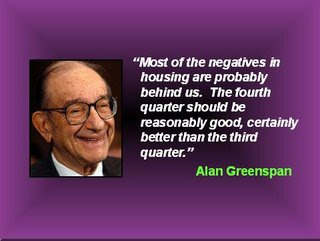

It's pretty obvious his incompetence caused the housing bubble (note - that quote above was from LAST fall). But like Mike Brown and Alberto Gonzalez, you don't go to jail for being a boob.

But corruption, that's another thing. For Alan Greenspan to call in 2004 for the creation and use of Option ARMs and Liar's Loans, and for Americans to rush into adjustable rate mortgages, right before a record string of interest rate hikes, is beyond incompetence, and most likely $$$ from the Mortgage Brokers Association. And the Fed, who is supposed to oversee banks and lenders, let things spin totally out of control during the bubble. Oversight? Regulations? Guidance? Nah!

You would think something funny was going on behind the scenes. Or payments or promises of future payments (like speaking fees to groups like the the corrupt mortgage bankers) being made. Follow the money.

So, should Alan Greenspan be investigated for criminal corruption?

Alan Greenspan played a major role in the housing boondoggle.

On February 26 2004, he said, "American consumers might benefit if lenders provide greater mortgage product alternatives to the traditional fixed rate mortgage. To the degree that households are driven by fears of payment shocks but willing to manage their own interest-rate risks, the traditional fixed-rate mortgage may be an expensive method of financing a home."

Greenspan tacitly approved the whacky financing which produced all manner of untested loans - including ARMs, piggyback loans, "no doc" loans, "interest only" loans et cetera. These loans are a break from traditional financing and have contributed to the increase in bankruptcies.

Millions of people who were hoodwinked into buying homes with "interest-only", "no down" loans will now either lose their homes or be shackled to an asset of decreasing value for the next thirty years. They've been tricked into a life of indentured servitude.

A recent article in the Wall Street Journal revealed the extent of Greenspan's involvement in the housing fiasco. Here's an excerpt from the article:

"Edward Gramlich, who was Fed governor from 1997 to 2005, said he proposed to Mr Greenspan in or around 2000, when predatory lending was a growing concern, that the Fed use its discretionary authority to send examiners into the offices of consumer-finance lenders that were units of Fed-regulated bank holding companies.

"I would have liked the Fed to be a leader" in cracking down on predatory lending, Mr Gramlich, now a scholar at the Urban Institute, said in an interview this past week. Knowing it would be controversial with Mr Greenspan, whose deregulatory philosophy is well known, Mr Gramlich broached it to him personally rather than take it to the full board.

"He was opposed to it, so I didn't really pursue it", says Mr Gramlich. Still, Mr Greenspan's views did color the regulatory environment, facilitating growing concentration in banking and a hands-off approach to derivatives and hedge funds. That approach, broadly shared by both the Clinton and Bush administrations, is coming under increased scrutiny." (Wall Street Journal)

July 29, 2007

Should Alan Greenspan be investigated for criminal corruption and fraud?

Posted by

blogger

at

7/29/2007

![]()

![]()

Labels: alan greenspan, blame, corruption, criminal investigation, incompetence, mortgage fraud

Subscribe to:

Post Comments (Atom)

22 comments:

I'm sure we can all remember when so many of our friends, work associates and collegues spoke so gleefully about the ever appreciating asset of their house.

No one cared that so many people were being priced-out of the market, as long as *they* were fine.

Now, that has all changed, and the once (speculated) appreciating asset has turned instead to an albatros around their necks.

Greed caused this, all Greenspan did was making it easily appealing.

The other problem is that so many people have been living off of credit ("easy money") for so long, that going in on a house with the same deby philosophy was only natural.

He's the bubble man. First the dotcoms and then homes.

For 99% of us Greenspan was a criminal.

For 1% he was the second coming of Jesus.

Unfortunately that 1% control our laws, politics, and media.

"Knowing it would be controversial with Mr Greenspan, whose deregulatory philosophy is well known"

Do you know who else's deregulatory philosophy is well known? Ron Paul.

Stick to finance / economics. Your political acumen is lacking.

"American consumers MIGHT BENEFIT if lenders provide greater mortgage product alternatives to the traditional fixed rate mortgage. To the degree that households are driven by fears of payment shocks but WILLING TO MANAGE THEIR OWN INTEREST-RATE RISKS, the traditional fixed-rate mortgage may be an expensive method of financing a home."

I am no Greenscum fan, but if you parse his quote you will see two very important caveates on his conclusion. He was not saying it was an absolute, clear benefit to go toxic loan, he was saying if you can manage the fact the rate will spike, they you might benefit. How could this be? If you already had plenty of cash and/or could count on an income spike in a few years before the ARM adjusts you could get a bonus by signing up for a lower teaser rate, insure there were NO refi/payoff penalties and before it adjusted go 30 year fixed or pay it off. Your cash in the interim could have been earning 7%+ in other more liquid investments.

This dynamic is no different, except for scale, than getting a rewards card and/or one w/ a low intro rate (e.g. 0%). If you pay off the card before the rate spikes and do not screw up and accumulate more debt or miss a payment then the consumer gets the benefit of the offer, but if the consumer screw up and continues to carry the balance beyond the intro rate period, them the benefit gets wiped out be the follow on rate, and if s/he misses a payment then whamO the bank cashes in.

The problem I see w/ Greenscum's tenure as Fed Chief was him not putting regulation in place to prevent predatory lending, because basically America produces a massive underclass of consumer drones that do not have the fiscal savvy to pull off what Greenscum was proposing. So to counter this he should have put robust anti-predatory lending regs in place, thus cabining the greed of lenders as will the ignorance & blind greed of the masses of consumer drones.

ARM reset is going to hit those who did not something before that intro rate expires, the current fiasco is caused by those who screwed up during the intro rate, those who benefited are the one's that maximized the savings from the low intro rate and stepped aside just before the time period expired. The only difference here is scale and the fact that the during intro rate period screw-ups are in turn screwing over some of the marginal borrowers who otherwise would have been able to step aside, thus exacerbating the post intro-rate period screw-ups.

To see Greenspan investigaged and frog marched would be amazing!

i think steve forbes should be, he was on Fox business block Sat AM telling people to buy homebuilder stocks.

Greenspan was also involved in the S&L crisis. He benefitted from that, too

Don't worrry, Greenspun will never have to answer for this. Remember Scooter Libby? Another example of the Good ol Boys club in America.

"Do you know who else's deregulatory philosophy is well known? Ron Paul."

the problem is, Ron Paul follows Confucious who believed that enlightened men behave themselves. when enlightened men/women rule, their is virtue in both regulation deregulation.

Greenspook did the bidding of TPTB. He is fully protected and has a place reserved in the vast underground cities, built for the elite.

This is from the blog at http://dickfitz2.blogspot.com/

Did Alan Greenspan try to set himself up as a stealth version of John Galt? Knowing that he was an acolyte of Rand's in the 60s and a firm believer in the gold standard and limited government, it seems unfathomable to me that he would so totally turn on those principles the way that he did in his facilitation of the run-up of the housing bubble. He KNEW what the consequences would be. He KNEW that the "crack up boom" that is happening now would be devastating, perhaps more devastating than the Great Depression. He KNEW that it would stress our economic system to the point of breaking. You may not believe these things right now, but I'm fairly certain that the next few years are going to be filled with financial turmoil. The laws of economics cannot be repealed, no matter how many laws and regulations the jackasses in DC try to create and enforce. This turmoil may be more than our already fractured and ossified federal government can handle. As the grassroots support of Ron Paul shows, many millions of educated and intelligent people are disgusted with our government. A lot of those people are ready to openly revolt against it, something that would have been unthinkable to them 2 decades ago. If our economic system crumbles, the fault will lie squarely at Greenspan's feet.

And that may not be a totally bad thing. Sure, it's going to radically alter life in America, but it will also accelerate the growing dissatisfaction people feel towards Washington DC, and may lead to a dissolution of the federal level of our republic. If the populace withdraws support for the Feds, then secession becomes a real possibility. If we decide to take matters into our own hands, and forcibly devolve those federal powers to the state level, then the United part of the US crumbles and we become a loose conglomeration of states instead of being a superstate. If that happens, then perhaps that loose grouping of states will learn to better manage their own affairs and slowly become free states committed to liberty and justice once again. The process may be slow, and full of fits and starts, but the end result will be a much freer and more peaceful country. And Alan Greenspan will be responsible. Perhaps he's a hero after all?

How silly. They are complaining that Alan Greenspan said it wasnt his job to crack down on predatory lending. Guess what. ITS NOT! Laws against predatory lending would have to be passed through the legislative branch. What on earth does he think Greenspan should do to combat predatory lending?

i truly believe that homebuilders thought that people would be prostitutes, pimps, drug dealers, lease out their children, rent rooms to vagrants, mow lawns, clean houses, or whatever to make sure they would make the payments on a house, (i forgot clean an old family members bank account) because in the past people have always figured out ways to keep their houses at the last minute. they thought that people would do it again and always and there are people out there who are but they are now in the minority because if there is nothing invested and an apartment cost hundreds of dollars less why go to bed with a headache every night trying to hold on to a rapidly escalating debt trap for which one can see no escape.

when i heard greenspan annouce 1 percent interest i thought it was crazy and i wondered how long would that last. i could not see it lasting forever and that is unfortunately what most people thought, they were getting something for nothing. but then i blame home builders for making homes impossible to afford so that in order to pay stock holders the big bucks and make the market a fun game to play robbing innocent people to get a dividend check and live high off someone elses misery. to make sure those 401k's and retired teachers get back everyone put the tip of their fingers in this cesspool of greed and now look at what all of it spawned.

if anyone thinks this is not going to affect them because they have insulated themselves from it. go to your local wal-mart and see fairly empty stores from a year ago, help wanted signs, skimpy offerings, and we should (if we don't)know wal-mart and those dollar stores were the dumping grounds of chinese made goods, as well as target, and few other clothing stores. remember if china is not happy then what will happen then.

Credit card free and happy.

Socialism. It's capitalistic greed that causes all the ills of this country. We've got to fight back and create a socialist government while we still can. Only then will we be able to protect the underclasses. They know not what they do.

PUT HIM IN JAIL

Re.homebuilders assuming that people would do ANYTHING, including pimp their own children , just to afford a house:

In fact, one of the major homebuilders (Pulte? Centex? Anyone remember?) came out at the top of the bubble in '05 or early '06 to announce that from here on in, Americans would be living in "multi- generational" families, just to afford a house. He seemed A-Ok with that.

Everyone, from Greenspan, Clinton (capital gains elimination), Bush (declaring June '06 "American Home Ownership Month"), Congress and Senate toadying to the NAR to relax borrowing restrictions, etc. They are all corrupt sleazeballs who could care less about you.

As long as they could cram you into a severely overpriced house, they were all happy enough to do it.

Their ideal was to make you and yours a debt slave. They got their wish.

fight back and create socialism? What's to fight back against? That's precisely where we're headed.

Sit back, watch TV, drink your beer and your one world socialist government will soon be upon us.

Total and complete power in the hands of the few.

The rest of us are well-doped up slaves.

It is too late.

He hath been awarded the Presidential Medal of Sauron, and the Medal has been awarded him.

The presscious it burns the brain.

How silly. They are complaining that Alan Greenspan said it wasnt his job to crack down on predatory lending. Guess what. ITS NOT! Laws against predatory lending would have to be passed through the legislative branch. What on earth does he think Greenspan should do to combat predatory lending?

This is is UNTRUE. The Legislature has already delegated authority to regulate banks, and in particular mortgages and mortgage terms to the Federal Reserve. It's been a Fed reponsibility for a long time now.

Congress is now angry, and some banking committee members are threatening to take away this apparently unused power and ignored responsibility and give it to Treasury OFHEO.

It sure WAS the Federal Reserve's responsbility to do something. In fact a Fed Governor has said---in public---that he suggested to Greenspan way back a few years ago that the Fed needed to look into poor lending standards in mortgages, but Greenspan had no desire to do so, on account of anti-regulatory ideology.

During the huge dot com bubble, the Fed also likewise had authority and responsibility to increase margin lending requirements for publicly traded stocks. And Greeny didn't. Everybody knew there was a bubble.

Point is that the Fed has precise powers to combat excessively foolish lending---Other People's Money for Cheap is always the source of bubbles---and they didn't.

Interest rates are a global club. Much better to attack precisely the problem. You can burst the bubble without killing the economy with rates, and then re-inflating it by going to excessively low rates once again, encouraging poor underwriting and lending standards all over again.

Anti-regulatory ideology prevented this sensible and logical policy.

Greenspan is the Paul Bremer of economics.

Alan Greenspan? Read Ayn Rand. Greenspan is a disciple of this kooky Ayn Rand.

I usually agree with most of what I see on this website. But, the suggestion you made on this posting is ridiculous. How can you claim to be pro-free-markets and also propose that the Fed should've stepped in to increase regulation? Individuals made poor decisions, individuals will lose their homes and I feel no need to step in and give them subsidies to bail them out. Likewise, I see no need to increase our taxes so we can increase the size of yet another beauracratic organization in order to establish greater federal oversight of the mortgage industry. Yes, I feel bad families will lose their homes. However, it was due to a PERSONAL DECISION. If they chose to take Greenspan's word as the only opinion that mattered and didn't do their research, that is their fault, not Greenspan's.

The FED setup up the people and squeezed every dim out of them. Now they can't clean up their mess,so they are saying there is no inflation but look at your housing cost, gas price, and food bills. Everything double in the last 5 years. But inflation remains low. That is Bullshit, FED wake up time to stop lying to the American people.

Post a Comment