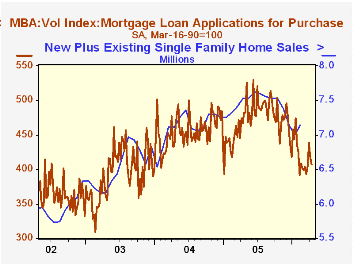

With a straight face, NAR says existing home sales grew 0.3% in March

If a corporation cooks the books, the CEO and CFO can go to jail. If the NAR is cooking the books, there's no oversight, and no penalty. And you know the last thing the NAR will admit to is that the housing market is blowing up.

If a corporation cooks the books, the CEO and CFO can go to jail. If the NAR is cooking the books, there's no oversight, and no penalty. And you know the last thing the NAR will admit to is that the housing market is blowing up.

Having them report home sales is like having Katherin Harris report Florida vote totals. There's a fox in the henhouse.

Keep that in mind when you see a hilarious number like today's. For the wonks among you, the suspect methodology the NAR uses to get to this number is equally hilarious

You can smell a rat just by looking at the falling mortgage application number. I guess the NAR buyers are paying cash, right? Right?

Sales of existing homes edged up in March following a strong rebound in February, according to the National Association of Realtors(r).

Total existing-home sales -- including single-family, townhomes, condominiums and co-ops -- rose 0.3 percent to a seasonally adjusted annual rate (see note 1) of 6.92 million units in March from a pace of 6.90 million in February, but were 0.7 percent below a 6.97 million-unit level in March 2005.

Total housing inventory levels rose 7.0 percent at the end of March to 3.19 million existing homes available for sale, which represents a 5.5-month supply at the current sales pace.

David Lereah, NAR's chief economist, said sales are leveling-out. "It's a good sign to see home sales holding close to the level of a strong rebound in the month before," he said. "This is additional evidence that we're experiencing a soft landing. We may see some minor slowing in home sales as interest rates rise, but the market clearly is stabilizing." Lereah expects 2006 to be the third strongest year on record for home sales.

Posted by

blogger

at

4/25/2006

35

comments

![]()

![]()

Wanna freak yourself out?

Visit the real-time National Debt Clock

Whoops! There goes another million!

04/21/2006 $8,349,970,836,065.88

09/30/2005 $7,932,709,661,723.500

9/30/2004 $7,379,052,696,330.320

9/30/2003 $6,783,231,062,743.620

9/30/2002 $6,228,235,965,597.160

9/28/2001 $5,807,463,412,200.060

9/29/2000 $5,674,178,209,886.860

9/30/1999 $5,656,270,901,615.430

9/30/1998 $5,526,193,008,897.620

9/30/1997 $5,413,146,011,397.340

9/30/1996 $5,224,810,939,135.730

9/29/1995 $4,973,982,900,709.390

9/30/1994 $4,692,749,910,013.320

9/30/1993 $4,411,488,883,139.380

9/30/1992 $4,064,620,655,521.660

9/30/1991 $3,665,303,351,697.030

9/28/1990 $3,233,313,451,777.250

9/29/1989 $2,857,430,960,187.320

9/30/1988 $2,602,337,712,041.160

9/30/1987 $2,350,276,890,953.00

Posted by

blogger

at

4/25/2006

21

comments

![]()

![]()

Bubble bench update

A HP reader (thanks Chris) took a picture the other day of Bubblemeter's now-famous Bubble Bench in DC. If you were a prospective buyer in this flipper complex, wouldn't you be a bit nervous? Well, a low-ball bid would likely get taken tough...

Send me any other great pictures of Bubble Benches, Bubble Gates, Bubble Trees or Bubble Posts - those congregations of desperate flipper lock boxes. A picture is worth a thousand words...

Posted by

blogger

at

4/25/2006

10

comments

![]()

![]()

FirstRung's administrator is now unethically changing the words in posts it doesn't like

But he can't touch HousingPanic - so for FirstRung and HP readers here's the post on FirstRung and their business model which has now been altered over at FirstRung:

But he can't touch HousingPanic - so for FirstRung and HP readers here's the post on FirstRung and their business model which has now been altered over at FirstRung:

firstrung - a wolf in sheeps clothing

Actually, it's a beautiful business plan - pretend to be on the side of the first time buyer (the last sucker in) - gain their trust, then POW! get them that ball and chain (mortgage)

Here's who first rung is folks, and here's what they do:

Firstrung represents the leading mortgage packager and distributor in the UK (FIRSTRUNG GETS PAID HUGE COMMISSIONS WHEN THEY GET A SUCKER ON THE LINE)

Firstrung prefers to introduce potential clients to Pink Home Loans (FIRSTRUNG'S SUGAR DADDY IS PINK HOME LOANS)

As mortgage packagers and distributors they also help in placing "non conforming" difficult cases (FIRSTRUNG TAKES ADVANTAGE OF THE MOST FINANCIALLY DESPERATE AMONG US, AND GETS BIG COMMISSIONS FOR DOING SO)

Firstrung is the leading company specialising in delivering solutions ONLY for the first time buyer (FIRSTRUNG HAS TARGETED ITS PREY AND IS OUT FOR THE KILL)

Firstrung does not actively encourage FTBs to buy now, we attempt to provide as much relevant information for the FTB as possible (FIRSTRUNG BRILLIANTLY USES THE OLDEST SALES TRICK IN THE BOOK - GAIN TRUST, THEN GET THE SALE)

The Firstrung opinion, based on extensive and exhaustive investigation over the past two years, which has resulted in the creation of the revised Firstrung web site, is that the market will return to 2003 levels as a minimum correction (FIRSTRUNG KNOWS DAMN WELL THAT WE'RE IN THE BIGGEST PONZI SCHEME IN HUMAN HISTORY. BUT THEY ONLY MAKE MONEY IF THEY CAN CONVINCE MORE GREATER FOOLS TO GET INTO THE SYSTEM)

Please submit your mortgage enquiry by clicking on the "buying your first home" banner or alternatively click here express interest (COME ON SUCKERS - GET A MORTGAGE - DENY THE BUBBLE - WE NEED TO GET PAID!)

Posted by

blogger

at

4/25/2006

11

comments

![]()

![]()

When this man talks, you should listen - here comes the dollar collapse

I know a lot of folks don't think the dollar's collapse effects them. They couldn't be more wrong. But like losing everything in the housing collapse, it'll just have to kick 'em in the head, then maybe they'll understand.

You have been warned. PIMCO's Bill Gross in his April report:

But with the U.S. Fed now almost done and the BOJ removing quantitative easing and threatening a tightening cycle of their own, the carry trade and importantly the existing level of the U.S. dollar vs. the Yen and almost all currencies is at risk.

As global real interest rates converge, the export potential of comparative economies should begin to dominate exchange values and it is there, of course, where the U.S. is so critically deficient.

Japan as we all know is an export powerhouse. Less well known is the ongoing ability of Germany as the center of Euroland to command global market share. The ascendancy of China’s production for export is of course unquestionable. That leaves the U.S. with its increasingly hollowed out manufacturing core as the near certain loser in currency valuations going forward. To be blunt, the dollar must go down as it loses its carry.

Posted by

blogger

at

4/25/2006

6

comments

![]()

![]()

April 24, 2006

HousingPanic declares all out war on UK's FirstRung - Join the new American Revolution!

I'm asking HP'ers to help me fight back. Go post on their message board - new bubble topics, with housing bubble stories, or respond to the current posts

This biased company makes commissions selling mortgages to "the last suckers in". They are trying to come off all high and mighty, the standard "we're on your side" approach. Tough to do when:

"Firstrung represents the leading mortgage packager and distributor in the UK"

Like China trying to keep out information harmful to the Communist government, FirstRung is trying to keep their ignorant readership, well, ignorant.

Thus, a declaration of war from HousingPanic. Fight 'em with the one thing on our side: The Truth. Enjoy the good fight. Keep it clean. But attack with everything you've got.

If you think the US has bubble trouble, you ain't seen nothing like the UK ponzi scheme (aka housing ladder).

Posted by

blogger

at

4/24/2006

16

comments

![]()

![]()

This article sums it up nicely: The Housing Bubble Has Popped

Yes, it's taking the MSM a bit of time to catch up to reality. The bubble popped afterall in Q4 2005. But nice to see them out with the news we've all known for some time...

Classic bubble. Classic ponzi scheme. And now, the classic ending, as we revert to (and possibly beyond) the mean.

Reports of falling sales and investors stuck with properties they can't sell are just the beginning. Property owners should worry; so should their lenders.

Ladies and gentlemen, unfortunately, a lot of people around the country are going to be badly hurt as this bubble unwinds. And, after they have taken their losses, the financial institutions that were the engine behind this folly will take their own hits. 'Easy Al' Greenspan at the Fed tried to bail out one bubble with another bubble. While it bought some time, it will end in far-worse pain.

Posted by

blogger

at

4/24/2006

27

comments

![]()

![]()

More Oil.

Should be an interesting week...

Should be an interesting week...

This isn't going to end anytime soon folks. Want a tip? Buy oil stocks.

Posted by

blogger

at

4/24/2006

14

comments

![]()

![]()

Does anyone know anyone, ANYONE, seriously looking to buy a house today?

If so, please nominate him (or her) here for the HousingPanic Greatest Fool award - someone has to be the last one in after all...

Posted by

blogger

at

4/24/2006

34

comments

![]()

![]()

April 23, 2006

HousingPanic exposes UK's Firstrung.co.uk - another biased member of the real estate industrial complex

Ah, you have to love it when one of the members of the REIC gets all huffy when HP calls them what they are - biased charlatans who pretend to be on the side of the potential buyer, when they're just after that big fat commission of course.

Ah, you have to love it when one of the members of the REIC gets all huffy when HP calls them what they are - biased charlatans who pretend to be on the side of the potential buyer, when they're just after that big fat commission of course.

Firstrung, of course, is on your side. Oh, except that

"Firstrung represents the leading mortgage packager and distributor in the UK"

Oopsie! They might, just might, be a bit motivated to make loans one would think, no? "Oh, no, Mr. Prospective Buyer, you don't want to buy that overpriced flat. No, no, no. We don't want to make a commission on a loan - don't do it!"

It must be tough though to defend a corrupt profession, one that is quickly going away as consumers get wise to the bursting bubble, the ponzi scheme, and the corrupt system that could care less about their welfare.

Check out the firstrung message board's HousingPanic thread (until they take it down), with the website administrator Iconoclast getting obviously huffy and defensive for HP calling a spade a spade. I could have called them worse of course - the words whore, leach and fake come to mind, but of course I'm too civil to suggest such a thing.

Posted by

blogger

at

4/23/2006

8

comments

![]()

![]()

More real estate corruption in the UK exposed by BBC - "Shocked, shocked I say!"

For HP readers who missed this a bit ago, a reminder on how horribly corrupt the UK property market (i.e. the "housing ladder") is... This BBC report was the single best piece of journalism I've ever seen. Ever.

For HP readers who missed this a bit ago, a reminder on how horribly corrupt the UK property market (i.e. the "housing ladder") is... This BBC report was the single best piece of journalism I've ever seen. Ever.

And it's just the tip of the iceberg - the corruption and inefficiencies in this market have created and enabled a bubble, a financial ponzi scheme, of historic proportions. It'll be a long, long way down for the UK...

Lying to customers, faked signatures, false passports and dodgy deals with developers. An undercover investigation reveals the secret world of estate agents' dirty tricks.

The Chard estate agency said: "We are shocked at these allegations and are grateful to the BBC for bringing them to our attention. On learning of them, we've taken immediate action to question the individual involved and then to suspend him. We are now conducting a full investigation of the circumstances."

A spokesman for Primetime Mortgage and Property said that a member of staff had been suspended while the matter was being fully investigated, and that they were not aware of any illegal practices. He said the company prided itself on providing an efficient, honest and high standard of service to its clients.

Posted by

blogger

at

4/23/2006

0

comments

![]()

![]()

HP'ers: Help the UK "First Rungers" avoid getting on the "Housing Ladder" before it's too late

It's truly funny to hear what they call the bubble over here - the Housing Ladder (seriously, I'm not making this up!)

As in "get on the housing ladder before it's too late!" and "once you're on the housing ladder, you can move up to the next rung!" Ahhh... nothing better than a great pyramid scheme...

Then there's this site - First Rung (really, I'm not making this up!). It encourages non-ponzi-scheme members to sign up for the program (i.e. be the last sucker in)

Well, the good news is they have a message board. I of course posted today. Feel free to crash the board and have fun! Perhaps a few of us yanks can help the potential First Rungers avoid the biggest mistake of their lives.

Posted by

blogger

at

4/23/2006

7

comments

![]()

![]()

Happy Earth Day (and why does it feel like April Fools Day?)

Gas prices aren't high enough to fix the ills that need to be fixed:

1) Foolish US homeowners driving 100 miles a day round trip in their Surburbans

2) Fools in power doing nothing to promote energy conservation

3) Foolish city planners designing miles and miles of new highways, but no public transportation

4) Fools who run GM building gas guzzling trucks, when Americans wanted energy-efficient cars

5) Fools on Fox News who state that global warming doesn't exist

6) A foolish compensation committe giving $400 million to ExxonMobile's fat fool

7) Foolish voters putting two oil fools into the White House

But alas, high gas prices sure did get us one thing:

A foolish war in the Mideast

Posted by

blogger

at

4/23/2006

18

comments

![]()

![]()