As many HP'ers would agree, Dr. Thornberg and the UCLA Anderson Forecast have been spot-on with their housing bubble reports and reflections, including this extremely insightful presentation on the bubble now available on Google Video.

Dr. Thornberg was kind enough to give a brief interview to Housing Panic on our bubble troubles. Here is the interview in its entirety. Enjoy!

_____________________

HP: David Lereah and the NAR continue to call the declining home sales and prices, and building inventory underway a "soft landing". Do you feel the landing in bubble markets will be "soft" or something more approaching "hard"? And do you feel David Lereah and the NAR should be seen as a trustworthy source of information on the real estate market?

CT: Actually what we are seeing is a very typical slowdown in the market so far—there is nothing particularly soft about it.

The claim is that because unit sales are falling but prices are still going up that this is an unusual slowing.

The fact is that most breaking markets start with activity, and it takes 3 to 4 quarters for that to take all the wind out of price appreciation.

How hard it will be remains to be seen. Of course they have a biased view—they are paid to be sunny. Caveat Emptor.

HP: Ben Bernanke is faced with what seems to be a tough choice - continue to raise rates to combat inflation and protect the dollar, likely hurting the housing market and home prices, or stop raising rates, and let inflation roar, the dollar freefall and the housing bubble continue. If you were Ben, what would be your action plan?

CT: This is a no brainer. The Fed’s first job is to promote price stability, and its second job is to help the economy through rough patches.

Given a situation where these two goals point in different directions, price stability is the most important factor. So if inflation rears its head, rates will go up regardless of the housing market.

HP: Who was most responsible for the housing bubble - The Fed, Realtors, Mortgage Brokers, Exotic Loans, Human Nature, Speculators, Appraisers, Builders, something else or an equal combination of all of these?

CT: Yes, and throw in China since they have been fueling our spending binge with cheap capital.

HP: What US housing markets do you feel are most at risk of collapse (defined as real median home sale price drops of more than 20% from peak) if any?

CT: Prices fall when you lose jobs. Right now the non-housing part of the economy is picking up speed, thus stabilizing things.

Still, those markets with the greatest level of speculative buying and building (Florida for example) may be most at risk.

May 31, 2006

A Housing Panic Exclusive: An Interview with Christopher Thornberg of the UCLA Anderson Forecast on the Housing Bubble

Posted by

blogger

at

5/31/2006

13

comments

![]()

![]()

Fed minutes on housing bubble and 1/2 point rise idea released

They also thought about raising 1/2 point, not just 1/4... I think it's housing that kept them from doing the right thing... as seen here in the UK, there's tremendous pressure on the central bank to keep rates low to keep housing prices high. That's sick and wrong, and they know it.

Although the Committee discussed policy approaches ranging from leaving the stance of policy unchanged at this meeting to increasing the federal funds rate 50 basis points, all members believed that an additional 25 basis point firming of policy was appropriate today to keep inflation from rising and promote sustainable economic expansion

The underlying pace of residential activity seemed to moderate in the first quarter. After unseasonably warm weather allowed a high level of single-family housing starts in January and February, starts fell in March to their lowest level in a year.

Sales of new homes also moved up in March, but their average in the first quarter was down substantially from the peak in the third quarter of last year.

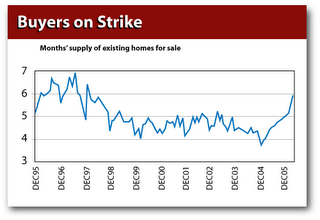

House price appreciation appeared to have slowed from the elevated rates seen over the past summer. Growth in the average sales price of existing homes in March, versus a year earlier, decelerated sharply, and the average price for new homes in March fell compared to a year earlier. In addition, other indicators, such as months' supply of both new and existing homes for sale and the index of pending home sales, supported the view that housing markets had cooled

Posted by

blogger

at

5/31/2006

7

comments

![]()

![]()

MSM picks up (and disagrees with) HP's post on paying off the mortgage vs. buying stocks

Motley Fool's Selena Maranjian found little ol' HP, and wrote about my post "Here's an idea - lose the mortgage", where I said never ever again will I have a mortgage - I'll sell my stocks if I have to. MSNBC picked it up too.

My argument is why pay someone interest, when there's no way the market will return 6%-8% annually over the next 10 years or so, not with our problems (past performance does NOT equal future returns). I'll take the guaranteed 6%, 7% or 8%, then invest any cash left over in risky stocks. And that mortgage interest deduction? Not as valueable as it's made out to be, and in risk of going away.

Bottom line - she disagreed with me. Do you?

As I was traipsing around the Internet the other day, I stumbled upon a blog titled "Housing Panic," where I read an interesting post. The writer asked for anyone's thoughts on this question:

"Anyone thinking of cashing in stocks, bonds, 401(k)s, etc., to pay off your mortgage instead? Say you have $200,000 in disposable financial assets, and a $200,000 mortgage. What do you do? ... My goal -- rent 'til this sucker blows over, then buy my next house for cash. No more mortgages for me..."

It's a question that many of us can relate to -- perhaps especially those who have already paid off a big chunk of their mortgage. Those with new mortgages might highly value the tax-deductibility of mortgage interest, but as your mortgage ages, you'll be paying less in interest and more against your principal.

My own answer would be that for most people, it's smart to keep the mortgage. There's that deductible mortgage interest, for one thing. And then there's the low interest rate that most of us, by now, should enjoy. When your rate is low, such as 5% or 6% or even 7%, you can compare that with what you'd make in the stock market over the long haul, and stocks will generally win out.

Posted by

blogger

at

5/31/2006

35

comments

![]()

![]()

FLASH: Fortune Magazine: Immigration reform could kill the housing boom

Remember the trolls who would complain when HP would post articles on the illegal immigration problem? Remember when people would complain that the housing bubble and immigration have nothing to do with each other?

Remember the trolls who would complain when HP would post articles on the illegal immigration problem? Remember when people would complain that the housing bubble and immigration have nothing to do with each other?

Guess what. These two subjects have EVERYTHING to do with one another.

My question is, why aren't we arresting or fining the employers knowingly breaking the employment and tax laws of the United States? My other question is, aren't you sick of the Dems and Reps pandering to the illegals, simply because they want the (future) votes of these illegals and their kids? Now, they won't want to deport them because it'll hurt home prices. Unreal.

For the home building industry, the immigration debate raging in Washington is anything but abstract. It's the biggest issue nobody wants to talk about.

Frank Fuentes, president of the Hispanic Contractors Association, queried his 20 largest member firms about speaking with FORTUNE, and not one was willing.

"They're scared to death of being raided," says Fuentes.

By FORTUNE's estimate, up to 40 percent of new-home construction in the U.S. is being done wholly or partly by undocumented immigrants. Fuentes suspects the percentage in his home state of Texas is closer to 80 percent.

According to a study by the Pew Hispanic Center, 36 percent of insulation workers, 29 percent of roofers, and 28 percent of drywall installers are "unauthorized workers."

Big builders don't employ construction workers, legal or illegal. They hire subcontractors that in turn hire the workers who do the actual sawing and hammering.

"The entire home building business is outsourced," says A.G. Edwards analyst Greg Gieber. It's unclear whether this setup will protect builders should the feds start enforcing immigration laws more vigorously.

Posted by

blogger

at

5/31/2006

13

comments

![]()

![]()

WSJ: Making realtors feel like A-listers (so they'll pimp your overpriced condos)

Tell me this isn't working anymore... But then again, vanity, stupidity and corruption go hand in hand... The perverse corruption between developers and realtors, and this type of payola, will be fodder for the Senate 2008 housing bubble hearings...

Hoping the Sizzle Will Sell The Steak in Condo Slowdown

At a party in Fort Lauderdale last month, guests in clingy cocktail dresses grooved on stage with singer Wyclef Jean and even tried to pull off his black-and-baby-pink striped tie.

A week later, in Las Vegas, party-goers attended a reception hosted by actress Pamela Anderson, who was surrounded by a small army of models dressed in black bikinis, white hard hats, tool belts and yellow "Do Not Cross" construction tape.

The latest dispatches from the Hollywood glamour circuit? No, it's real-estate developers wooing real-estate brokers and potential buyers of high-end condominiums.

The growing glut of expensive condos is pushing high-performing real-estate brokers and deep-pocketed potential buyers onto the "A" list.

By supplying them with coveted party invitations and celebrity access, developers hope to reduce the backlog of high-priced luxury condominiums before rival developers can flood the slowing sales market with even more new properties.

Developers are going all-out -- with celebrities, showgirls, circus performers and fireworks displays worthy of the Fourth of July. Sales incentives ranging from alligator-leather-covered notepads in Manhattan to $10,000 diamond-encrusted cuff links in Fort Lauderdale are dangled before guests.

In Fort Lauderdale, Las Vegas and Manhattan, an estimated 167,600 luxury units are due to hit the market in coming months. In Las Vegas, where 62,600 new condo units are planned, there's greater pressure because projects often are larger and developers can't get construction financing to build without selling a certain number of units in advance. Three condo projects already have been canceled and a half dozen are being re-evaluated in light of slowing sales.

Developers say the parties are a bargain considering the prices of the condos, and they generate far better returns than dropping the prices of units does.

Posted by

blogger

at

5/31/2006

16

comments

![]()

![]()

May 30, 2006

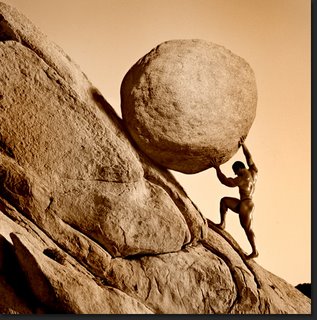

Somedays, I still can't believe the end of the housing bubble is here

We ranted and raved for months about what was to come, and then now it's come. The long unwinding is upon us. Prices are falling, inventory is exploding, and a whiff of panic is in the air.

Ding dong the Housing Ponzi Scheme is dead.

Should we be surprised? How does it make you long-time bubble-believers feel? Happy? Vindicated? Troubled? Unpopular? Angry?

Have you told anybody "I told you so" this month, or are you keeping a low profile?

And do you feel you've prepared enough?

Posted by

blogger

at

5/30/2006

49

comments

![]()

![]()

Funny stuff from Charles Hugh Smith - How to overpay for real estate

I'd call it a perfect bubble storm:

"The cutting-edge secrets to buying real estate at 30% to 50% above market value:"

Appoint a Federal Reserve which flooded the nation with virtually unlimited money supply even as it lowered interest rates to historic lows

Lower lending standards to basically zero so even those with poor credit and no cash can buy a house with no money down and no documented history of financial discipline

Enable investors to buy new condos and houses with maximum leverage so that 40% of all new homes are purchased as investments

Lower lending reserves requirements to the lowest levels ever, so lenders need not be encumbered with onerous standards like having cash on hand to cover bad debts

Enter into an unspoken agreement with our Asian trading partners in which our homeowners can borrow 105% the value of their homes to buy Asian-made consumer goods, and our trading partners will buy all our depreciating long bonds at low rates of return so mortgage rates stay low

Keep wage increases down to basically zero so consumers count on re-financing their homes to pay for vacations, college, new cars and boats, etc.

Enable a 10-fold expansion of mortgage-backed derivatives and various exotic financial instruments so that trillions of dollars in mortgages can be tranched, sliced and hedged, giving the financial markets the false impression that the risks have been lowered, even as they've actually increased to unprecedented levels

Enlist an army of Wall Street and media cheerleaders to promote the notion that "this time it's different" and "housing never drops in value," lulling the unsuspecting into believing that the business cycle and the laws of supply and demand have been officially revoked

Encourage builders to build up to 10 times the number of units which sell annually, insuring massive overbuilding (over-supply).

Rig the inflation measurements (CPI, etc.) to

Posted by

blogger

at

5/30/2006

5

comments

![]()

![]()

Housing Bubble Blogs Under Attack!

Will Housing Panic be next?

Readers - I've been made aware that three housing bubble blogs, hosted on blogger (blogspot) have been attacked and taken down today:

http://overvalued.blogspot.com

http://thereisnohousingbubble.blogspot.com

http://crash2006.blogspot.com

These sites are now redirected to spam sites. There may be others, and the attack may be ongoing.

I've changed my password on blogger, am logged in to avoid a logout, and backed up my code, however, the real risk may be the archives. I'd hate to lose those.

If anyone has any further advice, or know how to contact a human at blogger, please post here. I've been thinking of moving off of blogger, and have housingpanic.com, just don't have the time or wherewithal to do the move. Again - any advice appreciated. You can't just pick up the phone and call blogger unfortunately - there is no there there.

Yes, we are going up against some big forces and big $$$ - the NAR, millions of soon to be unemployed realtors, the entire corrupt Real Estate Industrial Complex. I'm surprised it's taken this long to attack us.

Posted by

blogger

at

5/30/2006

50

comments

![]()

![]()

The US hard landing starts now.

Well, that about sums it up. Good luck out there. (BTW - it's an Air Canada plane, but assume it's landing in Phoenix!)

We have repeatedly said that the key indicator for most of the world’s major stock markets is the US housing market. The Philadelphia Housing Market Index has now fallen to its major support level of 225. Any further weakness from here would be a prelude to a shock.

Because of the importance of this indicator, it has been our policy each fortnight to publish the latest news from the US housing market – it is getting worse!

Ten Las Vegas house projects have been halted or put on hold.

Toll Brothers, one of the major luxury house builders in the US, have said that their second quarter orders were down 33%.

Not surprising, bearing in mind the above, the National Association of House Builders say that the industry’s confidence is the lowest it has been since 1995.

According to the Washington Post a greater proportion of mortgage financers tapped their home equity for cash in the first quarter 2006 than any other quarter in 15 years. More than 50% of these applicants borrowed at higher rates.

One of America’s leading mortgage lenders, Ameriquest, is closing 229 branches and laying off 3,500 employees. (A clear indication of sharply lower activity.)

According to the Commerce Department, housing starts in April were down 7.4% at an annual rate of 1.85 million, the third consecutive monthly decline and the slowest since November 2004.

According to the Wall Street Journal, late payments on mortgages are rising. Delinquencies are sharply higher on loans made last year.

According to a recent study, 29% of 2005 purchasers now have no equity in the homes.

America’s new jobs figure for March was 138,000 - economists had estimated 200,000. 138,000 is the lowest since October last year and it followed three months of downward revisions.

The University of Michigan’s Consumer Confidence Index for April was 79, compared to 87.4 in March, the lowest since Hurricane Katrina.

Lombard Street Research said this week that the US economy had peaked and was tipping into an unstoppable bust. The property market is crumbling - “the real US hard landing starts now”.

Posted by

blogger

at

5/30/2006

32

comments

![]()

![]()

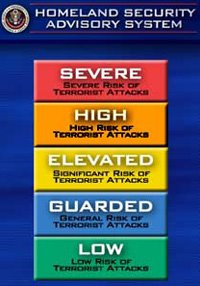

The Housing Panic housing bubble burst warning system

Everyone else has one. What color should we be at today? And maybe we should do it by market. The Red's really do match up nicely with where the speculators came in and then left. Oranges are bad economies and also speculators leaving. Yellow is everyone else.

Red Alert: Phoenix, DC, Naples, Tucson, Boston, Miami, Tampa, San Diego, OC

Orange Alert: Denver, Reno, Flagstaff, The Entire State of California, Detroit

Yellow Alert: The rest of the entire developed world

Remain calm. Do not run.

On second thought, run!!!

Posted by

blogger

at

5/30/2006

7

comments

![]()

![]()

Falling like dominos: Home price crash risk in Ireland, Denmark, New Zealand, Sweden, France, Spain and of course, USA

Ah, those pesky rising interest rates. Someone called the cops on the house price party.

High risk of Irish house-price crash

Ireland is one of a small group of countries that risk experiencing a sharp house-price reversal, according to a leading international think tank.The Organisation for Economic Cooperation and Development (OECD) said there was a 50:50 chance that the housing market would suddenly slow.

The organisation’s economists said that, in its study of 17 countries, Ireland was among those where there was a significant risk that house prices would fall sharply or collapse.Among the other countries most at risk are Denmark and New Zealand, where the probability of a major reversal was put at 100 per cent and 87 per cent respectively.

Sweden, France, Spain and the US are also in the high-risk category, with the chance of house price reversal being more than 50 per cent.

Ireland will join the high-risk countries if house prices continue to rise this year and interest rates increase by about 1 per cent, said senior OECD economist Paul van den Noord.‘‘It is giving a warning signal to policymakers and government,” van den Noord said.‘‘We call it peaking - it means that prices will fall in real terms after accounting for inflation.

‘‘We do not make a distinction between a soft landing or a hard landing. House prices do not bode well, but it would need another interest rate increase to tilt Ireland over into a high-risk country.”

Posted by

blogger

at

5/30/2006

5

comments

![]()

![]()

Show us your portfolio - is it housing-bust-proof?

No $'s, just holdings, %'s are fine. Me:

Bought to hold (20+ years):

YHOO

EBAY

SBUX

AAPL

EWC

EWJ

2012 expiration options:

COP

Speculative:

GLD

SLV

BEARX

and small fresh put positions on

QQQQ

FAST

LOW

and the rest, about 1/3 of worth, in HSBC 4.75% US$ savings looking for a home

I'd like to see some other portfolios. Still looking for great ideas. I'll be buying more YHOO and EBAY buy to hold, and possibly moving some $ back to Euros, although I think with the fed continuing to raise the dollar should be ok short term. Thinking of opening up puts on HD and others that'll be trimmed due to consumer spending meltdown to come.

Posted by

blogger

at

5/30/2006

27

comments

![]()

![]()

May 29, 2006

"Code Red" for the Phoenix Housing Bubble

Oh, man, Phoenix is so F'd I'm not sure if they even realize it yet. HP does... 47,225 listings by the way - let's see 50!!!

Code red on housing

Real estate analyst RL Brown has gone code red on the Valley's housing market. In his May newsletter released last week, Brown changed the background on his forecast from yellow to red. Yellow stood for caution. Brown has done the color codes signaling his take on the market for the past few years.

He has never gone red before. Brown said the red signals the housing "market continues to deteriorate. Hopefully that condition and color will be short-lived."

Posted by

blogger

at

5/29/2006

7

comments

![]()

![]()

Who will the third party candidate be?

I've floated the dems and reps - Obama, Hillary, Bayh, and then Allen, Frist and McCain. No takers.

On 3rd party, I've floated just two - Oprah and Trump. Both are kinda lightweight.

So give me your outsider - your 3rd party pick that can lead us out of this mess. Make some moves on social security, medicare and medicaid. Get us out of foreign quagmires. And get some sanity and accountability back into leadership.

I'm thinking a strong businessman, social centrist, libertarian, fiscal conservative, no-nonsense kinda guy. Maybe a CEO or maybe even a reporter/analyst.

Take your best shot. Who can we draft?

Posted by

blogger

at

5/29/2006

20

comments

![]()

![]()

There's no such thing as a free lunch - Milton Friedman

Time for some Friedman:

Inflation is the one form of taxation that can be imposed without legislation

Only government can take perfectly good paper, cover it with perfectly good ink and make the combination worthless

The Great Depression, like most other periods of severe unemployment, was produced by government mismanagement rather than by any inherent instability of the private economy

Posted by

blogger

at

5/29/2006

4

comments

![]()

![]()

This bust will be one that involves untold trillions of dollars, and will directly affect the value of every house in America

Fun read by the ultimate bear and gold bug - here's highlights - enjoy:

And this will not be just any old ordinary bust! No, sir! This bust will be one that involves untold trillions of dollars, and will directly affect the value of every house in America, because if you think that YOUR charming house will retain its over-inflated value while, all around you, house prices are falling and people are crying and wailing "The Mogambo was right! We're freaking doomed!", then you obviously do not understand the first damned thing about economics or real estate, and I feel sorry for you.

What's the worst news? If you are the government, for instance, that relies on the receipt of property taxes, sales taxes, taxes on gains, and all the documentary stamps and endless, expensive rigamarole involved with buying (and then again when selling) property, not to mention the income of realtors and title companies and lawyers and banks and mortgage companies and on and on and on, then THAT'S the bad news.

If, on the other hand, NMB also means less borrowing against the increased equity in your house, because there is not going to BE any more appreciation in the value of your house. This means aggregate, economy-wide spending of borrowed money will decrease, and the American economy will slow. By how much? Well, last year, GDP was boosted by something like $600 billion or so of additional spending, thanks to people increasing their mortgage debt. Hahahaha!

This means THAT particular stupid, childish, immediate-gratification insanity will soon stop, too. So, if you are a person whose standard of living depends on constantly extracting equity from the apparent appreciation in the "value" of your house during a seemingly-endless inflation in prices, then oops! Hahaha! The cruel joke's on you! This is how Father Nature takes care of the business side of life.

Equity withdrawal is, in bare essence, nothing more than increasing the absolute level of your mortgage debt and negating the entire gain in your equity. Hahaha! They ought to give the Anti-Nobel Prize for Sheer Economic Stupidity for these people, but there isn't one.

So, my Sweet Mogambo Cuties (SMCs), keep buying gold and silver, as they will rise in price for years and years and years to come

Posted by

blogger

at

5/29/2006

24

comments

![]()

![]()

Anyone visiting open houses just for fun this memorial day?

Aw, come on, if you haven't already, get in your car and drive down to the nearest open houses today. New condo tower? Sweet. New tract home development? You're there!

Ask the realtor or whatever the hack is called who sits in the shed how things are going, if they think buying now is a good investment, and if they'd put their own money into a unit.

Ask them if they think we're in a bubble. Ask them what their cancellation and deposit policies are. Ask them what happens if the unit is worth less than it is today when you have to close.

And then of course, report back. Damn, I'd be having fun with this back in the States...

Have fun - happy memorial day (or "bank holiday" here in jolly ol' England).

Posted by

blogger

at

5/29/2006

22

comments

![]()

![]()

Thought of the day

If the banks closed, ATMs and credit/debit cards didn't work, and you had no access to cash, how long could you go? What would you do?

hmmmm....

Posted by

blogger

at

5/29/2006

11

comments

![]()

![]()

May 28, 2006

Get the housing bubble lawsuits ready

Interesting exchange in our "would you walk away from $10,000" thread, where a former lawyer recommended bringing suit to retrieve the deposit due to false and misleading sales practices. You know, quotes at the sales office like

"These will easily double!"

"You'll have no trouble selling!"

"You were lucky to get one - our waiting list is thousands long!"

Blah blah blah

So I was thinking, who else will people sue? Their realtor? The appraiser? And will the developers sue the folks canceling, or just take the deposits back and try to unload to break even at any price? When there's blood in the water, you know the sharks will be circling

Here's the post:

Esquire said...

I would have my Attorney demand my $10,000 back under threat of lawsuit for deceptive sales practices.When the builder balked; I ask him if he'd rather pay me $10K now, or $10K + punitive damages + my attorney fees + court costs when the Jury made up mainly of folks who the builders ripped off award me $500,000 in compensory damages!Yes, In a previous life I was an excellent collections-attorney. Trust me a letter from an attorney to the builder will get your $10K back at this point in the cycle.

Posted by

blogger

at

5/28/2006

7

comments

![]()

![]()

Homebuilders say immigrants' work is vital

Not only should we send the illegals home, not only should we fine these businesses that turn a blind eye to illegal activity for the sake of profits, but people who knowingly hired illegals should be arrested for aiding and abetting. Period.

And I laugh at anyone who says illegal immigration is not tied to the housing bubble. Each is a cause of the other.

Whatever your opinion regarding immigrants who have entered the United States illegally, realize that if you are in the market for a new house, it's likely to take longer to build -- and cost more to buy -- if they are forced to leave the country.

The National Association of Home Builders estimates that 20 percent of the construction workforce -- about 2.4 million people -- is foreign-born. While it's impossible to know how many are undocumented, some estimates put the number at 50 percent or more.

Whatever the true count, builders across the country say illegal immigrants play an important role in a construction labor market that is already stretched thin.

An unknown number

Craig Havenner of the Christopher Cos., a builder in Virginia, has no idea how many of the carpenters, brick masons, roofers and other craftsmen who work for the subcontractors he hires are here illegally. Nor does Michael Fink of the Leewood Real Estate Group in Trenton, N.J.

But both builders say they'd be hard-pressed to deliver their products on time or at the same price if "illegals" were ordered to leave the country, as some federal legislators have demanded.

"We have the right to control our borders; every other country does and so do we," says Havenner, who builds high-end, single-family houses. "But we also need to realize we are terribly dependent on foreign-born workers. We can't be blind to that."

Posted by

blogger

at

5/28/2006

22

comments

![]()

![]()

Senator Frist tells Fox News that gay marriage and flag burning are top priorities for the Senate

OK, enough is enough. With all the problems going on in the world, with the financial carnage here at home, this is what our leaders see as the top priority?

Are Americans truly this stupid, or is it just an out-of-touch, clueless, incompetent and corrupt Senator desperate for far-right votes?

I know this ain't housing bubble, but in a way it is. We're run by idiots. Idiots helped create the policies which created the housing bubble (no cap gains on home sales, interest rates too low, illegal immigration), and idiots will fiddle while America burns. How soon until we throw these bums out?

HOST: You talk about a lot of issues that affect people's lives. And yet you're going to bring two constitutional amendments to the Senate floor in the next few weeks, one to ban same-sex marriage, another to ban flag-burning, both reportedly in the papers to mobilize your conservative base. I have to tell you, I talked to a Republican senator this week who said he may vote for both of them but said they're both pandering. Are gay marriage and flag burning the most important issues the Senate can be addressing in June of 2006?

FRIST: Let me tell you what the agenda is real quick. Secure America's safety here at home. I mentioned supporting our troops overseas, making sure we pass that supplemental bill, making sure we tighten down our borders. securing America, a healthier America, so we'll lcontinuee to

HOST: All right. But ...

FRIST: Let me tell you, right now there's no prioritization there. Securing America's values. I hope tomorrow and today as people see that American flag, and I'm going to Arlington cemetery tomorrow and I'm going to see that flag waving on every grave over there. When you look at that flag and you tell me that right now people in this country are saying it's okay to desecrate that flag and to burn it and to not pay respect to it, is that important to our values as a people when we've got 130,000 people fighting for our freedom and liberty today? That is important. It may not be important here in Washington where people say, well, it's political posturing and all, but it's important to the heart and soul of the American people

Marriage, you asked about. Right now. Why marriage today? Marriage is for our society that union between a man and a woman, is the cornerstone of our society. It is under attack today. Right now there are 13 states who passed constitutional amendments in the last year and a half to protect marriage. Why? Because in nine states today, activist judges, unelected activist judges are tearing down state laws in nine states today. That's why I will take it to the floor of the Senate, simply define marriage as the union between a man and a woman.

Posted by

blogger

at

5/28/2006

48

comments

![]()

![]()

Barrons Cover Story "The Big Glut" - announcing the end of the housing bubble and the housing crash underway

The most important and thorough article on the bursting of the housing bubble since "In Come the Waves" first predicted it. I'm tempted to end the blog here, but then again, there's still so much more to come, so we'll stick around.

The rush for the exits is speeding up in the hot spots. All those second home wonderlands - Naples, Vegas, Phoenix, Tampa, Miami, Colorado, ...? They're so screwed it's tough to even put into words. Panicked speculators and greedy boomers are trying to get out at any price now and its going to get so, so bloody.

The easiest home to sell is the second one they say. We're seeing it in real time now. Dot-condo is here.

Here's some highlights from the Barrons article on the bubble - I recommend the full read and picking up the magazine to show your kids one day

"If you want to sell, you've got to go back to '04 prices," says Chip Harris of Coldwell Banker Previews International, which is handling the property.

The market for second homes could use a second wind. After a long string of double-digit annual price increases, a number of second-home meccas across the country are suddenly suffering from plunging sales volume and burgeoning inventories of unsold homes.

Though the official figures on sales prices have yet to reflect the current round of cuts, interviews with real- estate pros and others strongly suggest that the averages are deteriorating in a number of key markets. Just look at green and hilly Litchfield, Conn., about a two-hour drive from New York City. It was a magnet for Wall Streeters during the past five years, and prices climbed accordingly. But in the past 10 months, prices in the lower end of Litchfield's market -- homes of $300,000 to $600,000 -- are down 12%-14%, and volume is falling at the next level up, says Stephen Drezen of the local Portfolio Properties Group.

IT'S ALL A BIG CHANGE from the seemingly endless rises in prices. For more than a decade, baby boomers have been flocking to the second-homes market and lifting prices, just as they'd earlier lifted the market for primary residences

While pundits debate when the bubble might burst in the primary-housing market, the air already is whooshing out of parts of the second-homes market.

With mortgage rates rising and home-price appreciation slowing or vanishing, buyers in Naples have pulled back in a big way.

The Naples experience is being repeated, to one degree or another, in a variety of other vacation hot spots -- from Palm Desert, Calif., to Phoenix, Ariz., to Ocean City, N.J. Phoenix in recent years has been overrun by property flippers from California, says Mike Messenger, president of Russ Lyon Realty in Scottsdale. But unit sales now are down by 40%-42%, and the city's inventory of unsold homes has shot up more than five-fold, to 39,000.

For starters, many second homes have been sold not to serious vacationers but to speculative investors hoping to cash on the national real-estate craze. How else to explain why six out of 10 second-home owners surveyed by the Realtors group own two or more homes in addition to their main residences?

The danger is that if enough of those investors decide the market has peaked, they could trigger a selling frenzy throughout the second-homes market. That, in turn, could add to the pressures in the main housing market. After all, second homes now account for a full 40% of all homes sold in America.

Says Ingo Winzer, president of The Local Market Monitor: "This makes me very worried because it implies that the price increases have been driven more by speculators than by people who are going to hold onto these properties, and indicates to me that there's a speculative boom."

BUT THOSE HIGH ROLLERS COULD LOSE THEIR nerve quickly if prices continue to weaken.

"People don't believe in the laws of supply and demand anymore," says Alan Skrainka, chief market strategist at Edward Jones. "We're not saying it's a bubble, but we're saying prices are overstated and will likely correct 20% to 25% over four or five years."

Mike Messenger, the Scottsdale, Ariz., broker, sounds considerably more glum. He says this is the first time in 16 years that the lower end of the market -- always the driver for the area -- has weakened. The culprits? Mainly the flippers; Messenger figures investors account for 35% to 40% of the market

Posted by

blogger

at

5/28/2006

15

comments

![]()

![]()

Colorado foreclosure rate #1 again - unregulated predatory mortgage brokers to blame

What the heck is going on in Colorado that makes it the national leader in foreclosures? Are the lenders out there even more evil than other states? Os - enlighten us here... I guess the good news for me personally is I intend to move back to Colorado one day - and looks like I'll have my choice of dirt-cheap houses to buy...

Remember, that once these evil mortgage brokers get the sucker, I mean the buyer, into the loan, they get rid of the hot potato - and Fannie or Freddie and then the Chinese hold the bag... These bad loans are going to hurt someone besides the bankrupt buyer in the end - and I think it's the foreigners holding the bad debt.

From a KRDO in Colorado Springs report:

Colorado reports the highest rate of home foreclosures in the United States for the second month in a row.

Colorado is one only a few states in the country with an unregulated mortgage industry. Consumer advocates say some lenders take advantage of their loose leash. Critics say lenders in the state don't fully educate their buyers. And worse yet, FBI statistics put Colorado in the top ten states for mortgage fraud each of the last three years.

Many buyers are apparently talked into using loans that aren't right for them. For example most buyers shouldn't be setting up interest only loans that will increase to include principal payments after just a few years.

For most buyers, once they start paying the principal their payments go up substantially, forcing foreclosure.In Colorado the responsibility to avoid these problems is with the consumer. The Better Business Bureau recommends calling them before deciding on a lender.

Posted by

blogger

at

5/28/2006

15

comments

![]()

![]()

May 27, 2006

Virginia: This is what a housing panic looks like

Classic rush for the exits... Houses, tulip bulbs, pets.com stock, it's all the same thing when the music stops and the Ponzi scheme ends...

Thanks HP'er powerlines for the image.

Amazing.

Posted by

blogger

at

5/27/2006

47

comments

![]()

![]()

Florida: The CEO of the local Realtors group told sales agents the residential market could get 'scary.'

"Could get"? Try, "is getting". And I love the "There is no housing bubble in Orlando!" quote. Oh, man, that's so damn funny!

Remember, too, that for the realtor newbies, who got their license post-peak, they'll be back to bartending in a matter of weeks as there's no business out there, and they won't be able to afford their own homes (or eat)... hattip to boomer bubblesitter for the link

The top executive of the Orlando area's Realtor association is warning members that they may be in for a shock and some pain if the residential real estate market continues to soften.

"For some of you, it will be a scary thing," Jennings said to several hundred members during an association luncheon this week at the Renaissance Resort at SeaWorld.

During the past year alone, the local association's membership swelled 26 percent to 11,897 people. So any softness in the market will be magnified.

If it continues, he said, some real estate offices will close. "Marginal agents will retire faster," he predicted, and consolidation within the industry will continue. "The big get bigger," he said, and boutique shops will do fine but midsize offices will be squeezed out.

"There is no [housing] bubble in Orlando," he said. "We still have demand for housing, and jobs are being created."

Posted by

blogger

at

5/27/2006

3

comments

![]()

![]()

Ignorance still reigns in Phoenix: No housing "bubble" bursting in Valley

You know, I actually feel sorry for folks who, because they're about to close on a house, feel motivated to write to the media to tell them shhhh... no more bubble stories... you'll blow it for everyone!

Letter to the Editor - Arizona Republic

No housing 'bubble' bursting in the Valley

May. 27, 2006 12:00 AM

I see an awful lot written about the real estate "bubble" bursting, but I've yet to see evidence of this happening in Phoenix.I'm buying a home in Buckeye, a town that has seen a 4 percent increase in sales this quarter compared with the same time last year and where price appreciation has increased every month during the past three months.

In the overall Phoenix market, inventory is up more than 10 times year-ago levels; prices are up 70 percent over 2004 levels; yet sales dipped only 7 percent in the first quarter of 2006. Is this evidence of a bubble bursting? I think not.

The media's bubble talk could become a self-fulfilling prophecy. It's easy to write about the doomsday scenario because it makes for dramatic reading, but the problems start to arise when it has no basis in fact and readers actually start to believe it - much like the overhyped Y2K bug.I would like to see a thoughtful, sane, rational article about the real estate market that looks at the actual numbers, breaks them down, and tells us what they mean. Is that too much to ask?

- Sonny Shrivastava, Tolleson

Posted by

blogger

at

5/27/2006

16

comments

![]()

![]()

Six Ways To Profit From A Real Estate Collapse

From Forbes - the big question on HP'ers mind - how to make $$ during the meltdown. Not great advice, still looking for the magic bullet, but here's theirs: Hat tip to Uknow...

From Forbes - the big question on HP'ers mind - how to make $$ during the meltdown. Not great advice, still looking for the magic bullet, but here's theirs: Hat tip to Uknow...

Buy In Depressed Markets

If you're a committed property investor, consider exchanging a pumped-up property in a hot coastal market for a comparable place in markets that are already deflating.

Play The Vulture

Sometimes in an overpriced and illiquid market, you can snatch up a good deal well in advance of the fall. To get the best deals, call the distressed homeowner before the bank moves in to foreclose

Circle With The Sharks

If being a vulture is too labor intensive, try buying from foreclosure sharks.

Don't Become Prey

Make sure you don't get into a position where a vulture calls you. Even with the low mortgage rates of recent years, a lot of people bought by using by high-test "negative amortization" financing or its evil twin, the "interest-only" loan.

Downsize Your House

Maybe you have too much house. The answer: Sell while you still can get a respectable return and move to a smaller residence

Turn To Wall Street

When real estate heads down, the big money flows into big apartment buildings. So far this year, says SNL Financial, apartment REITs have delivered a total return of 16%.

Posted by

blogger

at

5/27/2006

12

comments

![]()

![]()

What a housing panic looks like

From the NBC report "Is the Housing Bubble Bursting"

The number of homes for sale is on the rise. ZipRealty reports the following increases compared to one year ago:

166 percent more in Los Angeles County

266 percent more in the Miami area

394 percent more in Phoenix

Bidding wars are being replaced by price cuts. ZipRealty reports the following sale price reductions:

28 percent of the homes in Los Angeles County

35 percent in Miami

38 percent in Phoenix

43 percent in Boston

After the inventory explosion, after the price drops, after people figure out builder incentives are actually price cuts, and after the NAR can no longer spin the numbers to their liking, Panic sets in.

We're almost there nationally, and we're sure there in Phoenix, Boston, San Diego and Miami.

Posted by

blogger

at

5/27/2006

3

comments

![]()

![]()

Immigration: Will Congress do nothing, or do something stupid?

I think that's pretty much the two choices for this corrupt boat of fools.

I'm 100% against the Senate version, which would reward people who broke the law, jumped the line and came here illegally.

That version passes and our leaders can go F themselves for all I care, and the US no longer will be a nation of laws or one deserving of respect, and they'll have to earn it back one day - by the people throwing these bums out - Congress and the Illegals.

The House thankfully is so far from the Senate (and more to my liking) - with no free pass, and no amnesty. I think since 100% of them are up for re-election in a few months that the Senate version or anything like it is doomed to fail. There would be an uprising.

My version? Build a wall, deploy the Guard, actively deport anyone here illegally, $50,000 fine for any business or person hiring an illegal for every instance, and liberalized immigration policy and numbers. Come to America, but do it LEGALLY. In the country illegally? Get out.

I also like the lazy MSM quoting someone (no source) that there are 11 Million illegals here. Guess what folks, there may be 50 million for all we know. See, there's this thing - THEY'RE HERE ILLEGALLY! In other words, Mr. Census ain't countin' 'em.

What a mess we've gotten ourselves into. And why? Because we needed a cheap outsourced workforce to build all those damn houses.

Posted by

blogger

at

5/27/2006

18

comments

![]()

![]()

May 26, 2006

The end of retirement

Great 4-part series on PBS's Frontline on retirement. Here's the last chapter. Get ready America (and home-value-reliant baby-boomers) for reality. Including a lifetime of work.

Posted by

blogger

at

5/26/2006

21

comments

![]()

![]()

Here's to the Housing Bubble bursting!

So many will be hurt by this, how can we possibly toast the death of the housing ponzi scheme? Because it would have been so much worse if it kept on, that's why.

Cheers to getting back to a sane housing market, where people can afford homes, with traditional loans, and not have to worry about their values collapsing.

Here's to young kids getting jobs out of college and being able to buy a house.

And this toast from HP'er JM:

Cheers to the end of the housing bubble, let's all raise our glasses of MD 20/20!

Posted by

blogger

at

5/26/2006

11

comments

![]()

![]()

Foreclosures skyrocket - but realtors and mortgage brokers got paid

I know that people make their own decisions in life and then have to live with them, but I think there's a special place in hell for the realtors and mortgage brokers who steered financially ignorant folks to these interest-only and no-down and no-doc ARMs.

These human scum knew that they'd earn their nice and tidy commissions, but that the buyer would likely get foreclosed on one day for not being able to make the payment.

Who cares! We got paid! Who cares if lives were ruined. Who cares about their fellow man. We got our commissions. Like drug dealers and pimps. Hat tip Investor for the link.

As rates rise, home foreclosures surge - Adjustable-rate mortgages make it hard for many to make payments

RealtyTrac, an industry organization that maintains a nationwide database of foreclosures, says mortgage defaults between January and March of this year numbered 323,102 compared with 188,122 during the same period last year — an increase of 72 percent.

Indianapolis leads the nation, with one out of every 69 homes in foreclosure. Atlanta follows closely at 1 in 70 homes. Then Dallas — where the Edwardses live — at 1 in 99. Memphis is fourth at 1 in 101. Denver rounds out the top five at 1 in 105.

“The reason homeowners have been buying properties that are probably beyond their means, is that they haven't been looking at what the house costs,” says Rick Sharga with RealtyTrac, which maintains a database of foreclosed properties. “They've been looking at what the monthly payment was.”

Posted by

blogger

at

5/26/2006

24

comments

![]()

![]()

The Housing Bubble Surplus

With the dot-com bubble overbuild, it was telecom equipment, fiber optic lines, routers, business models, Porsche salesmen, lava lamps and First Monday events.

Here are some things there are now too many of because of the Housing Bubble overbuild. I was amazed to find out that in Arizona, there are over 70,000 realtors now, up from just over 20,000 three years ago. Ouch. Say goodbye to at least 50,000 of 'em in Arizona alone...

* Realtors

* Mortgage bankers

* Builders

* Developers

* Bankers

* Home Depot workers

* Houses

* Condos

* Sign makers

* Landscapers

* Illegal Mexican workers

* Architects

* Land surveyors

* Appraisers

* Flippers

* Get rich quick in real estate book writers and speakers

* Tiles for roofs

* Pool salesmen

* Remodelers

* Bubble bloggers

* NAR employees

* Builder stock owners

* Subprime lenders

And what aren't there enough of?

* Bankruptcy lawyers

* Foreclosure auctions

* "How to survive the bubble burst" books

* Job training centers

* Bartender jobs (for the unemployed realtors)

Posted by

blogger

at

5/26/2006

23

comments

![]()

![]()

The fake real estate based economy of Phoenix will make it Housing Bubble Ground Zero

With 33% of the entire fake Phoenix economy tied in some way to the Real Estate Industrial Complex (no real jobs there - they just sell houses to each other), this First Crash, the rapid decline in new homes being built, has to mean significantly less work for carpenters, roofers, foundation layers, stucco salesmen, architects, landscapers, painters, realtors, mortgage brokers, developers, etc. And those folks dry cleaners, auto salesmen, Home Depot workers, etc.

In other words, what's already happening in Phoenix means significant and growing job losses to come, and a tremendous crash in employment and to their economy.

More listings, less sales, declining prices, and a cycle spinning out of control.

One piece of good news though is that many of those homebuilding jobs went to Illegal Mexican Immigrants, who don't get direct social services and don't buy houses. So different than traditional unemployment for the State. However the question remains, will they go home? Will they start committing crimes?

New home permits and sales of existing homes fell sharply in April compared with the same month a year ago and they didn’t meet industry expectations they would match 2004 levels, the Phoenix Housing Market Letter reported.

RL Brown, author of the letter, said consumers have so far failed to buy up the growing inventory of new homes generated by an apparent wave of cancellations from consumers. He said this is because consumers haven’t been able to realize gains in their present homes in a faltering resale market.

And, he says, buyers have lost confidence in the current state of builder housing values.

Sales of existing homes so far in 2006 are down nearly 22 percent from the same time last year. Brown said the market should be showing some evidence builders have stemmed the flow of cancellations, adjusted their pricing policies and regained some momentum in their sales offices.

“It is becoming more and more unlikely that we will salvage a 2004-like year out of this quagmire,

Brown said builders haven’t been able to hold buyers to contracts even when customers are forced to fork over thousands in earnest mocancelingling the deal.

“Consumers are perceiving that the deep incentives builders are offering new buyers are indeed price cuts that will leave them with homes and mortgages that are perhaps $50,000 to $70,000 higher than what a walk-in can buy,” Brown wrote. “Builders can’t stomach giving the old buyers credits down to the ‘new price’ at closing and seeing those profits flushed out.”

Posted by

blogger

at

5/26/2006

16

comments

![]()

![]()

May 25, 2006

"San Diego renters getting an amazing deal"

It's not just San Diego either - it's worldwide. Rejoice renters, and owners who sold and now bubble-sit. Rejoice.

It's not just San Diego either - it's worldwide. Rejoice renters, and owners who sold and now bubble-sit. Rejoice.

Hat-tip to HP'er Mark for the link

San Diego renters often express frustration at having missed the housing boom of a lifetime and fear that they will now never be able to purchase a home.

Well, I think they ought to buck up. Relatively speaking, they are getting an amazing deal.

Even as San Diego home prices headed to the stratosphere these last few years, local rents grew at a fairly subdued pace. The end result is that it costs quite a bit more to buy a given home than to rent that same home.

What arguments of this type fail to take into account is that homebuyers are themselves renters -- it's just that instead of renting homes, they are renting money from the bank. And when homes cost so much that the "rent" on the money required to purchase a home -- otherwise known as the mortgage interest -- is more than the rent required to simply live in that same home, aphorisms like these cease to apply.

Of course, when used in the manner above, the word "equity" does not refer to wealth that is saved by avoiding excessive carrying costs. It refers to wealth gained by owning a home that is increasing in price. That's a great plan, as long as homes are actually increasing in price -- but they are not, nor should they be expected to for years to come.

Posted by

blogger

at

5/25/2006

20

comments

![]()

![]()

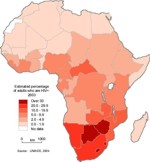

FLASH: 25 Million dead, 40 million infected by chimp virus worldwide

Thought I'd bring some attention tonight to the continuing world AIDS crisis, especially the dying of a continent in front of our eyes - Africa. I like Bono's Red campaign - think about getting a Red AMEX - 1% goes to Aids in Africa.

And, let me point out that it's not so farfetched that humans can catch a virus from an animal (or a bird), kill millions and millions worldwide, and scientists cannot stop it.

Now back to the housing bubble...

Posted by

blogger

at

5/25/2006

10

comments

![]()

![]()

FLASH: Yield curve inverts again - 10 year below Fed Funds rate

And the smart folks in the room know what that means

Posted by

blogger

at

5/25/2006

6

comments

![]()

![]()