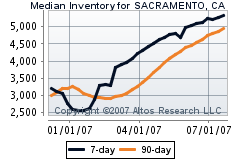

We all know in places like Phoenix, Las Vegas, San Diego, Miami, Tampa, Washington D.C., Boston, Sacramento and more, that new homebuilders have taken prices down big-time - either posted price or through the use of massive incentives.

We all know in places like Phoenix, Las Vegas, San Diego, Miami, Tampa, Washington D.C., Boston, Sacramento and more, that new homebuilders have taken prices down big-time - either posted price or through the use of massive incentives.

Yet in those markets, stubborn existing homedebtors, less in tune with the market or Econ 101, and still under the illusion that 2005 prices are real, haven't adjusted their prices to the new market reality - or Marked to Market (yes, there's those three words again).

So what's happening in those markets and more? New homes are selling moderately well at the new prices as homebuilders take the haircut, slash the prices, and move the inventory, yet existing homes continue to not sell, and pile up like tumbleweed on a windy western day.

Eventually, some existing homedebtors will have to sell - or have the house sold for them via foreclosure. This starts the rush for the exits, the first ones out the door will be best off, then the real mess starts.

Note to existing homedebtors - 2005 prices are a joke. 2006 prices are a joke. 2007 prices are a joke. If you want to sell, just look at what true new home prices are at in your neighborhood (posted price less incentives), and price accordingly.

Here's a quick tidbit on this from CNBC's Diana Olick yesterday. Not only are prices going to come down, but when they do, watch for even more blood in the streets with the lenders.

I spoke to Nishu Sood, an analyst over at Deutsche Bank today, and he makes an interesting point. The big home builders have lowered their prices in the hot markets, like Las Vegas, down 25%, but the existing home owners have not dropped as far.

He expects to see existing home owners start to drop prices more dramatically in the second half of this year. If prices really start to hit the skids in these big markets--which are where all those speculator investors lived and breathed--then you can expect all those adjustable rate mortgages they used to really kick into high gear default.