Post articles (tinyurl), rant away, keep it clean, have a good chat

November 30, 2006

Words of wisdom from the National Association of Homebuilders (NAHB)

WARNING: If you're drinking your morning coffee, set down the cup, swallow, breathe in, breathe out, OK, now you can proceed.

Here's probably the most hilarious advice I've ever seen when it comes to "should I buy a home". Everything you wanted to know about the late great housing ponzi scheme can be wrapped up with this.

And away we go... The first question is:

AS A FIRST-TIME BUYER, SHOULD I WAIT UNTIL PRICES GO LOWER TO BUY A HOME?

No. If you continue to wait, you may never be able to afford to get into the housing market. Even as home prices are currently moderating – or even falling in some areas – rents continue to climb. The best way to build household wealth is to own a home

IF I WAIT TO BUY A HOME, WON'T PRICES GO DOWN EVEN LOWER?

Timing the market isn't a great idea. All the market fundamentals show that now is a good time to buy – prices are down, interest rates are affordable, there are lots of homes to choose from and you can bargain with sellers.

IS IT BETTER TO WAIT UNTIL THE ECONOMIC PICTURE IS CLEARER SO MY HOUSE WILL APPRECIATE?

No. The fact is, the economy is still solid. After expanding rapidly over the past couple of years, economic growth is moderating – and this is actually good for housing.

ISN'T IT BETTER TO "PLAY IT SAFE" AND KEEP RENTING UNTIL THINGS ARE MORE CERTAIN?

No. The best way to “play it safe” is to actually buy a home

SHOULD I INVEST MY MONEY IN THE STOCK MARKET, OR USE IT TO BUY A HOME?

Buy a home. Thanks to the concept of “leveraging,” purchasing a home is by far the best long-term investment. Leveraging means putting down a small amount of money to earn a big return.

SHOULD I WAIT TO SELL MY HOUSE UNTIL I CAN GET THE SAME PRICE MY NEIGHBOR SOLD THEIR HOUSE FOR?

No. It’s always better to trade up in a buyer’s market, like the one we are in now. While the value of your house has fallen, the price of higher-end homes has also dropped

Posted by

blogger

at

11/30/2006

54

comments

![]()

![]()

November 29, 2006

HP dedicates this to all the suckers who bought overpriced condos in the ghetto

Posted by

blogger

at

11/29/2006

7

comments

![]()

![]()

HousingPanic Stupid Question of the Day

Who is the MOST screwed:

Homebuilders

Realtors

Mortgage Brokers

Hedge Funds

Appraisers

Home Depot Clerks

China

Bankers

Mexicans

Homedebtors

Stucco manufacturers

Pottery Barn

America

Other _______

Posted by

blogger

at

11/29/2006

46

comments

![]()

![]()

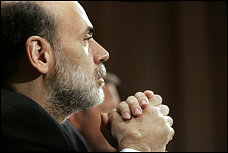

A paralyzed Bernanke talks tough, but the market knows he's just bluffing

Poor Ben.

Poor Ben.

He can't raise interest rates, as that'd cause the housing industry, already in full historic meltdown, to meltdown even faster.

But if he can't raise interest rates, the the dollar sells off and inflation could get ugly.

Well, the market has called his bluff now. The dollar is in free fall because they know he won't raise 'em. The yield curve is inverted. The bond market knows for a fact that a housing-led recession is underway. And the end game is now here.

The Fed Cries Wolf; Mr. Market Isn't Listening

Nov. 29 (Bloomberg) -- Federal Reserve officials are getting a first-hand lesson in the law of diminishing returns: Try as they might, they can't seem to get the same mileage from their hawkish rhetoric.

In the past few months, every time a policy maker found a waiting platform, he or she used the opportunity to remind us that the Fed is more concerned about rising inflation than slowing growth.

Their words had predictable results. The prices of interest- rate futures contracts that reflect expectations of Fed policy sank, wiping out the gains registered on weak economic data.

Then something strange happened. The market stopped listening.

While June Eurodollars have yet to scale their former heights, they haven't revisited their September/October lows in the face of repeated reminders of the risks of inflation from the Fed.

The current inverted shape of the yield curve, with long rates lower than the funds rate, reflects the bond market's view that short rates are unsustainable at this level.

Does the market know something the Fed doesn't know? It usually does. Bernanke may be smiling, but on some level, he has to be concerned about the message he's receiving loud and clear.

Posted by

blogger

at

11/29/2006

45

comments

![]()

![]()

Hungry Phoenix realtor Greg Swann declares victory in battle against "HP'er morons"

Boy, this guy really is delusional.

I've grown bored of the guy - it's obvious now he had one goal - to drive traffic to his realtor website. So hopefully this will be my last post on the loser. If you want to see how bad Phoenix real estate must be, just ask yourself why this guy isn't out conning people or selling homes. There are no more suckers left to buy, and he has barely any listings to manage. Career change coming up for Greg Swann (do you want fries with that).

Arguing with the dolt is like arguing with a flat earth society member. HP'ers posted all kinds of great data about the Phoenix housing meltdown, but I guess Swann chose to ignore all of that. He also got his lonely realtor buds to post about the war, thus driving more traffic to his site.

At the end of the day though, anyone, ANYONE, considering doing business with this scum would run the other way now. Swann is simply a grotesque, misinformed, dirty little boy, not a professional, and his blog reflects that. The fact that he doesn't even own a home himself, and has only been practicing real estate in Arizona for a year should show you what an amateur we were dealing with in the end.

Remember HP'ers there's a million hungry realtors out there now. And they're pissed. So we could take our fight to all million of them, or we can keep our aim on the NAR and REIC. I choose the latter.

Here's today's posting from the loser Swann. Anyone so inclined please feel free to keep after the guy, but he bores me to no end.

So: Keith puts on a predictable pantomime of outsized outrage, heavy on the high-moral dudgeon. And the mouth-breathing morons zoom in to BloodhoundBlog to poke around at random and issue inane comments — heavy on the profanity, light on the grammar.

There’s more, but it’s all nothing. I told Keith in advance that it would come to nothing. The original post stands. Forever will it be known that the modus vivendi of Keith at Housing Panic is Masturbating to Armageddon. If the jack-off had any sense, he’d steal it like every other joke I’ve written for him. It would make an excellent title for his autobiography, “a tale told by an idiot, full of sound and fury, signifying nothing.”

Note also that I am unscathed. I stood alone — really the only way I know how to stand — against everything Generalissimo Foghorn Leghorn could bring to bear, and I bore no injuries. Keith has never laid a glove on me and he never will.

Posted by

blogger

at

11/29/2006

41

comments

![]()

![]()

The iamfacingforeclosure.com kid now wants to borrow another $50,000

If you want to read something REALLY uncomfortable, stop by Casey's blog and read about his current situation and thinking.

Ever see the movie Titanic? You loved it, even though you knew the ending.

Kid is going to file for bankruptcy eventually, and probably do some jail time. Just doesn't know it yet. I actually like the kid personally, just another Trump/NAR/REIC/Sheets victim, albeit a co-conspirator and responsible for his own actions, but it's all just so sad and predictable in the end.

Borrow 50 Grand to Stop Foreclosure and Sell My Houses Creatively

This is one of the burning thoughts that I came up with during the facing foreclosure fast: I really want to sell all those houses ASAP and stop foreclosure!

I’m sick and tired of having all this non-performing inventory continue dragging me down for so long. I need to be moving forward towards my goals of becoming a successful real estate investor.

Posted by

blogger

at

11/29/2006

31

comments

![]()

![]()

HP'ers, make your best case

Why shouldn't a young couple go out, qualify for an interest-only, no-down, no-doc, negative-am loan, find a realtor, and go buy a house today in America? You know, live the American Dream?

Why shouldn't a young couple go out, qualify for an interest-only, no-down, no-doc, negative-am loan, find a realtor, and go buy a house today in America? You know, live the American Dream?

Posted by

blogger

at

11/29/2006

24

comments

![]()

![]()

13% of HP'ers are now outside the US as the biggest bubble in world history pops

Yes, this bubble, the biggest in recorded human history, was worldwide.

And now the great housing meltdown shall be as well.

Enjoy the Economist classic - In Come the Waves. Now THAT was some good reporting.

The worldwide rise in house prices is the biggest bubble in history. Prepare for the economic pain when it pops

Never before have real house prices risen so fast, for so long, in so many countries. Property markets have been frothing from America, Britain and Australia to France, Spain and China. Rising property prices helped to prop up the world economy after the stockmarket bubble burst in 2000. What if the housing boom now turns to bust?

According to estimates by The Economist, the total value of residential property in developed economies rose by more than $30 trillion over the past five years, to over $70 trillion, an increase equivalent to 100% of those countries' combined GDPs. Not only does this dwarf any previous house-price boom, it is larger than the global stockmarket bubble in the late 1990s (an increase over five years of 80% of GDP) or America's stockmarket bubble in the late 1920s (55% of GDP). In other words, it looks like the biggest bubble in history

Posted by

blogger

at

11/29/2006

20

comments

![]()

![]()

November 28, 2006

Desperate and discredited National Association of Homebuilders gives spin a shot

Figuring the National Association of Realtors multi-million dollar advertising buy was a complete and total failure, the NAHB put out their own "study" saying that people don't rely on the "media" when making decisions on whether or not to buy a home.

Yeah, right.

With home sales cratering, in some cases 40%, 50% or more, with NAHB poster boys on their way to jail for insider stock swindles, and with massive layoffs and bankruptcies within the NAHB membership, I'd suggest a different tact. One that's not seen in the REIC and should be.

It's called honesty.

People around the US are now laughing at the REIC. You're witnessing the destruction of the "realtor" profession. Greedy and corrupt homebuilders like Bob Toll are the new Bernie Ebbers, Ken Lays or Dennis Kozlowskis. And millions of Americans are now financially ruined, thanks in part to the NAHB and NAR.

Here's their attempt at spin. Makes you wonder, with $1.9 Trillion or 16% of the entire US GDP relying on the real estate business, why they've not come after HP and yours truly, in addition to the other bubble bloggers. I guess that proves that stupid corrupt greedy rich business guys have no idea what's really going on out there on "the google" or "the internets". Or reality.

WASHINGTON, Nov. 20 /PRNewswire/ -- The nation's prospective homebuyers may derive some of their information on the housing market from the news media, but at the end of the day the things that matter far more when they are deciding whether to make a purchase include the price of the newhome, mortgage interest rates and their housing needs, according to a new nationwide survey commissioned by NAHB.

"While the majority of the households we polled indicated that they found the media a reliable source of information on the housing market,what they read in the newspaper, saw on television or heard on the radio was no substitute for actually going out and shopping the market," said Thomas Riehle, a partner in RT Strategies, which conducted the research for NAHB.

Posted by

blogger

at

11/28/2006

20

comments

![]()

![]()

A rapid change in mindset is always the end of a financial mania or Ponzi Scheme

That's why the sudden death of the Late Great US Housing Bubble is playing out so text-book perfect.

From housing cheerleading (Time Magazine etc) a year ago, to articles like this today from CNN.

Nobody, except a complete idiot or masochist, would be out buying a home today given the radical change in the collective consciousness.

Thanks HP'er Karin for the great photoshop!

Home prices post record drop in October - Median price sinks 3.5 percent from a year earlier, trade group see more price declines ahead.

The price of existing homes sold in October fell for the third straight month and posted the biggest drop on record, an industry group said Tuesday, adding it expects weakness in pricing to drag on into next year.

The National Association of Realtors said that the median price of a home sold in October was $221,000, the same as in September, but down 3.5 percent from October 2005.

Where not to buy

California's Central Valley - Bakersfield, Fresno, Merced, Sacramento, Stockton

Southwest Florida - Fort Myers, Naples, Punta Gorda, Sarasota

The Jersey Shore - Atlantic City, Ocean City

Phoenix

California's Inland Empire - Riverside and San Bernardino counties

The Bottom 10 - Stockton, CA, Merced, CA, Reno/Sparks, NV, Fresno, CA, Vallejo/Fairfield, CA, Las Vegas, NV, Bakersfield, CA, Sacramento, CA, Washington, D.C., Tucson, AZ

Posted by

blogger

at

11/28/2006

24

comments

![]()

![]()

FLASH: Used home sales (supposedly - NAR stat) plummet 13% in October

Remember having the NAR report on home sales is like having Bernie Ebbers report on MCI earnings. Don't forget that the NAR doesn't take into account the massive use of incentives to move dead inventory, and their data collection methodology is laughable.

But here's the latest for HP'ers keeping score at home.

The National Association of Realtors, the country's trade association for real estate agents, reported that national sales of existing homes, both single-family homes and condominiums, sagged 12.7 percent in the third quarter compared to the same period last year. Sales were down to a seasonally adjusted annual rate of 6.27 million units, the NAR reported.

Nine states had sales declines of 20 percent or more over the summer with the biggest declines in states that were once the hottest. Sales fell by 38 percent in Nevada; 36 percent in Arizona; 34.2 percent in Florida and 28.6 percent in California

Not surprisingly, the weakness in sales translated to price declines -- 45 metropolitan areas in the country experienced price declines, including the Washington area, according to a separate survey also released today by the agents' association.

I saw this funny spin on the Lereah quote over at seekingalpha:

Perhaps the usually hallucinogenic David Lereah, the Realtors' chief economist, got it is right this time: "With the market in full transition, buyers now have choices [read: more inventory] and sellers are more willing to negotiate [read: desperate]. Under these circumstances, it's no surprise that overall home prices are slightly below a year ago."

Posted by

blogger

at

11/28/2006

35

comments

![]()

![]()

Doomed Chateaux on Central condo project in Phoenix headed to foreclosure. What a shock!

I started HousingPanic after seeing laughably overpriced (and poorly designed) projects in Phoenix that I knew would go belly up - The Duke, Elevation Chandler, The Valley Ho, and the Chateaux on Central being among the worst.

I do say, I believe almost all of those projects are now bankrupt, foreclosed, mothballed or in serious trouble. The latest to fall was the disgusting eyesore modeled after some type of French castle that somehow got zoning approval in central Phoenix. A laughable project, with units priced from $2 Million to $4 Million. In four years, guess how many sold?

Zero.

So sad. Just think of the expected realtor commissions that won't be earned now! I just wonder if they'll simply tear this eyesore down now.

The developer of the posh brownstones going up on Phoenix's Central Avenue has run into some financing problems. The project's lender, Desert Hills Bank, has filed to foreclose on the Chateaux on Central property on the northwestern corner of Central and Palm Lane, according to public records.

Developer Central Phoenix Partners owes its lender $12 million, according to the foreclosure filing. The project had been valued at $30 million. Property records show none of the upscale homes in the Chateaux on Central have sold yet, though deals for a few are pending. The houses were priced from $2 million to $4 million.

A huge copper turret was lowered onto one of the homes earlier this month, shortly after its lender filed to foreclose on the property. A trustee sale of the property is scheduled for February, but Chateaux's developers are said to be negotiating for other financing.

ll

Posted by

blogger

at

11/28/2006

24

comments

![]()

![]()

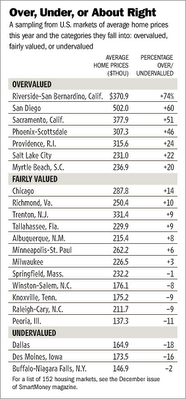

Uh-oh. Someone tell Greg Swann that Phoenix home prices are being reported as 46% overvalued at Smart Money / WSJ

At this point of the housing crash, arguing with a real estate pumping corrupt realtor in Phoenix is like arguing with a member of the flat earth society, so I won't even try.

At this point of the housing crash, arguing with a real estate pumping corrupt realtor in Phoenix is like arguing with a member of the flat earth society, so I won't even try.

Smart Money and the Wall Street Journal had this report out today on "What to do in a market that is headed for a falloff". Above all, I have one sane piece of advice that commission-hungry realtors like Greg Swann will disagree with:

DON'T GO OUT AND BUY A FRICKING HOUSE TODAY!

After hurtling along for years, the nationwide real-estate boom has come to a screeching halt. In 2005, home prices in the U.S. rose more than 12%; this year, the National Association of Realtors expects appreciation to reach just 1.9% -- the lowest gain since 1992.

Rising mortgage rates and selloffs by skittish real-estate investors have helped depress housing prices in many metropolitan areas. But there's another factor that many observers miss: the relationship between home prices and incomes.

When the cost of housing in a given area grows far faster than local wages and salaries, the pool of potential buyers shrinks, and prices are much more likely to sink.

According to Mr. Winzer, any market that's more than 30% overvalued is due for a correction. In the fall of 2003, only eight markets on the list of 152 fit that description; on this year's list, 37 did. Sure enough, price decreases are beginning to pop up in many of the markets that have shown up year after year as the most overvalued -- especially in Florida and California.

Posted by

blogger

at

11/28/2006

17

comments

![]()

![]()

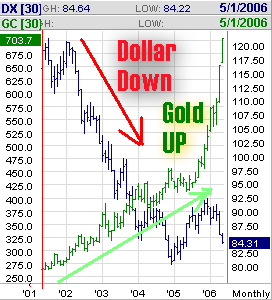

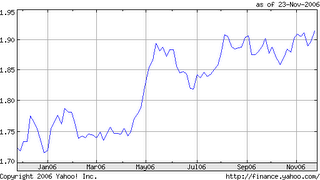

The incredible shrinking US dollar

Want to see inflation first hand? Move to Europe and have the dollar drop 15%. Ouch. Make the pain stop someone. Make the pain stop. Maybe I should ask clients to pay me in gold from now on. These dollars are a waste.

Want to see inflation first hand? Move to Europe and have the dollar drop 15%. Ouch. Make the pain stop someone. Make the pain stop. Maybe I should ask clients to pay me in gold from now on. These dollars are a waste.

Oh, that cheap crap at Wal-Mart is either gonna get more expensive now, or Wal-Mart will hold prices and make less profit. One or the other.

Dollar slumps further, eliciting fear in Europe

The greenback hits lows of 20 months or more versus the euro and British pound. German and French stocks slide.

The dollar continued to slide against its major rivals Monday, but the decline slowed from last week's speedy pace.

In Europe, export-related stocks fell sharply on concerns that the strengthening euro currency would make the continent's manufactured goods too expensive for some U.S. consumers.

Some European politicians expressed alarm about the currency market's gyrations. The euro rose to a 20-month high of $1.313 in New York from $1.309 on Friday. The British pound ended at a two-year high of $1.937, compared with $1.932 on Friday.

The U.S. currency began to tumble Wednesday after mostly treading water in recent months.

Posted by

blogger

at

11/28/2006

43

comments

![]()

![]()

November 27, 2006

Oh dear god I can't stop watching this car crash! Suzanne researched this!

That's not the point.

What is the point?

What?

I loved that house.

Plus the schools.

The kids are three and one

They're gonna grow up

What?

Suzanne researched this!

This listing is special John, you guys can do this!

OK

Are you kidding?

This is awesome!

Did you see the size of that garage?

Yes!

Oh, that's great! Now let me get to work!

Posted by

blogger

at

11/27/2006

33

comments

![]()

![]()

HousingPanic Stupid Question of the Day

Why can't people making $100,000 a year afford a home, when people making $10,000 a year own more than three?

Posted by

blogger

at

11/27/2006

25

comments

![]()

![]()

Any HP'ers old enough remember when Americans gave a damn?

Keep buying those cheap Chinese exports materialistic Americans with your ever-weakening dollar. You're shopping your way straight to the unemployment line. And you no longer have a soul.

Anyone displaying an American flag and Bush/Cheney 2004 bumper sticker on their pickup truck while shopping at Wal-Mart is not only a hypocrite and a fool, they're also the root cause of the problem, caring only about themselves, and an America-hater.

Deal with that. Recognize the error of your ways. Then be part of the solution.

Posted by

blogger

at

11/27/2006

45

comments

![]()

![]()

Richard and Borka - this post is for you. What's on your mind today?

Posted by

blogger

at

11/27/2006

20

comments

![]()

![]()

If holiday shopping got off to a "big bang" as some lazy MSM reported, why are retailers getting killed today?

Every year, the lazy MSM writes reports the day after Thanksgiving weekend about how great things are, how there were big long lines at the malls, and how retail sales were "above expectations"

Then the true numbers come in.

Well, same arc today, with lazy reports like this one in the Tribune.

Retailers got what they wanted over the Thanksgiving weekend -- a strong start to the 2006 holiday shopping season as consumers crowded stores in search of huge discounts on flat-screen TVs and other hot items.

But then the real numbers come in

"There is now significant concern that the holiday retail season is going to underperform," said Gregory Miller, chief economist at SunTrust Banks. "Traffic doesn't necessarily translate into profits," he said, referring to reports of crowded stores over the weekend.

Almost like the housing bubble and Iraq - cheerleading followed by reality

Why does the MSM do it? One, they're lazy. Two, who are the MSM's big advertisers? You got it - the retailers. Just kissing the feet, doing their job.

Posted by

blogger

at

11/27/2006

16

comments

![]()

![]()

November 26, 2006

Get ready America for the historic wave of foreclosures which will now consume so many areas

I doubt anyone, bankers, the government, local communities, charitable organizations, etc, have really thought through the housing disaster underway.

You'll see areas where homes are just burned to the ground in a desperate attempt by the homedebtor to get out. You'll see neighborhoods where nobody lives there. You'll see condo developments half-completed, an urban eyesore for all to see the folly of man. And you'll see the ugly legacy of this housing bubble for years to come. Go check out Colorado for a sneak preview.

In Colorado, the state with the nation's worst foreclosure rate, some neighborhoods have been spared the wave of house auctions. Others have been deeply wounded, and it is not just those losing their homes who get hurt.

In Montbello and Green Valley Ranch, existing-home values are falling as foreclosures spread. Burned-down houses sit abandoned for a year or more. For-sale signs carry notes of desperation. One offers a week-long Caribbean cruise to the buyer of a foreclosed house. "Zero down? Poor credit? First-time buyer? Call for a free two-minute pre-approval," another urges.

From August to October, the median sale price on existing homes in Green Valley Ranch was $185,450, down from $201,000 during the same months a year ago, according to real estate website Trulia.com. In Montbello, median sale prices dropped from $175,385 to $164,950.

Posted by

blogger

at

11/26/2006

35

comments

![]()

![]()

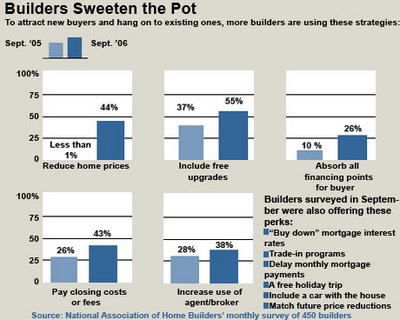

You'll see below a stupid homebuilder trying to sucker homedebtors into buying a debt bomb with a pizza. What should they be offering?

You're the marketing director for a desperate Phoenix homebuilder with tons of dead inventory sitting there now that your cancellation rate has soared to 50% and you're still finishing up the houses you can't stop.

So, here's your marketing budget per home - what do you offer to try to sucker someone into buying your mistake? Assume the original list price was $300,000.

A: $10

B: $1,000

C: $10,000

D: $100,000

My answers:

A: $10 in McDonald's coupons for the realtor to buy some food - they haven't eaten in awhile

B: Free Botox injections for the realtor - you're going to start to see some really sad cases as realtors won't be able to keep up their injection schedules anymore. Housing may be falling but now so will realtor faces

C: $10,000 worth of free gas - since you're trying to sell a house 50 miles out of Phoenix in Maricopa, that homedebtor is gonna have to get there somehow, but won't be able to afford gas even with the no-down, no-doc you'll put him into

D: Sit at home and watch TV on us!! "We'll pay you a $100,000 salary for a year" incentive for the last sucker in

Anyone see the problem with these incentives? All they're really doing is spending the homedebtor's own money, while keeping the year over year comparisons and "comps" looking good in those NAR and government reports. And they allow the realtor to earn their commission on the full price, vs. the true discounted price. Shameful.

Posted by

blogger

at

11/26/2006

17

comments

![]()

![]()

FLASH: Even with fire sale pricing, Wal-Mart to post same store sales decline for November

Market ain't gonna like this one on next week. Flat sales are a real drop when factoring in inflation FYI.

And if you think sales are bad, wait until retailers start releasing their profit numbers - those are going to be even uglier as they chase each other to the bottom...

The US consumer, thanks in part to the housing crash, is finally spent.

Wal-Mart predicted a rare decline in monthly sales on Saturday, even as U.S. bargain-hunters jammed stores in search of gifts at the start of the crucial holiday shopping season.

Wal-Mart estimated that November sales fell 0.1 percent at its U.S. stores open at least a year -- a closely watched retail measure known as same-store sales.

The retailer will provide a final monthly sales report on Thursday, when most other major chain stores report their November figures. This would mark Wal-Mart's first monthly same-store sales decline since April 1996.

"We would frankly have expected better," Merrill Lynch retail analyst Virginia Genereux wrote in a note to clients dated Friday, pointing out that Wal-Mart had slashed prices on popular toys, electronics and other gift items to lure customers. The retailer's widely publicized $4 generic drug program should have drawn more shoppers, too.

Investors are watching holiday sales particularly closely this year to gauge how consumers are coping with a slowdown in the housing market that has already hurt home improvement retailers and furniture stores.

Consumer spending accounts for some two-thirds of U.S. economic activity, and the November-December holiday season makes up anywhere from 20 percent to 40 percent of retailers' annual sales.

Posted by

blogger

at

11/26/2006

32

comments

![]()

![]()

HP does battle with an unprofessional, disgusting and desperate realtor: Greg Swann at Bloodhound Blog

I figured the guy must be having hard times. Phoenix real estate is having an historic meltdown. Sales are down 40% from last year. Inventory is up hundreds of percents. People stupid enough to work for Bloodhound Realty are likely hungry, desperate and pissed.

So, as predicted, who do they blame? Themselves? Nah. The market? Nope. Supply and Demand? No way. The fundamentals? Nope.

They blame the messenger, and in this case HP and yours truly.

But as we've said all along, that's to be expected from the small minded set. We expect plenty of REIC trolls and we get 'em. Greg Swann himself is our sock puppet here at HP, hijacking posters identities and probably spending hours here trolling since he has nothing else to do in life now.

But, the unprofessional weirdo went overboard the other day, with this revolting posting on his supposedly professional site (WARNING - FOUL DISGUSTING LANGUAGE - SKIP AHEAD):

Finally, it might be nice if everyone would chip in to buy Keith at Housing Panic some lubricant. The poor sod has been Masturbating to Armageddon for months now, to no discernible result. It’s gotta chafe…

(FOUL LANGUAGE OVER - SAFE TO READ AGAIN)

Yeah, that's professional. That's the kind of language professionals should use. I hope he doesn't have children, parents or attend a church.

Criticism I can take but that was just disgusting, and beyond the pale. I don't know about you HP'ers but I'd never do business with (or even associate with) a person who used that language. But par for the course with realtors I guess. Lack of class, lack of education, lack of intelligence.

So HP'ers tipped me off to this, so instead of going right online and posting something even more vile against this disgusting hack Greg Swann, I decided I should put an end to it right there, take the high road, and offer a truce, but back it up with a penalty if he chose to go to war. Here's my private note I sent him:

I’ll give you a choice. 1) A war with the thousands of HP’ers so harsh and loud your practice and reputation in Arizona likely wouldn’t survive (beyond the damage you’re doing yourself) 2) A truce. Here’s your post that is way beyond the pale, and made you look like some unprofessional weirdo. I’d suggest this be pulled by the weekend.

Well, he chose war. Here's his post on his site:

Here is Keith from Housing Panic volunteering to “go easy on me”, to “pull his punches” — essentially to “take a dive”. Why? Because he can’t bear up to the ridicule his ridiculous behavior incites. Bring it on, Keith. I’m having a great year, and you haven’t laid a glove on me yet. I’ve never pulled a post and I never will. I’ve never failed to tell the perfect truth about you — and I never will.

So HP'ers (or flying monkeys as he calls you), if you chose to join ranks with me versus Bloodhound, here's what I suggest to start the war plan. Please add your strategies and tactics as well:

1) Fight his disinformation and REIC spin with the facts. And the facts are pretty simple - housing is crashing, we're in the beginning stages of a historic meltdown, and he and folks like him are on their way to losing their careers. How can a Phoenix realtor look you in the eye and say everything is fine when sales are off 40% from last year? 40%? And now it's even getting tragic in Phoenix.

2) Flame away, and hard, over at Bloodhound Blog. If he's gonna troll here, feel free to hit 'em there. I know I'm helping him drive traffic to his site, but hopefully anyone thinking of buying a home from this disgusting unprofessional creep thinks twice about it after visiting his blog.

3) Dig up postings, articles and quotes from Greg Swann for all to see. Where he admits having unlicensed or out of work realtors working for him. Where he tells people there is no housing bubble. That sort of thing.

4) Here are his meager listings. I'm sure these homedebtors would like to know the type of unprofessional and revolting man representing them.

At the end of the day, I feel sorry for him. A desperate and disgusting man, losing his profession along with all professional respect. He's lost mine for sure.

Posted by

blogger

at

11/26/2006

121

comments

![]()

![]()

November 25, 2006

HousingPanic Stupid Question of the Day

What's taking Time magazine so long to correct their housing peak cover?

And instead of a homedebtor hugging his house, what should the new cover art be?

Posted by

blogger

at

11/25/2006

23

comments

![]()

![]()

Chuck Hagel, conservative GOP senator from Nebraska, finally calls a spade a spade with the mess in Iraq

The mess in Iraq was caused by the same incompetents who helped cause the late great housing ponzi scheme at the same time - namely a corrupt Congress, a boob of a President, and a clueless US population who went along willingly.

This Washington Post op-ed from Chuck Hagel will go down in history. I thought it was important that HP'ers saw it and understood what it meant. I'll give you the highlights but please read the entire piece.

Hagel admits we screwed up, infers Bush is a dimwit on a misguided God-complex mission, admits Congress aided and abetted, admits to $500 billion down the tubes, although we all know the true cost will be well over $1 trillion when this is over, and calls for us to get out. Let Iraq, Iran and Syria clean up our mess.

And oh, what a mess it is.

Leaving Iraq, Honorably, By Chuck Hagel

There will be no victory or defeat for the United States in Iraq. These terms do not reflect the reality of what is going to happen there. The future of Iraq was always going to be determined by the Iraqis -- not the Americans.

The time for more U.S. troops in Iraq has passed. We do not have more troops to send and, even if we did, they would not bring a resolution to Iraq.

We have misunderstood, misread, misplanned and mismanaged our honorable intentions in Iraq with an arrogant self-delusion reminiscent of Vietnam.

America finds itself in a dangerous and isolated position in the world. We are perceived as a nation at war with Muslims.

The world will continue to require realistic, clear-headed American leadership -- not an American divine mission.

The United States must begin planning for a phased troop withdrawal from Iraq. The cost of combat in Iraq in terms of American lives, dollars and world standing has been devastating.

We are destroying our force structure, which took 30 years to build. We've been funding this war dishonestly, mainly through supplemental appropriations, which minimizes responsible congressional oversight and allows the administration to duck tough questions in defending its policies. Congress has abdicated its oversight responsibility in the past four years.

Posted by

blogger

at

11/25/2006

24

comments

![]()

![]()

OK, now these homebuilder incentives have gotten out of control - free pizza with any home purchase

1) If Pardee homes has a marketing director, he or she is the most incompetent marketing director in US history (yes, worse than the Burger King MD during the "Herb" campaign)

2) If times are so tight for homebuilders that they can only offer a free pizza to move their dead inventory, well, just file for bankruptcy and get it over with

3) If any potential homedebtor buys a home from Pardee because they get a free pizza, well, well, well, well, I'm speechless.

Thanks Tom for the email. Amazing.

Posted by

blogger

at

11/25/2006

20

comments

![]()

![]()

On our way to insolvency (or hyperinflation) - a picture of US debt, revenue and expenses as % of GDP

I know, I know, nobody cares, "deficits don't matter", screw future generations, we're having a great party now, and "it'll all take care of itself over time". I know, I know.

But there's just one thing.

I do care.

Under the assumptions CBO made for this 125-year picture of the federal government's finances, the projected rise in expenditures for Social Security, Medicare, and Medicaid would drive total federal outlays well above the level that they have been throughout much of the post-World War II period.

The core costs of the federal government--that is, ignoring net interest on the debt--could rise from approximately 18 percent of GDP today to 24 percent in 2050 and 28 percent in 2075.

Left unattended, that steady escalation in spending could cause major deficits to emerge and thereby push the government's debt and interest expenditures to unprecedented levels.

The total cost of government, including interest expense, could more than double as a share of the economy, rising from 19 percent of GDP today to 40 percent in 2075

Posted by

blogger

at

11/25/2006

32

comments

![]()

![]()

November 24, 2006

Things fall apart. The center cannot hold. Mere anarchy is loosed upon the world.

Anyone else feeling it's all hitting the fan right about now, spinning so out of control our incompetent and clueless government will just have to move to the sidelines as Rome burns?

Militiamen grabbed six Sunnis as they left Friday worship services, doused them with kerosene and burned them alive as Iraqi soldiers stood by, and seven Sunni mosques came under attack as Shiites took revenge for the slaughter of at least 215 people in the Sadr City slum.

Home sales tumbled nationally by 12.7% in third quarter, 115,568 properties nationwide entered some stage of foreclosure during October, the most reported in any month so far this year and an increase of 42 percent from October 2005 ~ California reports highest number of foreclosures for second straight month ~ fasten your seat belts / Recession draws near

And thus I'm reminded today of Yeats

Posted by

blogger

at

11/24/2006

19

comments

![]()

![]()

Oh, man, now this is getting ugly - soon it'll be cheaper to use the US dollar over here than toilet paper

If this doesn't turn around soon, I'll be joining the realtors in the ramen noodle line.

$1.93 now buys 1 British Pound, or 1.30 Euros. It takes about $8 to buy a pint at the pub FYI.

For those of you in the US who could care less, you should start caring if 1) you buy any imported items and 2) you ever plan on traveling outside of the US.

For those of you outside the US who could care less, you should start caring since 1) your economy will tank as exports to the US tank and 2) The US and China melt down at the same time

Ugly. Just ugly. Thank god I'm sitting on a lot of gold to take away some of the sting...

Posted by

blogger

at

11/24/2006

70

comments

![]()

![]()

Idiot Phoenix realtor says housing was not a bubble because it'll only drop 10%

I say wrong-o! Why? One word: Leverage.

I say wrong-o! Why? One word: Leverage.

People were out buying houses with infinite leverage. This was much different from stocks.

If you have no savings, and went out and bought a $500,000 apartment in Phoenix with $0 down, and it drops 20%, you're out $100,000 plus the fees and carrying costs. In other words, one mistake (listening to an idiot realtor) and poof, you're bankrupt.

Now if you took out an advance on your credit card and bought pets.com for $10,000 and it dropped 100%, you lost $10,000. There's no way you'd have gotten access to $100,000 or $500,000 to buy pets.com stock (thank god!).

And that's why this bubble and its resulting crash will be the biggest in recorded human history.

Here's the dolt's quote. Also note he has a BUY rating on Phoenix real estate right now. Feel free to respond to that lunacy here.

What is a "bubble"

When a technology stock loses 90%, 95% or even 100% of it's value that's a bubble, a bursting bubble.

When a housing market loses 5% or 10% of it's value, that is not a bubble.

Posted by

blogger

at

11/24/2006

12

comments

![]()

![]()

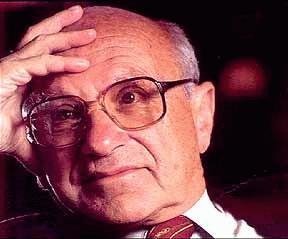

Congressman Ron Paul (HP hero) on the death of Milton Friedman (HP hero)

His death only underscores the sad lack of economics knowledge in Washington, however. Many of our elected officials at every level have no understanding of economics whatsoever, yet they wield tremendous power over our economy through taxes, regulations, and countless other costs associated with government.

They spend your money with little or no thought given to the economic consequences of their actions. It is indeed a tribute to the American entrepreneurial spirit that we have enjoyed such prosperity over the decades; clearly it is in spite of government policies rather than because of them.

The truth is that many politicians and voters essentially believe in a free lunch. They believe in a free lunch because they don't understand basic economics, and therefore assume government can spend us into prosperity. This is the fallacy that pervades American politics today.

Our schools teach children virtually nothing about economics and personal finance, which leaves them woefully unprepared for the working world. It also creates whole generations of young Americans who are incredibly vulnerable to the worst pandering politicians.

We cannot suspend the laws of economics or the principles of human action any more than we can suspend the laws of physics. Yet this is precisely what Congress attempts to do time and time again, no matter how many times history proves them wrong or economists easily demonstrate the harms caused by a certain policy.

The nation would be well-served if Congress spent more time reading the works of Milton Friedman, and less time worrying about petty party spoils.

Posted by

blogger

at

11/24/2006

26

comments

![]()

![]()

Over 1,000,000 homes in US entered foreclosure stage in 2006 (so far). Up 42% last month.

Can anyone say 'Resolution Trust Corporation'?

Can anyone say "Government Bailout of Fannie Mae"?

Can anyone say "We're Just Getting Started"?

Can anyone say "Massive Supply of Homes to Get Worse"?

Casey, at least you're not alone...

More homes went into foreclosure last month than in any month yet this year, according to figures compiled by RealtyTrac of Irvine, a foreclosure information company.

It says 115,568 properties nationwide entered some stage of foreclosure during October, the most reported in any month so far this year and an increase of 42 percent from October 2005.

The national foreclosure rate is now one new foreclosure filing for every 1,001 U.S. households, the highest monthly foreclosure rate reported so far this year.

"So far this year more than 1 million properties have entered some stage of foreclosure nationwide, up 27 percent from the same time last year," says James Saccacio, chief executive officer of RealtyTrac.

For the eighth consecutive month Colorado had the nation's highest state foreclosure rate

With one new foreclosure filing for every 389 households, Nevada documented the nation's second highest state foreclosure rate for the fifth straight month as foreclosures continued to climb.

Posted by

blogger

at

11/24/2006

8

comments

![]()

![]()

Gee, what a shock - a corrupt mortgage broker forges papers to collect her commissions

Just watch the video report.

Just watch the video report.

And then tell me this out of control scummy industry full of con men, liars, cheats and fraudsters powered by the lure of big commissions doesn't need oversight and regulation.

We (and the Chinese bag-holders) look back on these days and wonder how we let the system run so out of control for so long.

Posted by

blogger

at

11/24/2006

10

comments

![]()

![]()

A note from the smartest guys in the room - the REAL economists at PIMCO

Ya know, I read some real reports by real economists and I think to myself - those are some smart dudes.

Then I read reports from the NAR's Chief Economist, the corrupt David Lereah, and I wonder why the other real economists don't track him down and give him a wedgie.

Here's a note from bond house PIMCO's really smart guys, who basically are saying that the dummies buying these nifty new commoditized mortgage backed securities are gonna eventually get slaughtered. Conservatism will be rewarded, just like during the NASDAQ tom foolery.

Innovation is playing a huge role in both the mortgage industry and the corporate bond market, bringing lenders and borrowers together and providing easier access to credit than ever before.

As the housing market slows, mortgage lenders are beginning to tighten credit in recognition that innovative loans are fine in a bull market but perhaps less so in an increasingly bearish market.

We suspect the corporate bond market will eventually follow a similar path toward tighter credit, particularly as the slowdown in housing leads to slower economic growth.

Innovation is a wonderful thing, but it can also lead to excesses that separate asset prices from their underlying value, whether we are talking about houses, corporate bonds, credit default swaps or pets.com.

That’s why PIMCO continues to focus on value in corporate bonds, researching our credit investments from the bottom up and taking advantage of value opportunities like negative basis trades when they present themselves. In today’s corporate bond market, our focus on value, while not innovative, may be the most sensible approach of all.

Posted by

blogger

at

11/24/2006

4

comments

![]()

![]()

November 23, 2006

"Unrelenting housing slump" in Sacramento, CFO says: "We will have perhaps the largest growth drop year to year we've seen in modern times"

This is what Housing Devastation looks like, government-revenues-style. Anyone got 2001 deja-vu yet?

This is what Housing Devastation looks like, government-revenues-style. Anyone got 2001 deja-vu yet?

There are no surprises with this Housing Panic. Not a one. It's as if it hath been foretold...

As goes Sacramento goes the fake economies of Phoenix, Vegas, Miami, DC, Tucson, Denver, Detroit, Boston, LA, San Diego, Boise, Albuquerque, Tampa, etc. And they all know it's coming.

An unrelenting housing slump that has driven down the region's home values and sent sales into a tailspin is expected to strike local governments next year, curbing the record growth rates in tax collections that pushed some budgets into the black for the first time in years.

No one knows how much the slowdown will cost local governments, and the decline in growth comes after years of climbing budgets propelled by a private- sector housing boom. But the slowdown clearly has financial experts worried.

"We will have perhaps the largest growth drop year to year we've seen in modern times," said Geoff Davey, the county's chief financial officer.

Davey and others say the trouble is being generated by two key issues:

• A dramatic plunge in home sales. New and existing home sales in Amador, El Dorado, Nevada, Placer, Sacramento, Sutter, Yolo and Yuba counties have fallen by 24,000 this year compared with last year.

• The prospect that county assessors will have to lower property taxes for thousands of homebuyers whose home values have fallen below the purchase price.

Posted by

blogger

at

11/23/2006

16

comments

![]()

![]()

Happy Thanksgiving HP'ers

In England of course, today is simply called "Thursday".

And let's remember that today we celebrate the Pilgrims, who eventually declared eminent domain and stole the land from the "heathen natives" in order for future generations to build stucco homes on it with toxic loans, and Indian casinos of course.

Posted by

blogger

at

11/23/2006

24

comments

![]()

![]()

November 22, 2006

More MSM housing meltdown reporting

Here's the report on PBS Newshour the other day (thanks Frothy)

Either Americans are tuning this type of reporting out (like not looking at 401k statements in 2002), or they're now seriously freaking out.

Which is it?

Posted by

blogger

at

11/22/2006

24

comments

![]()

![]()

The Epic US Housing Meltdown hits Oprah today - now the REAL panic starts

Gonna be panicked housewives all over America today.

"Biggest one month drop in the last 40 years!"

"Incentives to lure buyers - trips, cars, cash back.. crazy things I've never seen before"

Watch her and her "stager" try to help a "desperate" debt-ridden couple sell their dead inventory in California in the middle of an epic housing collapse. A really, truly sad story, being repeated all over America today.

Thanks frothy for posting to youtube. Here's part 1 of 5.

Posted by

blogger

at

11/22/2006

58

comments

![]()

![]()

November 22, 2006: The day the UK housing ponzi scheme died

Headlines all over the UK papers tonight were about the housing bust that's coming.

Morgan Stanley UK's chief economist, an advisor to Chancellor Gordon Browne, put out a report that said with certainty that the UK property market is overvalued and will burst.

"Housing Bust Likely in Next Few Years" Financial Times

"UK Housing Market Bubble At Risk of Bursting" Ireland Online

"Housing Bust a Certainty" London Lite

How do I know this is the end of the bubble in the UK? Because all manias throughout history have ended because of one thing:

A change in perception.

Not the wild overvaluation. Not the detachment from fundamentals. Not the unaffordability. Nope, it's the change in consumer psyche that causes bubbles to pop. Call it doubt. Call it losing faith, or losing nerve. Its when people go from thinking "it's a sure thing" to "hmmm.. It looks like this is the peak - I should get out now"

Here's today's report. Get ready now for the panic.

UK housing market bubble at 'risk of bursting'

The housing market is likely to bust within the next few years, a prominent economist and former advisor to Gordon Brown will warn today.

The Financial Times reports David Miles, chief UK economist at investment bank Morgan Stanley, has written a report arguing that house price growth has been grounded in unrealistic expectations of double digit annual rises.

Mr Miles says it is only possible to explain the more than doubling of house prices in the past decade if people’s demand for housing has been heavily influenced by expectations that rapid price rises would continue.

Once house price rises come down below expectations, Mr Miles believes “significant” falls are likely.

The report concludes: “A sharp fall in real house prices is likely at some point in the relatively near future, though it could yet be one to two years away.”

The Financial Times says that buoyant expectations of price rises, based on home owners’ experiences over the past five years, have fuelled demand and driven prices even higher.But these prices are a “bubble”, which will deflate rapidly once price rises fail to meet expectations.

Mr Miles’ comments were echoed in May by Mervyn King, governor of the Bank of England. Mr King added: “The level of house prices still seems remarkably high relative to average earnings or average incomes or anything else you could look at.”

Posted by

blogger

at

11/22/2006

19

comments

![]()

![]()

An HP Rant: The criminal Mexican invasion of America and the late great American housing ponzi scheme

Yes, folks, it all goes together...

Millions (the government says 11 Million, I'd lean more towards 20 Million) of Mexicans illegally broke into the United States over the past decade. Invaded us. Broke our laws. Cheated the system. Jumped the line. Call it what you will, and I'll call it what it is - an illegal invasion.

It is not racist to call Mexicans "Mexicans". Just like calling Russians "Russians". Get over it, and get over your PC-self on this one.

These gate-crashers stormed America and stole the jobs of legal Americans. So at the same time we were losing our manufacturing base to China, we lost millions of other jobs to illegal Mexicans at home and had our wages surpressed by a new, ready-made and illegal labor force.

Do I blame the Mexican people? No. If I lived in Mexico and job prospects were bleak, I couldn't feed my family, and there was a way to make a better living by simply walking across the border, I'd have to think about it. Illegal or not. People are going to do what they need to do to better themselves and take care of their families.

So I simply blame the US and Mexican governments and the businesses that knowingly hired them.

The Democrats want votes (and millions of birthright US citizen Mexican babies born on US soil), as they were out of power and desperate.

The Republicans were doing what they do best - helping American businesses lower costs and increase profits. A wave of slave labor who'd work for peanuts vs. legal Americans was too good to pass up for the GOP and their business buddies.

And now the Dems and GOP are even thinking of offering the illegals amnesty. Now there's a terrible idea.

Then of course, there's the corrupt Mexican government. They love the billions and billions of US$ being sent back to Mexico.

And you know who LOVED this illegal invasion of the US? You got it - the REIC. The housing bubble demand for new houses required significant new labor - roofers, fencers, painters, framers, etc. It's estimated 30% of all construction jobs have now gone to Latinos.

To earn those massive bonuses, the REIC CEOs also needed to lower their costs at the same time their profit margins were exploding due to irrational pricing. The key was hiring cheap illegal Mexican workers to replace the fairly paid American workers.

Cha-ching.

Well, everything was great for awhile - for the Mexicans, for the Democrats, for the GOP and for the REIC.

And then the bubble burst.

So now what do we have? Well, for starters, we've got 20 Million Mexicans stuck here in the US and many of them now without jobs. We've got hundreds of thousands of new Mexican US citizen birthright babies with illegal and unemployed parents. We've got millions of Americans who've lost their jobs to illegal Mexicans, and we've got a declining US wage due to the millions of illegals in the US who'll work for cheap.

What we'll have next is an exploding crime and unemployment rate, soaring costs for supporting the illegals and their babies, and some serious moral issues of what to do with the illegals we no longer need now that the REIC jobs are going away.

You thought the illegals were pissed this summer when they were out protesting in the streets? Well, just wait, because now they're unemployed, hungry and even more pissed. And to add insult to injury, some of them even bought homes at the peak using toxic mortgages and are well on their way to defaulting and running.

Now that's squaring the circle, wouldn't you say?

Posted by

blogger

at

11/22/2006

107

comments

![]()

![]()

November 21, 2006

Olbermann again points out that we're living under the most incompetent president in US history

The fact the housing bubble and meltdown happened on Bush's watch, in addition to the Iraq debacle, the soaring US debt and the out of control spending, will make Bush the worst president of all time when the history books are written.

Posted by

blogger

at

11/21/2006

66

comments

![]()

![]()

Is the housing meltdown underway "The Big One"?

Read this article - "Housing Bubble Smack-Down" (thanks borka for the link)

Read this article - "Housing Bubble Smack-Down" (thanks borka for the link)

The only thing I haven't figured out is simply this:

Why?

Why did the Fed allow the housing bubble to become the biggest financial mania in recorded human history?

Was it negligence? Or pure incompetence? Or just plain evil?

Well, first of all, you can ignore all the gibberish you hear on the business channel about “soft landings” and a “temporary downturn”. There’ll be no soft landings.

This is the Big One; Real Estate Armageddon followed by a plague of locusts.

JUST LOOK AT THE NUMBERS! There’s a $10 trillion difference between the aggregate in 2000 and 2006! $4.5 trillion of that is new mortgage-debt! That’s more than a little “froth” as Greenspan likes to say. In an economy that’s currently growing at a feeble 1.6%, a plummeting housing market could pave the way for another (dare I say it) Great Depression.

$10 trillion!?! Some things are worth repeating.

Posted by

blogger

at

11/21/2006

70

comments

![]()

![]()

Reader's Choice - which HP rant do you want next?

1) Immigration

2) Iraq

3) Toxic Loans

4) Wal-Mart

5) The Fed

6) Fannie Mae

7) The Corrupt Congress

8) The Declining American Wage

9) Bush

10) Fox News

Feel free to pick your own topic for consideration, and feel free to rant away here on any ol' subject burning you up today.

Wild Card Post - just keep it clean.

Posted by

blogger

at

11/21/2006

43

comments

![]()

![]()

Liars anonymous: "Hello, My Name is David Lereah" - "Hello, David!"

Here's the laughable NAR preso from their annual confab. Oh, man, I wish I was there to heckle. So many slides have so much misleading spin, it's worse than any politician or Cubs manager.

Here's a few select tidbits. Download the entire preso, and also thanks to David at BubbleMeter for the images

Slide 1: "The Road to Recovery" - even the preso title is hilarious! We're on the highway to devastation - recovery lane is miles and miles away

Slide 5: Calling the bottom on new home sales. How stupid does he think we are? A little blip as panicked builders unload at any price is not a bottom, it's a blip. This chart will go down and down and down and down for years and years to come, as builders stop building new dead inventory.

Slide 16: "Very Cold" markets: California, Southern Florida, Arizona, Nevada, DC Region

Slide 21: "Large Corrections" - Arizona, Nevada, South Florida, Las Vegas

Slide 42: Blaming the media for the end of the ponzi scheme: "Bubbles Will Burst. Balloons Will Pop. Prices Will Fall 30% to 40%. Housing Downturn Will Send Economy into Recession"

Slide 47: Still cheerleading: "Wake up and smell the equity! The national median home price has increased 88 percent over the last 10 years!"

Slide 71: Ending with the bizarre and laughable Greenspan quote “Most of the negatives in housing are probably behind us"

Posted by

blogger

at

11/21/2006

18

comments

![]()

![]()

November 20, 2006

HousingPanic Stupid Question of the Day

Will the late great American housing bubble (aka Ponzi Scheme) end up being a zero-sum game?

Will the late great American housing bubble (aka Ponzi Scheme) end up being a zero-sum game?

It was reported that US housing stock increased from $14 Trillion in 2001 to $25 Trillion in 2006 - that's $11,000,000,000,000 of new "equity" and inventory.

So now that the bubble has burst, will that $11 Trillion (and more) simply go poof?

My take is - of course it will, as it always does. There will be some winners - those that speculated, rode the lightening, and got out before the crash. And of course the bubblesitters, who saw the bubble, sold at the peak, and now rent.

But there will be a LOT more losers - those who did HELOCs and MEWs, and then went out and spent the fake equity they thought they had "earned". And baby boomers who stopped saving because they thought their house was their new 401k. And of course the entire soon-to-be-unemployed REIC.

So, no, it will not be a zero-sum game - it will end up being a net-negative for America and the world.

And it was never a game. Even though it seemed like one to so many.

Posted by

blogger

at

11/20/2006

26

comments

![]()

![]()

The corrupt David Lereah says "You'd have to go back to the Great Depression to find a housing period that is this unique"

Oh, Mr. Lereah, you are correct, we will be going back to the Great Depression soon. Thanks to your swindling and cheerleading.

Oh, Mr. Lereah, you are correct, we will be going back to the Great Depression soon. Thanks to your swindling and cheerleading.

Here's the Newsweek report on the NAR confab. Must have felt like COMDEX in 2001...

Realtors are a professionally upbeat group, and their trade association is sometimes criticized for parsing data to present a too-positive spin. Sure enough, even amid lots of down arrows, chief economist David Lereah found reasons for optimism.

Despite all the talk about a nationwide boom, Lereah says only 26 percent of U.S. home markets got really overheated, with speculators driving prices up by more than 20 percent annually.

"The biggest question I'm faced with is how far do prices have to drop and how long will it take for the correction to finally turn around in [those] markets. I don't have an answer," Lereah says, conceding that those markets could stay soft into 2008.

But he counters that falling prices, while unpleasant for homeowners, are really a good thing, because lower prices will spur more buyers to make offers, and the resulting sales will help not only commission-hungry agents, but also the furniture makers, appliance companies and other ancillaries that make housing such a vital prop to the economy. And while he calls predictions that home prices might fall 30 or 40 percent "nonsensical," he can't offer a number of his own.

Says Lereah: "You'd have to go back to the Great Depression to find a housing period that is this unique."

Posted by

blogger

at

11/20/2006

22

comments

![]()

![]()

Everyone out there with real jobs can now puke: Corrupt and disgraced KB Homes crook to get $175,000,000 windfall

Sickening, I tell ya. Just sickening.

$175 Million by the way would buy 875 homes at $200k

Report Says Ex-CEO Karatz Could Get $175M Despite Leaving KB Home Amid Scandal

Bruce Karatz, who stepped down last week as chief executive of KB Home, could get as much as $175 million in severance pay, pension benefits and stock options despite leaving the homebuilder amid a stock option controversy, according to a published report.

The multimillion dollar windfall, experts say, may be possible in part because Karatz wasn't fired. The 61-year-old agreed to retire Nov. 12 and repay KB Home $13 million after an internal report concluded the home construction company incorrectly reported stock option grants.

Posted by

blogger

at

11/20/2006

12

comments

![]()

![]()

HP's Top 10 Things that Suck about the Late Great Housing Bubble

1) Realtors, mortgage brokers, builders and the corrupt REIC

1) Realtors, mortgage brokers, builders and the corrupt REIC

2) The Fed

3) Bush's "Ownership Society"

4) 20 year old GEDs living the big pimpin lifestyle fueled with fraudulent debt and condo flipping proceeds

5) 25 year old college grads who can't afford a house anymore because of #4

6) Phoenix, Arizona

7) Paranoid Ben not supporting the other bubble bloggers

8) Our own stupidity - that we'd fall for another financial mania so soon after the last one

9) David Lereah, Nicholas Retsinas, Catherine Reagor, Bob Toll, Greg Swann and Bob Nardelli

10) That millions will lose their homes, the economy will crash, lives will be ruined, and that it happened at all

Posted by

blogger

at

11/20/2006

9

comments

![]()

![]()

AZ Republic: Complaints against realtors soaring - up 150% since before the bubble

Thank god for Glen Creno at the Republic, who serves as a counterbalance against the lazy reporting of "Rolodex-of-Realtors" Catherine Reagor. Bravo, GC. Keep it up.

Here's his piece about complaints against our favorites, Arizona schisters (oops, I mean realtors). If you want the home of get-rich-quick hucksters, say-anything-to-make-a-deal-liars, and a fake economy based on a dead industry (housing), visit Phoenix, Arizona.

Grievances targeting agents rise - Boom opened door to violations, abuses

Glen Creno The Arizona Republic

Complaints against real estate agents are on the rise, with consumers accusing them of everything from selling property without a license to cutting corners to make a sale.

As of June, the number of complaints opened with the Arizona Department of Real Estate had jumped 53 percent since 2003, the year before the housing boom took the Valley by storm. Complaints forwarded for discipline increased 150 percent in that same time.

More consumers are not only griping about the way they have been treated, but they're also alleging they have lost money in real estate deals.

Agents found in violation of state laws that govern license holders can wind up paying fines or having their licenses suspended or revoked. Part of the spike in complaints reflects the rush of new agents who flooded the market to take advantage of the housing boom of 2004 and 2005.

The housing market fizzled this year as rising prices and more inventory kept buyers on the sidelines. Now, buyers are scarce, it's harder to make sales, and agents may cut corners by doing something such as not disclosing a termite problem, he said.

Most of the complaints come from consumers. Others come from agents complaining about other agents or governmental jurisdictions reporting what they believe are illegal subdivisions.

"I honestly think the agents got caught in the frenzy of the market," Schubert said. "They were making a lot of money. They forgot their responsibility to their clients."

Lending fraud also is a growing concern, he said, citing situations in which a buyer may not meet certain qualifications. An agent knows it, so does the lender, but it's not disclosed, he said, and that hurts the seller.

Posted by

blogger

at

11/20/2006

9

comments

![]()

![]()

PBS housing implosion report: "If it goes down by as much as it's gone up, that's a disaster"

I liked the "disaster" quote. And as students of history know, all manias end with a reverting past the mean - falling to levels seen before the bubble started. And yes, that'll be a disaster.

I liked the "disaster" quote. And as students of history know, all manias end with a reverting past the mean - falling to levels seen before the bubble started. And yes, that'll be a disaster.

Here's some PBS bubble transcript highlights. You can also listen to the audio by clicking on the headline

Slow Housing Market Affects Economic Growth

PAUL SOLMAN, NewsHour Economics Correspondent: The economy's good: unemployment, low; stock market, up. The economy's bad: consumer confidence, shaky; auto industry, stalled; and most importantly, perhaps, housing is on the skids.

Home sales are down some 14 percent from last year. New housing starts, down almost 30 percent, knocking more than a full percentage point off economic growth. And there's great fear these days that the hottest housing markets of recent years, like California and New York, will fall hardest.

ED YARDENI, Chief Investment Strategist, Oak Associates: The total value of the housing stock in the United States is actually close to $25 trillion today. And just five years ago, it was only about $14 trillion.

NOURIEL ROUBINI: Prices have already fallen almost 10 percent for new homes.

KARL CASE: Well, if it goes down by as much as it's gone up, that is a disaster.

Posted by

blogger

at

11/20/2006

2

comments

![]()

![]()

November 19, 2006

I'm baaaaccckkkk....

Figure a lot of you have been to Rome, but for a first-timer, five stars. The food, the music, the people, the shopping and the history. Great city.

Figure a lot of you have been to Rome, but for a first-timer, five stars. The food, the music, the people, the shopping and the history. Great city.

I think all Americans should consider Rome when they're watching the now discredited Fox News about how great we are, about how we dominate the world, how deficits don't matter and how our military is not over-extended.

Yup, Rome would have a lesson or three about that....

On this subject, I recommend Diamond's excellent book "Collapse".  Like the housing bubble relates to historic financial manias, our hubris of being the dominant world power has a been-there-done-that feel to it, especially after a few days looking at the ruins of another great society that could no way fail.

Like the housing bubble relates to historic financial manias, our hubris of being the dominant world power has a been-there-done-that feel to it, especially after a few days looking at the ruins of another great society that could no way fail.

Posted by

blogger

at

11/19/2006

20

comments

![]()

![]()

November 18, 2006

HousingPanic Stupid Question of the Day

It continues to amaze me anywhere I go (and I mean ANYWHERE I go), without me even getting into it, people bring up and want to talk about housing prices. Even with perfect strangers.

Are you seeing and hearing the same thing in your neck of the woods?

Posted by

blogger

at

11/18/2006

21

comments

![]()

![]()

Hello from Rome

Buon Girono as they would say here...

I see the blog was having a bit of fun in my absence! Richard, dude, you were in charge! Like kids when the teacher is gone I swear...

Since the thread below got threadjacked about yours truly thought I'd do a thread about me if that's what you'd like to chat about. The thread below on the UK FSA prepping UK banks for a crash is an important one so keep that one going

On yours truly, yes, HP'ers, as I've said all along, I have a marketing consulting practice, had a long career in corporate retail management. I started a consulting practice after deciding you have to look out for yourself, and not leave your fate (and happiness) up to a corporation. My practice pays the bills and is quite fun, but it's HP that lets me take a shot at changing the world, no matter how small.

I don't mind being outed since you all know I'm seeking world domination, fame and fortune. You know HP is just one step on that path - bwa ha ha ha (evil laugh)

Now I'm off to see the Colosseum...

Richard's in charge

Posted by

blogger

at

11/18/2006

18

comments

![]()

![]()

November 16, 2006

FLASH: UK banks told by FSA to prepare for 40% housing price fall, 35% mortgage default rate, in "severe but plausible scenario”

This should cause a bit of nervousness on this side of the pond. Hate to burst their bubble, but...

The Times

November 16, 2006

Banks told to predict effects of a 40% crash in house prices

BANKS in the UK have been ordered by financial regulators to assess how they would cope in the event of house prices crashing by 40 per cent.

The instruction to include a housing slump scenario in their stress-testing models comes after the Financial Services Authority found that some banks were failing to include gloomy enough assumptions in their modelling.

The FSA said yesterday that an “appropriate” benchmark was to assume property prices fell by 40 per cent and that 35 per cent of mortgages in default ended with homes being re-possessed.

It stressed that this was not a forecast but a “severe but plausible scenario” and one that banks should examine when deciding how robust their balance sheets were.

In a speech to the British Bankers’ Association yesterday, Clive Briault, the FSA’s managing director for retail markets, remarked on banks’ differing views over the size and impact of a house market downturn, hence the need for reference points.

He also warned bankers to ensure that they have properly stress-tested their mortgage portfolios in the wake of decisions by some to lend people greater multiples of their incomes.

In a letter to bank chief executives last month the FSA accused some of failing to consider scenarios in which they might be forced into losses, dividend cuts or capital shortfalls.

“We were struck by how mild the firm-wide stress events were at some of the firms we visited,” wrote the FSA’s director of major retail groups, David Strachan.

A few banks were “weak in all respects” in stress-testing.

House prices fell about 15 per cent nationwide in 1989-1992, and in parts of East Anglia by 40 per cent, leading to repossessions, write-downs and bank losses.

Banks are obliged to stress-test hypothetical adverse movements in asset prices, interest rates and exchange rates to ensure that they have a sufficient capital cushion. But stress-testing is only as robust as the assumptions made.

The FSA move came as UK house prices grew at their fastest for four years, according to new figures from RICS.

Posted by

blogger

at

11/16/2006

31

comments

![]()

![]()

November 15, 2006

HP is off to Rome for a few days - use this thread to talk amongst yourselves, post articles, have a good chat. The blog is in your hands HP'ers.

I feel like a parent leaving his 16 year old at home by himself for the first time.

Crack and hookers? Or a study group and tea? I guess we'll see... Just keep it clean, please, and ignore the trolls.

I'm off to a Mozart concert series at the Vatican for four nights. Might post from a 'net cafe if something big breaks, or might not.

I'm interested to see the remnants of a society who once dominated the known world militarily and culturally, only to implode, weighted down by its own hubris, gluttony and overconfidence.

Sound familiar?

Posted by

blogger

at

11/15/2006

96

comments

![]()

![]()

BBC report on 125% and five-times-income loans

Plus you can all laugh at the funny British accents...

Posted by

blogger

at

11/15/2006

19

comments

![]()

![]()

Running away as fast as they can - Home Buyers Back Out Of Deals in Record Numbers

I'll say it again. Anyone buying a home in America today is a fool. But it looks like most people have come to terms with that, and are walking away from deposits so as not to make the worst financial decision of their lives. Bravo.

It's always fascinating to watch the end of a financial mania, where the object of desire (tulip bulbs, pets.com stock) that was soooooo desirable just a few hours ago is suddenly seen as simply disgusting.

We're there with housing. From "Manias, Panics and Crashes: "The final phase is a self-feeding panic, where the bubble bursts. People of wealth and credit scramble to unload whatever they have bought at greater and greater losses, and cash becomes king."

Now here's an update from move.com:

A little over a year ago, buyers couldn't wait to sign contracts to purchase homes. Now, many can't wait to get out of them.

With real-estate prices falling around the country and even pro-industry trade groups predicting further declines over the next year, buyers are backing away from deals in droves.

At a semiannual housing forecast conference in Washington, D.C. recently, economists reported that contract-cancellation rates for big builders were running around 40 percent — about twice as high as last year's levels. Anecdotally, real-estate professionals say they are seeing a similar dynamic in existing-home sales.

"There are a whole lot of people running from contracts," says Alexandria, Va., real-estate attorney Beau Brincefield.

Posted by

blogger

at

11/15/2006

24

comments

![]()

![]()